Whether you’re opening a new business or you want to swap out your legacy point-of-sale (POS) system for something more modern and cost-effective, you’ll need to know what makes for the best POS system for your business.

Cloud-based systems have become the norm in the last few years due to their accessibility, reasonable price points, and reduced need for physical hardware or infrastructure.

We’ve put together this list of the nine best cloud POS systems to help guide you through your software choice. We’ll cover the features and price points of all systems to help you decide which solution is right for your business.

Here are our top picks for the best cloud POS systems for small businesses:

- Stripe Payments

- Toast POS

- Lightspeed POS

- ShopKeep

- Shopify Point of Sale

- Square

- PayPal Here

- Epos Now

- Clover POS

What to consider when choosing a cloud POS system

Whether you’re running a pop-up store, a restaurant, or stores in multiple locations, you’ll need basic POS functionality -- but what else? Each business has its own needs, and though POS features should be the most important aspect you consider, you’ll also need to consider the platform’s other attributes, too.

1. Feature set

This one’s pretty simple: You need to work out what your core business needs are before you start evaluating POS systems. Make a list of must-have features, and when it comes to evaluating systems, be sure that they offer them.

Don’t be tempted to forgo a certain feature just because the price is right. Similarly, if you only require basic POS features, don’t be tempted into using a system with bells and whistles you don’t need.

2. Pricing

There are a few free POS software solutions out there, but don’t settle for a free tool that doesn’t offer the functionality you need.

POS tools are priced according to a number of factors -- some are free but charge transaction fees, some require that you use their POS hardware and charge per POS terminal, and others operate with monthly subscription rates.

The key is to figure out which pricing structure and tier you can afford, and which one suits your business best.

3. POS reporting functionality

For your business to thrive, your POS system needs reporting functionality. Reports are created from the POS data the system gathers and gives you a clear idea about your sales, profits, and inventory. This crucial information is what can help you make profit-popping adjustments to business strategies.

9 best cloud POS systems for small business

In this list of the nine best cloud point of sale platforms, we’ll cover each solution feature set and pricing tier breakdowns.

1. Stripe Payments

Stripe Payments is primarily an online payments solution for online businesses, but it also supports those running physical stores. We recommend Stripe as a good option for merchants who operate both online and offline stores.

The solution is very developer-centric, and Stripe’s free and straightforward API is the biggest lure for many users. Stripe has a very good reputation in the developer community for being an uncomplicated solution to work with.

Stripe Payments’ features include:

- Tools for accepting multiple online and in-store payment options

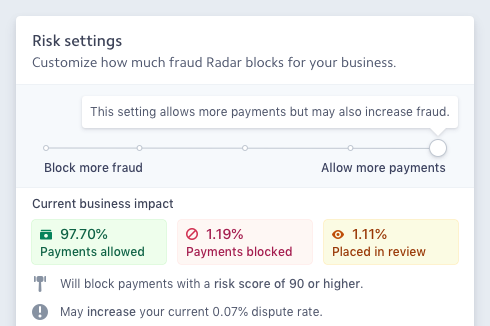

- Fraud protection via Stripe Radar

- Billing, invoicing, and subscription management

- Reporting and analytics

Users can use Stripe Radar to detect and block fraud. Image source: Author

For online sales, Stripe’s payment processing fees come in at 2.9% + $0.30 per online credit card transaction.

Stripe Terminal processes in-store and in-person payments, but users must purchase Stripe’s card and chip readers. The fee for these transactions is 2.7% and $0.05 per transaction.

Read The Ascent’s full Stripe Payments review

2. Toast POS

Toast POS is an Android-based system designed for restaurants. The solution is suitable for businesses of all sizes and types, ranging from full-service restaurants to cafes, bakeries, bars, nightclubs, and others.

Toast POS must be purchased as an all-in-one package, which includes software, hardware, and a credit card processing contract.

It also offers an impressive number of add-ons, such as Toast Now for online ordering via mobile app or website, Toast Go for tableside ordering and payment via handheld device, and Toast Kiosk for customer ordering via self-service tablets.

Toast POS features include:

- Front of house

- Back of house

- Back office. Toast POS inventory management allows you to track cost of goods sold and calculate the value of inventory on hand

- Customer engagement

Toast POS sales item reports can help users identify their best and worst selling menu items. Image source: Author

Toast POS pricing is complicated, but on the surface, costs are broken into four main categories:

- Monthly software subscription ($75/month/terminal)

- Payment transaction fees

- POS hardware purchase and installation

- Add-on features and integrations

Users must use Toast as a payment processor. We recommend you read our full Toast POS review for more detailed pricing information.

Read The Ascent’s full Toast POS review

3. Lightspeed POS

Lightspeed POS offers two POS systems: one for retailers (Lightspeed Retail), and one for restaurateurs (Lightspeed Restaurant).

