PayPal Here is a user-friendly mobile payment app from one of the best-known names in the payment processing industry. PayPal's security and performance are reliable and trusted by enterprises across the globe. Yet there are many alternative point-of-sale (POS) solutions out there that provide different features, pricing, and capabilities.

With so many PayPal competitors vying for your business, it pays to consider your options and do a few trial runs before committing to a POS system. The Ascent’s experts have tested them for you and published their findings in detailed POS reviews to guide your search.

Here's a quick tour of eight excellent alternatives to PayPal Here.

The top POS software alternatives to PayPal Here:

- Stripe Payments

- Toast POS

- Lightspeed POS

- ShopKeep

- Shopify Point of Sale

- Square

- Revel POS

- Epos Now

What to look for in a great PayPal Here alternative

The PayPal app has limitations that may make other POS systems a better option for your business. Here are three areas where PayPal Here could be stronger.

1. Advanced business management tools

When you subscribe to PayPal Here, you have access to a PayPal business account with a POS terminal and features for managing sales, inventory, customers, and staff. Yet some POS providers offer tools that are more advanced or tailored for specific industries. Depending on your business, you might find another feature set better suited to your needs.

2. Processing fees

PayPal business fees are 2.7% for card payments, 2.9% + $0.30 per online transaction, and 3.5% + $0.15 for keyed transactions. If you qualify to accept payments of less than $10, known as micropayments, you'll pay a PayPal transaction fee of 5% + $0.05 in U.S. dollars.

Charges across the industry are similar, but even a small variation can have a big impact on your bottom line. When comparing fees, consider your average sales amount and dominant payment methods.

3. Integrations

PayPal partners with top software providers for e-commerce, website development, customer relations management (CRM), accounting, and more. Yet some POS solutions allow additional widespread and customizable integrations.

Our top 8 picks for PayPal Here alternatives

Here are our top picks for the best alternatives to PayPal Here.

1. Stripe Payments

Stripe provides a powerful suite of payment solutions ideal for businesses with web development capabilities and the desire to customize the sales process from beginning to end.

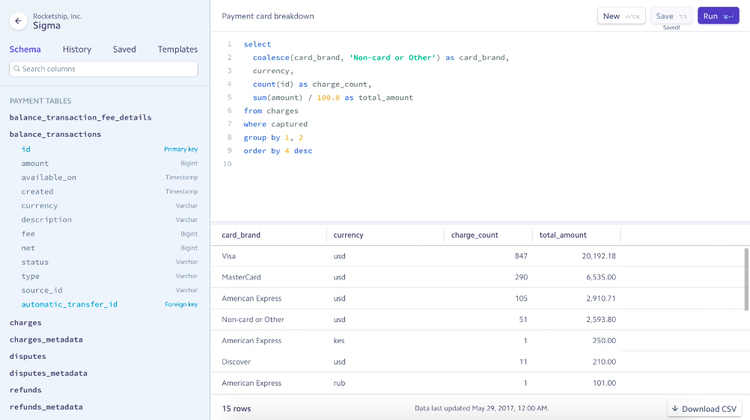

Stripe makes it easy to tailor your website and mobile checkout flows to align with your sales and marketing strategies and reflect your brand. It comes out of the box with more than 100 POS features for everything from invoicing and subscription management to financial reconciliation. Stripe also comes with robust business management tools, including structured query language (SQL) reporting.

Stripe provides advanced reporting tools, including SQL. Image source: Author

Stripe's fee for online payments is 2.9% + $0.30, and its POS fee for in-person card payments is 2.7% + $0.05 per transaction. If you process a lot of small payments, this might save you money. Also, Stripe's fraud protection is state of the art.

Stripe is close to unmatched in integrations, connecting you with more than 450 platforms and extensions. From e-commerce and email to accounting and taxes, Stripe is ready to connect with the systems you rely on to run your business.

If you're weighing Stripe vs. PayPal, Stripe offers more advanced business analytics, competitive pricing, and almost unlimited built-in integrations, so it is definitely worth checking out.

