From the one-person office to the global enterprise, everyone can benefit from expense management software. But the biggest benefits accrue to the managers who traditionally spent hours reviewing incomplete expense reports, hounding employees for missing receipts, and wondering if they were ever going to finish. Today, with OCR technology, automated expense report creation, and sometimes immediate employee reimbursements, expense management software is no longer a luxury -- it's a necessity.

The Best.

Those two words are subjective, particularly with expense management software. My best may not be yours, and that's fine. That's why we encourage you to take advantage of all of the resources these online expense reporting applications offer, which usually includes a free 30-day trial.

There's no better way to know if a software application is right for you than to test drive it for a couple of weeks.

But test driving an application takes time, a scarce commodity for small business owners. That's why we did a lot of the upfront work for you. While the reviews can't replace trying these expense tracking software applications, they hint at which products you may like to try.

| Product | Description | Next Steps |

|---|---|---|

|

Rating image, 4.60 out of 5 stars.

4.60/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Certify combines expense reporting with optional travel management and accounts payable capabilities into one easy-to-use application suitable for businesses of any size.

|

|

|

Abacus

Rating image, 4.40 out of 5 stars.

4.40/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Abacus Expense features a modern user interface and good expense policy management capability. Though best suited for larger businesses, even small business owners can use this scalable application.

|

|

|

ExpensePoint

Rating image, 4.40 out of 5 stars.

4.40/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

ExpensePoint manages receipts, integrates with credit cards, and is easily accessible from a variety of devices. Better yet, it easily creates expense reports and gets employees reimbursed quickly.

|

|

|

Rating image, 4.30 out of 5 stars.

4.30/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Zoho Expense is an online expense management application designed for almost any business looking for quick reporting automation and fast expense reimbursement.

|

|

|

Expensify

Rating image, 4.20 out of 5 stars.

4.20/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Freelancers, sole proprietors, and small businesses will all appreciate Expensify’s easy-to-use interface and expansive list of options. See if Expensify is right for your business.

|

|

|

Rydoo

Rating image, 4.20 out of 5 stars.

4.20/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Built for a global market, Rydoo is an excellent online expense management application. Rydoo offers expense and travel management, easy system setup, and intuitive navigation at an affordable price.

|

|

|

Tallie

Rating image, 4.20 out of 5 stars.

4.20/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

If you’re looking to automate the expense report creation process, look no further than Tallie, an expense management application that takes the work out of creating an expense report.

|

|

|

Concur Expense

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Concur Expense is part of SAP Concur’s suite of expense and travel management apps that are best suited for midsize businesses. Concur Expense offers good expense management capability.

|

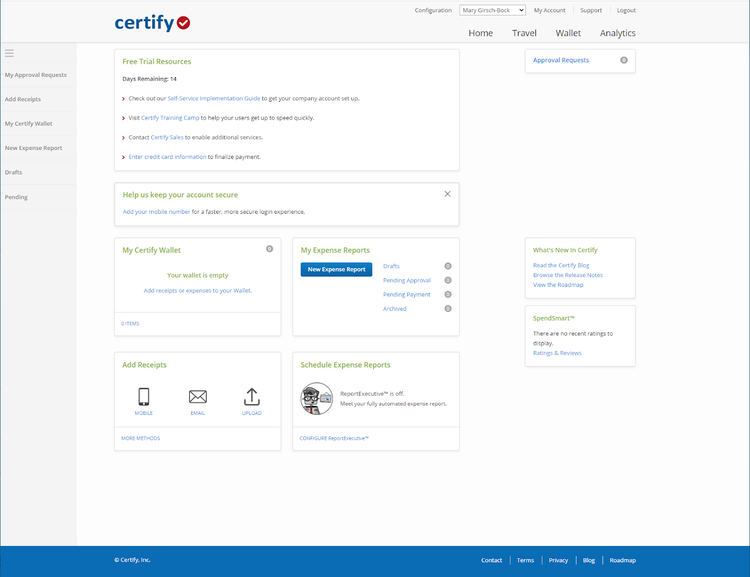

Expense management software like Certify is so popular because it automates the entire expense management process, from initial receipt to expense report. Instead of carrying a receipt around for a week, Certify lets you snap a photo -- and you’re done.

Certify simplifies the entire expense management process for both employers and employees, making everyone happy.

Rarely seen, Certify can bridge the divide between the needs of small businesses and larger companies, effectively handling the needs of both by addressing the major issues that businesses of any size face, including lost receipts, late expense reports, and company policy violations.

Certify is also easy to implement and offers implementation services that can be a lifesaver for larger businesses that don’t have the time to implement the application.