With higher price points and a full feature set, Lightspeed Retail is suitable for mid size and larger businesses, while Lightspeed restaurant is suited to small and mid size, full-service restaurants, cafes, bars, etc.

Lightspeed Retail features include:

- Inventory management

- Multi-tender function

- Purchase order management

- Customer loyalty

Lightspeed Restaurant features include:

- Menu management

- Raw ingredient tracking

- Floor plan management

- Reporting and analytics

Lightspeed Analytics provides users with insight into their best selling items, purchase trends, and category sales. Image source: Author

Lightspeed Retail pricing ranges from $69/month for the most basic features to $229/month for a pro account which includes e-commerce, accounting, and analytics features.

Lightspeed Restaurant costs $69/month for one POS register, and the vendor will provide custom quotes for multiple registers. If you want the full restaurant POS experience, add-on plans that provide customer facing display, kitchen display system and more are available for an additional $12 or $39/month.

Both Lightspeed Retail and Restaurant offer a 14-day free trial with no credit card information required.

Read The Ascent’s full Lightspeed POS review

4. ShopKeep

ShopKeep is a POS system designed for small to medium-size retail and food/beverage-based businesses. It’s tailored for quick service businesses.

ShopKeep’s features include:

- Back office

- Inventory management

- Customer marketing

- Employee management

- Offline payments

ShopKeep’s register provides a comprehensive yet simple user interface. Image source: Author

ShopKeep offers no-contract monthly subscriptions, but doesn’t offer flat-rate pricing. To get a price quote, you can call or answer several questions online.

However, ShopKeep offers a free subscription plan to small businesses with a single location, single register, and single staff member, processing less than $5,000 per month.

Read The Ascent’s full ShopKeep review

5. Shopify Point of Sale

Most people know Shopify as an e-commerce platform, but its POS solution supports merchants’ in-store sales operations. It’s best for those looking for a platform that can support both online and in-store sales with seamless integration.

Shopify POS features include:

- Inventory management

- Customer management

- Employee management

- Sales analytics

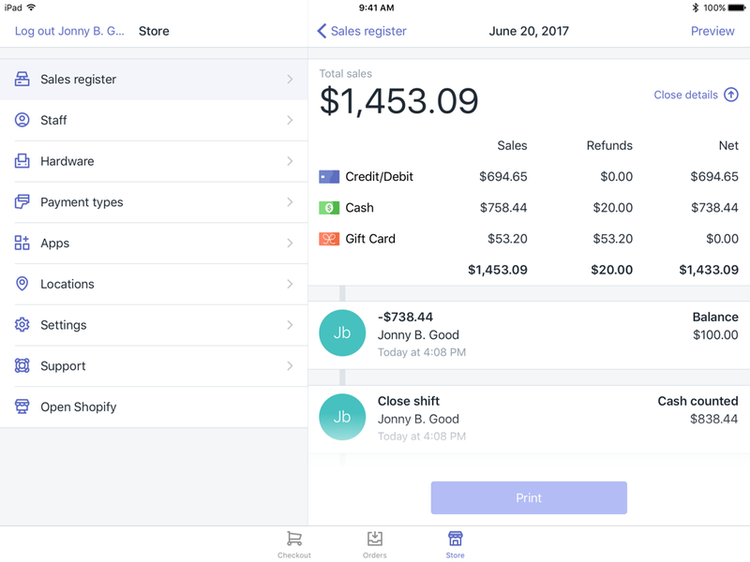

Shopify’s sales register is clean and uncluttered, and allows users to reconcile transactions by employee. Image source: Author

Shopify offers a number of pricing tiers, making it accessible to businesses of all sizes. Prices start at $9/month for its Lite plan, which supports both in-store and online payment processing. If you want true POS features. you’ll need to choose a more expensive plan, ranging from $29/month to $299/month.

Read The Ascent’s full Shopify Point of Sale review

6. Square

Square is a free mobile POS app that requires no investment in hardware, making it a great option for businesses in their early days, and it also offers a rich feature set for mid size and larger businesses. Square also offers Square for Retail and Square for Restaurants solutions which come with specialized features.