Read The Ascent’s full Stripe Payments review

2. Toast POS

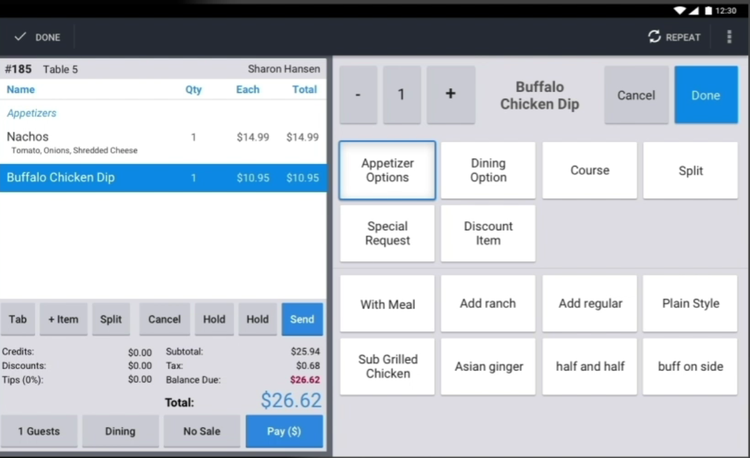

Toast is a restaurant POS designed to address the unique challenges of running a busy food service business. Its front-of-house features include a user-friendly, intuitive POS system, online ordering, touch-free guest experiences, and digital receipts.

For back-of-house operations, Toast provides a deluxe kitchen display system (KDS), multi-location management, and advanced inventory management tools such as variance reporting and waste tracking. Toast also includes features for gift cards and loyalty programs.

Toast's order interface is easy to use and customize. Image source: Author

Toast's POS pricing is $75 per month for software to support one register. Its payment processing fees are individually determined but are in the range of 2.5% + $0.15 per transaction. There are additional fees for specific features and POS hardware.

The system integrates with more than 70 of the most popular restaurant partners such as Grubhub. If you're in the restaurant business, Toast should definitely make your shortlist for POS software.

Read The Ascent’s full Toast POS review

3. Lightspeed POS

Lightspeed POS includes solutions for retail businesses and restaurants with thoughtful features to drive business success.

Lightspeed Retail seamlessly integrates in-store, mobile POS, and online sales channels. Its smart inventory system makes it easy to import stock, synchronize your physical inventory with your online store, generate and manage purchase orders, and organize shipments. The company provides specific features for stores selling everything from apparel and bikes to vaping supplies.

Lightspeed Restaurant makes it easy to manage seating and capacity. Image source: Author

Lightspeed Restaurant offers an equally rich feature set, including digital menus, contactless ordering, an intuitive reservation system, and floor plan management. It also features a powerful KDS and advanced reporting and analytics.

Lightspeed's customer loyalty feature lets you collect and track customer information to create targeted marketing campaigns. The company offers five subscription plans ranging from $69 to $299 per month depending on the add-ons you choose.

Lightspeed integrates with social media as well as apps such as Uber Eats and DoorDash on the restaurant side and Ikeono Business Texting on the retail side. If you operate a store or restaurant, Lightspeed is a definite POS contender. You can even test Lightspeed for free through a 14-day trial.

