As your business grows, you should always be looking to add new customer payment methods. While you may have started out by accepting only cash and checks, you've probably graduated to processing credit cards. Those are not, however, your only payment options.

Your business could also benefit from setting up automated clearing house (ACH) payments, especially if you offer monthly subscription plans or other recurring transactions. We'll go over the ACH basics below and show you the steps to get you started.

Overview: What is an ACH payment?

ACH payments are a method of directly transferring money from one bank account to another without using checks, cash, credit cards, or wire transfers. While they can be used for one-time payments, they are more common for recurring transactions.

As a consumer, automatic monthly payments that come out of your bank account for utility bills or a mortgage payment are ACH payments. So are peer-to-peer (P2P) transaction systems like Zelle.

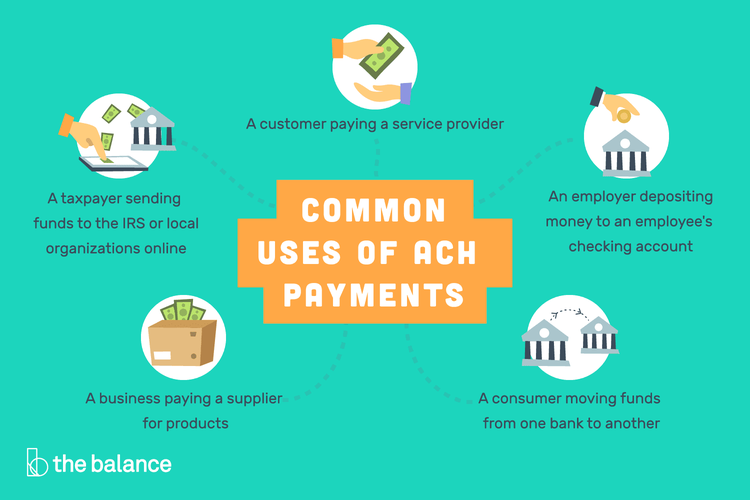

ACH payments are used in a variety of ways to directly deposit money from one bank account to another. Image source: Author

For a business owner, paying your employees by direct deposit is another example of using ACH payments. In essence, each ACH deposit and credit functions as an electronic "check."

How ACH payments work

ACH consumer payments use a four-step process:

- Customer authorization: A consumer authorizes direct payments from their bank account at a company's website.

- Transaction initiated: A business sends payment details to its bank or ACH provider, known as the Originating Depository Financial Institution (ODFI).

- Payment requested: The ODFI's request for payment is routed to the customer's bank, known as the Receiving Depository Financial Institution (RDFI).

- Payment processed: The RDFI checks that there are sufficient funds in the account to make payment and, if so, processes it.

ACH payments vs. wire transfers vs. EFT payments: What’s the difference?

ACH transactions are a subset of electronic funds transfer (EFT) payments, which encompass a wide range of financial processes to route money directly from one bank account to another. These include debit cards, ATMs, wire transfers, electronic checks, and pay-by-phone transaction systems.

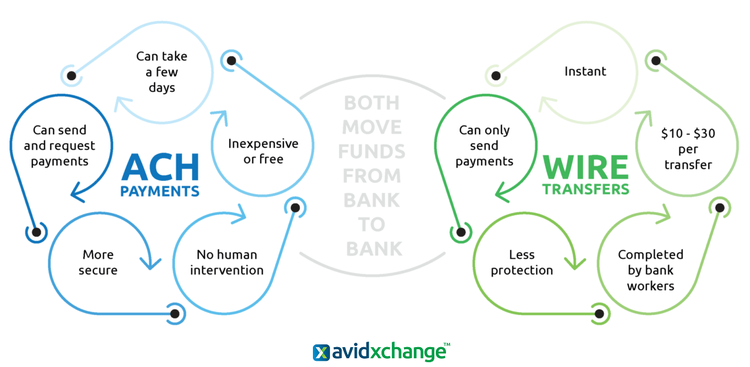

ACH payments and wire transfers are significantly different even though both electronically transfer money from one bank account to another. Image source: Author

There are key differences between ACH transactions and wire transfers despite both being EFT payments. While ACH transactions can be used to both send and receive money, wire transfers can only send funds.

Plus, ACH payments do not require any human input, but bank employees will manually complete wire transfers. ACH payments are also designed for transactions typically under $5,000, while wire transfers can be used for almost any amount.

How to accept ACH payments in your small business

While accepting ACH payments, especially for recurring purchases, can increase your revenue, the transaction process is completely separate from that of credit cards. You'll need to be aware of the specific requirements for ACH payments before incorporating it into your sales management operations.

Step 1: Determine feasibility

While cash, checks, and credit cards are suitable for virtually all customer payments, the same is not true for ACH payments. For example, ACH payments work only within the United States, so if a majority of your business is international, you won't be able to use this process to its maximum benefit.

Tips for determining feasibility

In addition to geographic restrictions, there are a couple of other considerations to keep in mind relating to your customer base and types of sales.