Square’s features include:

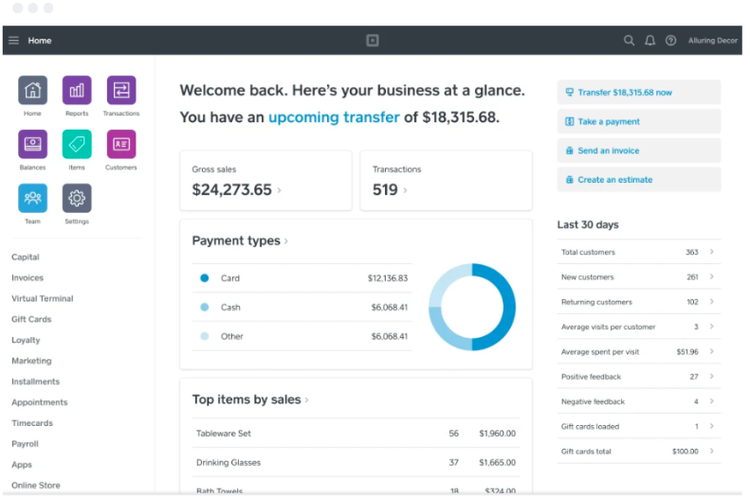

- Customizable main dashboard

- Virtual terminal

- Sales analytics

- Inventory management

- Offline mode

Square’s customizable dashboard gives users an overview of business and sales data. Image source: Author

While Square’s POS app is free, its payment processing fees cost a flat rate of 2.6% + $0.10 for each swipe, dip, or tap payment. Keyed transactions cost 3.5% + $0.15 per transaction, and online transactions cost 2.9% + $0.30 per transaction. Square provides all users with a free magstripe card reader.

Read The Ascent’s full Square review

7. PayPal Here

PayPal Here is a mobile payment solution that offers payment processing and basic POS features. It’s a good solution for users who need to process payments from both in-store and off-site locations via a tablet or smartphone.

PayPal Here also offers card readers that process both magstripe and Europay, Mastercard and Visa (EMV) chip cards and mobile payments such as Apple Pay.

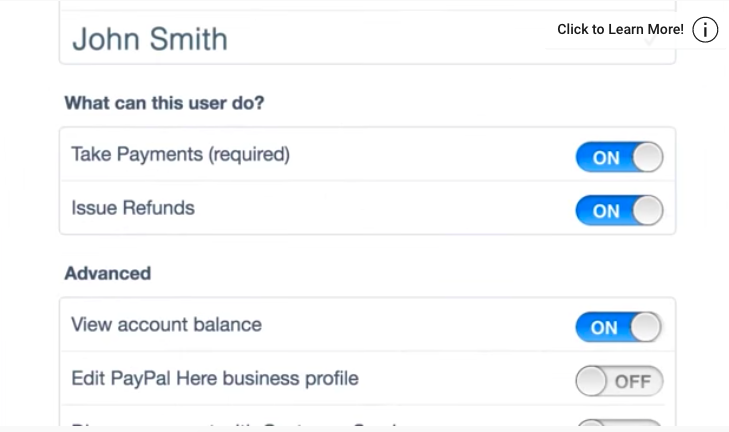

PayPal Here’s features include:

- Payment processing

- Invoicing

- Online payments

- Inventory management

- Customer management

- Reporting

PayPal Here allows users to manage staff access and permissions from the app. Image source: Author

PayPal Here’s payment processing charges: 2.7% per swiped or inserted card payment, 3.5% per keyed transaction, and 2.9% + $0.30 per online transaction.

Read The Ascent’s full PayPal Here review

8. Epos Now

Epos Now offers two distinct solutions for retail merchants and restaurant and hospitality businesses. Epos Now's software can be used on iPads, Android tablets, Macs, and desktop PCs. It’s highly customizable and easy to use.

Epos Now’s features include:

- Inventory management

- Reporting dashboards

- Customer management

- Employee management

Epos Now is available on both terminals and handheld tablets. Image source: Author

Retail and restaurant systems are priced the same and offer the same POS features. The basic option costs $39/month, and the premium offering is $69/month for the first POS terminal and account.

Additional terminals cost an extra $24/month/terminal on the basic plan and $45/month/terminal for the premium plan. Users who choose the premium plan can expect high levels of customer support. All Epos Now software plans offer a 30-day free trial.

Read The Ascent’s full Epos Now review

9. Clover POS

Clover POS is an Android-based POS solution. It serves the retail, service, and restaurant industries, but most of its users are in the food service industry.

Clover POS’s features include:

- Order management

- Customer management

- Sales reporting

- Virtual terminal

Clover POS daily sales report displays gross and net sales, money collected, and total orders. Image source: Author

How much you pay for Clover POS depends on three factors:

- Software

- Payment processing fees

- Hardware

Monthly subscriptions range from $14 to $70/month on top of payment processing fees, and users are required to use one of Clover’s own POS hardware packages. Package prices start at $69 per card reader to $1,649 for one POS terminal.

We recommend you read our full Clover POS review for more detailed information on pricing.

Read The Ascent’s full Clover POS review

Final words on choosing a cloud POS system

Whether you’re looking for a retail cloud POS system or a solution to help you run your restaurant or bar, the fact remains: You need to focus on the must-have features that will help you run your business smoothly and avoid spending a pretty penny on a system that has a ton of great features you don’t need.

As always, we recommend you explore product demos and free trials to experience each tool’s features before making a commitment.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.