Read The Ascent’s full Lightspeed review

4. ShopKeep

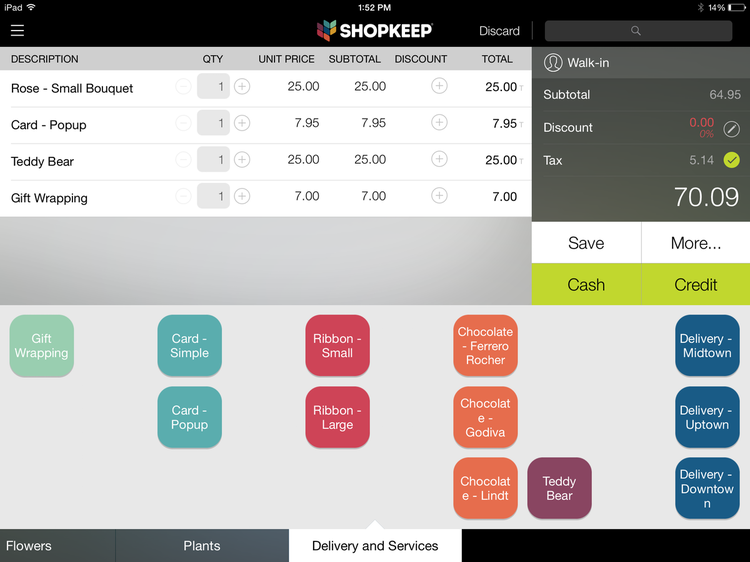

ShopKeep was designed by a merchant to provide a simpler payment system for busy retailers and restaurateurs. The company boasts stress-free setup in minutes and a smart POS system with features such as inventory management, accounting, sales reporting, and staff management.

ShopKeep makes it easy to identify top sellers and restock them on time to keep sales flowing. You can easily group items and analyze sales from a central dashboard and view reports from any mobile device.

ShopKeep's register software lets you customize your register layout, capture customer email addresses, issue gift cards, and leverage marketing tools to engage your customers. With ShopKeep, you get all of the tools you need to run a store or restaurant in a simple, user-friendly package.

ShopKeep's register is easy to use and customize. Image source: Author

Shopkeep offers payment processing for as low as 2.5% + $0.10 per transaction. You can get a free smart terminal for three months and keep it without charge if you process more than $5,000 per month in credit card transactions.

If you own a retail or restaurant business and want an affordable payment solution to simplify your life, ShopKeep is definitely worth a look.

Read The Ascent’s full ShopKeep review

5. Shopify Point of Sale

Shopify is a major online payment processing solution, and Shopify POS extends those capabilities to your in-person and mobile points of sale. If you're already using Shopify online, adding Shopify POS to your sales system is effortless.

Shopify provides an advanced platform for back-office tasks, including sales, inventory, customer, and employee management. Its inventory tools let you generate purchase orders, forecast performance, transfer stock, and analyze key metrics such as inventory turnover ratio. Unified analytics for online and in-store sales make it easy to manage all aspects of your business.

Shopify's inventory management tools are a strong asset. Image source: Author

Shopify offers five pricing tiers starting from $9 per month, plus a free card reader. Fees are 2.7% for card reader payments and 2.9% + $0.30 per transaction for online payments.

Shopify offers extensive integrations with more than 2,800 apps featured in its online store.

Read The Ascent’s full Shopify Point of Sale review

6. Square

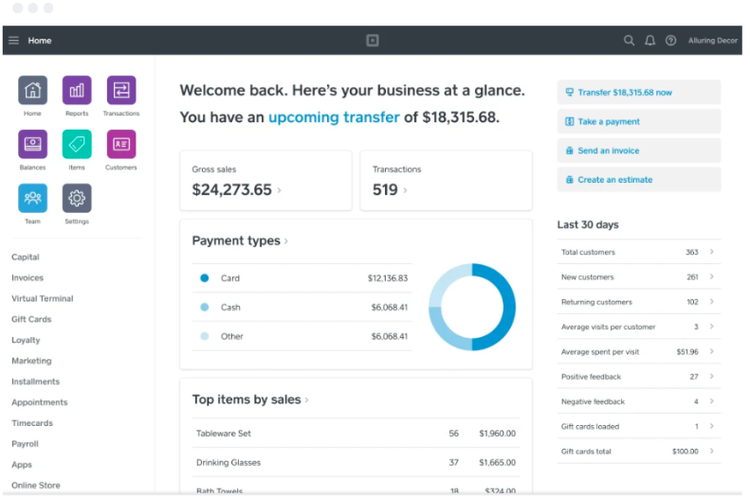

Square is a powerful payment solution for online and mobile sales. With no up-front investment, you can download the Square app and begin accepting cards, cash, checks, and gift cards anywhere you do business using Square's free card reader.