Certify’s home page showing all features and functions including expense reporting. Image source: Author

Perhaps the one downside is that the excellent travel management module offered by Certify is not included in the expense application, but has to be purchased separately. But if you or your staff do a lot of travel, it’s well worth the extra cost.

Finally, Certify helps to reduce and even eliminate hours of tedious reconciliation required anytime someone travels. Now your finance department can spend minutes reviewing expense reports and then move on to more rewarding tasks.

Isn’t it time to give your employees (and you) an affordable tool like Certify that will automate the entire business expense management process?

Employees love Abacus because while they may love to travel, they hate waiting to be reimbursed for expenses. By eliminating the entire expense report process with Abacus, your employees can immediately submit their reimbursable expenses, and get paid in days, not weeks.

Abacus also provides easy trip management, where you can place all of your travel-related expenses into one single submission. As a business owner, Abacus lets you create an expense policy that your employees can follow, and approve only the expenses that fall within that policy.

By eliminating the expense report process, Abacus provides you with a better way to manage your business expenses by offering insights and analytics across the board.

You can easily approve employee submissions from the Admin homepage. Image source: Author

Let’s face it, your employees want to be reimbursed quickly. You want to account for their expenses promptly, and who doesn’t want to have a more efficient way to manage their expenses?

That’s what Abacus provides.

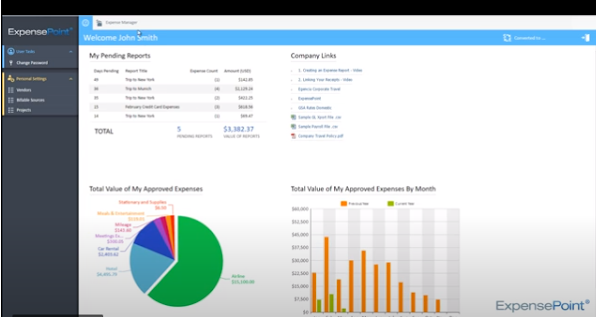

Designed to manage your receipts before they become historic relics, and you suddenly spend hours reminiscing about your first job, expense management software such as ExpensePoint can help you get control of business expenses and assist with managing those pesky receipts.

Suitable for businesses of any size, ExpensePoint is an affordable way for small business owners to completely automate the entire expense management and expense report process.

ExpensePoint offers the features you expect in an expense management application with some added perk, including free telephone support, free product setup, and free training. And who doesn’t like free? In addition, ExpensePoint offers a single plan at an affordable price so you don’t have to decide between features and cost.

ExpensePoint’s homepage offers easy access to expense reports as well as useful expense graphs that detail spending habits. Image source: Author

Are you tired of carrying around handfuls of receipts in your pockets, your wallet, or your purse? Are you interested in managing expenses better, but you know that your business can’t afford another high monthly expense? Or, maybe you’re tired of your employees asking you where their reimbursement is. If so, it’s time to check out ExpensePoint.

Unless you’re fond of stacks of crumpled up receipts, tracking expenses isn’t anybody’s idea of a good time. The good news is that even if it isn’t fun, it doesn't have to be difficult.

At least, not if you use Zoho Expense. Affordably priced and easy to use, Zoho Expense includes one of the best user dashboards I’ve seen in expense management applications. It’s easy to navigate, uncluttered with useless data, and provides quick access to all system features.

Completely online, Zoho Expense offers easy expense report creation, eliminating the need to manually track expenses. You’ll keep your employees happy by quickly reimbursing them for out-of-pocket expenses in days, not weeks.

Zoho Expense lets you snap a photo of a receipt and reconcile your corporate credit card transactions in minutes. It also includes a multilevel approval process, ensuring the correct people see the expense report when they’re supposed to.

The application also allows you to set up travel and expense rules for your business, which can help manage spending limits.

Zoho Expense makes it easy to get started with links to short video overviews of major features. Image source: Author

Zoho Expense can be used with other Zoho applications or synced with your accounting software so your expenses are recorded properly. With pricing levels that won’t break anyone’s budget, there’s no good reason not to check out this popular expense management application.

So toss away those piles of receipts (after you scan them) and start using Zoho Expense to manage expenses for your business. You and your employees will appreciate it.

If you're a business owner, you probably already know that managing business expenses is about as much fun as getting a root canal. If you’re tired of dealing with piles of receipts, hunting down missing receipts, and trying to find creative ways to curb excessive employee spending, it may be time to take a look at Expensify.

A partner of the American Institute of Certified Public Accountants (AICPA) and CPA.com, Expensify is easy enough for the computer novice to use but includes a long list of features usually found in more complex (and expensive) applications.

Expensify lets you do as little or as much as you like to manage your expenses, all with an affordable price tag attached.