- Customers: Do you already have customers you're billing on a recurring basis or they could be set up that way? Do you serve a demographic that does not use credit cards?

- Types of transactions: Are you already handling a lot of paper checks? Do you process business-to-business (B2B) transactions? Are you processing credit card payments that could be converted to ACH check payments with lower transaction fees?

Step 2: Choose an ACH provider

First, check with your bank to see if they provide ACH transaction support. If they do, compare their rates to third-party ACH handlers. If you're already using a third-party provider for credit card processing, ask if they can do these transactions too.

Tips for choosing an ACH provider

As always, you'll want to make sure you don't tie yourself into a long-term contract for your ACH payments, and that the costs and benefits are clearly stated.

- Know the fees: All your ACH fees will be separate from any current credit card processing. In particular, find out what the chargeback and non-sufficient funds (NSF) fees will be and if you will have to pay extra for transactions over a certain amount.

- Ease of use: Make sure the process to set up an ACH debit is easy for both you and your customers. In addition, double-check the amount of online documentation and customer support as well as reviews of each provider's customer service skills.

Step 3: Set up an ACH merchant account

Even if you already have a merchant account for credit card sales, you'll have to set up a separate account for ACH payments. This should not be an onerous amount of work to keep track of, but it is another financial asset you'll have to monitor.

Tips for setting up an ACH merchant account

If you're not currently processing credit card sales, you'll want to choose one of the best point-of-sale (POS) systems that will also allow you to create a second account for ACH transactions.

- Have the right documentation: You'll need to provide your certificate of incorporation; any other local documents as required by your jurisdiction identifying company directors and owners; a utility bill, lease agreement, or bank statement with a corporate name that identifies the company's location; and copies of valid identification for company directors and owners.

- Recurring billing: Many ACH providers offer recurring billing as a free option, but some do not. Make sure you choose one that is free because this is the primary appeal of and application for ACH payments.

Step 4: Choose your ACH payment methods

While the typical recurring ACH withdrawal will be set up and executed online, that doesn't have to exclusively be the case. That's why you'll want to know all the available payment options and how to incorporate them into your sales mix.

Tips for choosing your ACH payment methods

You don't need to convert every sale to an ACH transaction, but where appropriate, consider the following options.

- Check scanner: This POS hardware will allow you to process checks without having to physically deposit them.

- Virtual terminal: Key in mail order and telephone order (MOTO) payment information on your computer.

- Website payments: Encourage ACH transactions at your website for even one-off sales. Sure, you'll have to prod customers to look up their account and routing information, but this is a better option for you. That's because a $100 PayPal payment, for example, costs around $3 to process, but an ACH electronic debit can cost as little as $0.20.

Step 5: Avoid unwanted costs

The devil is always in the details, and whatever the topline ACH processing fees are, you want to avoid all unnecessary add-on fees or penalties.

Tips for avoiding unwanted costs

NSF and chargeback fees can quickly ding your bottom line, so you'll need to look at your ACH account statement regularly to make sure they're not occurring too often.

- Check guarantee/verification: This service will cost extra but should easily pay for itself over time.

- Chargeback protection: Sure, chargebacks exist to protect consumers, but that doesn't eliminate the possibility of your being the victim of fraud. Make sure your ACH provider has a Payment Card Industry Data Security Standard (PCI DSS) certificate and offers both fraud and chargeback prevention services.

Benefits of taking ACH payments

Increasing your available payment options will aid with customer acquisition. Plus, why not incorporate a pricing strategy that offers a discount for ACH payments? You can also increase your profit margin thanks to time savings and lower fees.

1. Faster processing times

The ACH payment processing time will be faster than paper checks thanks to its hands-free process, which also includes not having to make a trip to the bank to make a deposit. The typical turnaround time is 3-5 days, just a day or two slower than credit card transactions.

2. Lower processing costs

Despite being a bit slower to process than credit cards, ACH transaction fees can be considerably cheaper. For example, credit card transactions have two associated fees: a percentage of the total amount (1.5% to 3.5%) as well as a processing fee of $0.10 to $0.30.

For ACH payments, however, there will typically be either a flat fee of $0.20 to $1.50 per transaction or just a percentage fee of around 0.5% to 1.5%.

3. More predictable revenue

Processing time and fees aside, the other big advantage of ACH payments is the predictable revenue from recurring payments.

That is, you don't have to worry when -- or if -- customers will send you a monthly payment. Instead, your sales forecasting will be much more accurate, based on when each ACH transfer will be deposited in your account. Remember, however, that PCI compliance will be critical to avoid unnecessary fees.

In addition, some providers will have an ACH merchant cash advance option, which allows you to receive a cash advance without having to apply for a loan. That way, you can access money during your slow season and then repay it when business picks up again.

Incorporate ACH payments into your business

If ACH payments are a good fit for your business, there's no time like now to set up this option as part of your sales and marketing efforts. Not only will it give customers an additional payment method in your sales process, but you'll also have potentially lower transaction fees and a more predictable revenue stream.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.