Square includes user-friendly tools for managing inventory in real time, tracking customer data, sending digital receipts, and managing online and offline orders from your POS. You also get reporting and analytics to drive your sales and marketing strategies.

Square users can manage everything from an intuitive, customizable dashboard. Image source: Author

Square's fees are competitive at 2.6% + $0.10 for in-person credit card payments. Manually entered payments cost 3.5% + $0.15. Square's hardware is affordable, with the free card reader accepting swiped cards via smartphone or tablet. A reader for contactless and chip cards, as well as apps such as Google Pay, is available for $49.

The Square app marketplace includes platforms for accounting, e-commerce, inventory, site building, accounting, and more.

Read The Ascent’s full Square review

7. Revel POS

Revel offers POS systems for quick-service and full-service restaurants, as well as retail shops. The systems include restaurant-friendly features such as menu builders with easy add-ons, mobile order takers, self-service kiosks, split bills, and bar tabs. Revel POS caters to customers with fast, simple transactions, gift cards, and easy refunds and exchanges.

On the back end, Revel provides advanced inventory management tools, including real-time inventory tracking, plus analytics such as turnover rates, holding costs, gross profit calculations, and forecasting. Revel also provides employee management tools, including built-in time cards.

Revel POS provides insights into key metrics to guide business decisions. Image source: Author

Revel's pricing is based on an annual subscription fee of $1,188 per terminal with unlimited users and advanced POS reporting. Payment processing is quoted individually, and onboarding starts at $649. One advantage of Revel is that you can use your own iOS hardware.

Revel integrates with many Revel-developed applications, as well as partner solutions such as e-commerce, CRM, and workforce management.

Read The Ascent’s full Revel POS review

8. Epos Now

Retail, restaurant, and hospitality businesses have another strong POS option in Epos Now. Epos promises fast, easy setup and onboarding into its POS solutions, which include helpful features such as inventory control with barcode scanning and automatic restocking, employee management, and real-time POS data and reporting.

Restaurants will appreciate features such as table and kitchen management, split bills, and online booking.

Epos also includes thoughtful add-ons such as loyalty programs with custom receipts that display customer data.

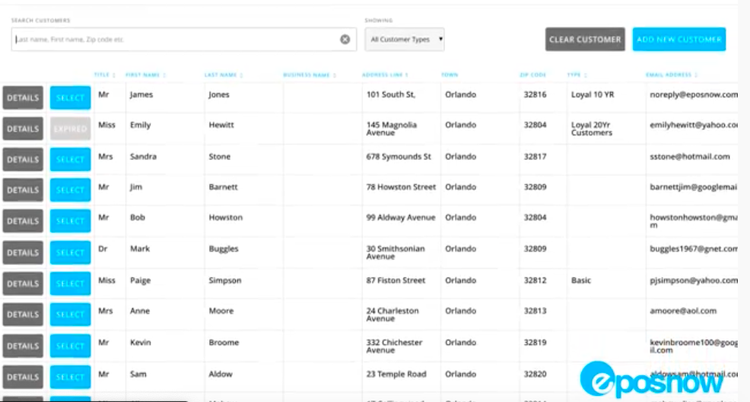

Epos Now helps you manage customer data and deepen relationships. Image source: Author

Epos Now offers monthly subscriptions at $39 per month for the standard plan and $69 per month for premium. Support varies with your chosen plan.

Epos is a great option for restaurants, bars, gyms, hotels, and other hospitality businesses. The company offers a 30-day free trial so you can check out the full system before committing to a solution.

Read The Ascent’s full Epos Now review

The right solution for your needs

There are many POS systems out there, and most will do a good job of securely processing your payments. But differences in features, pricing, and integrations can make a huge difference for your bottom-line cost, user experience, and customer experience. Be sure to check out our full POS reviews to research the optimal solution for your needs.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.