You can scan receipts, reimburse employees immediately, auto-sync to your accounting application, and even integrate with enterprise-level ERP systems. You can create policies and be notified when they’re violated, and you can even reimburse your employees for out-of-pocket expenses immediately.

Expensify’s main screen displays current messages from the Concierge as well as easy access to system features. Image source: Author

At the same time, your employees can automatically create expense reports, which you can approve directly from the Expensify mobile app. And you can use the Expensify Card to eliminate employee overspending and make unauthorized expenses a thing of the past.

With four plans available, freelancers, sole proprietors, and small business owners can all take advantage of the features found in this platform. So whether you need to manage your own expenses or those of dozens of your employees, Expensify may be the product that you’re looking for.

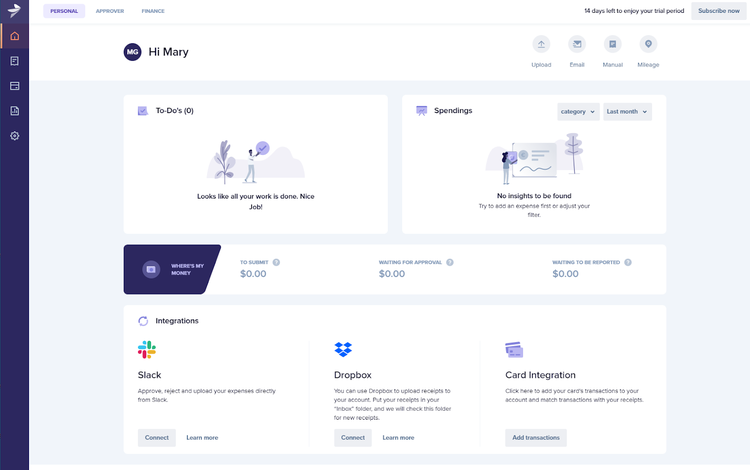

Convincing your employees to track their expenses can be hard enough. Now imagine having to do that in multiple languages, dealing with multiple currencies.

No more imagining, because Rydoo can do that for you. Designed in Belgium, Rydoo has always been one of the better selections for small to midsize businesses that need to track business expenses internationally.

Previously known as Xpenditure, Rydoo was formed when Xpenditure combined with two other expense management applications (iAlbatros and Sodexo) to create an easy-to-use application that appeals to U.S. and overseas users.

Its international character shines through in its multicurrency capability. Rydoo takes it further by offering multilingual dashboards for both the web version and the mobile app.

Rydoo lets you reimburse overseas employees in their native currency, so you don’t have to worry about exchange rates and inaccurate reimbursements.

Rydoo’s dashboard offers access to a to-do list, spending totals, and other system features. Image source: Author

It includes most standard features found in expense management software today: receipt scanning, automatic expense report creation, and the option to submit an expense immediately upon uploading it or saving it to submit later.

Multiple approvers can be set up in Rydoo, and you can easily create custom rules for submitting expenses.

In addition, Rydoo lets you connect your bank account and credit card accounts directly to the application. It offers multiple roles for authorized system users, and it contains a good selection of helpful add-on applications, including Insights, Audit, and a NetSuite Connect option for easy connectivity.

All these features are available at an affordable price, making Rydoo a serious contender in your search for expense management software.

Creating an expense report is nobody’s idea of a good time. If you dread reviewing employee expense reports that are partially complete and missing receipts, you may want to check out Tallie by Emburse.

One of the reasons I like Tallie is its snappy name, but behind that name is an online expense report software platform that can make the entire expense reporting process easier for your employees and for you.

Tallie automates the entire expense report process, offering complete receipt management capability whether you snap a photo with a smartphone or email a receipt directly to Tallie to read.

Tallie also connects to your bank account as well as to any credit cards, importing transactions and matching them with expenses.

But Tallie takes the process one step further by automatically categorizing submitted expenses and bundling them into an expense report that’s ready for approval. No more manual matching of receipts to expenses, no more wrong categorizing, no more endless data entry.

You can review all uploaded receipts from the New Expenses screen, where they can be uploaded directly to an expense report. Image source: Author

But that’s not all. Tallie also allows you to set expense policies for your business and will automatically detect duplicate receipts so you won’t have to worry about reimbursement or expensing the same item twice.

The application offers automatic notifications when a report is submitted for approval and a second notification when approval is complete. And employees can go online and see the status of any submissions themselves.

Designed to integrate with popular accounting software applications like QuickBooks and Xero, Tallie eliminates the need to re-enter data a second time by importing all data directly into your accounting application.

Finally, with three plans to choose from that offer a variety of features and functions, Tallie may be the expense management application you’ve been looking for.

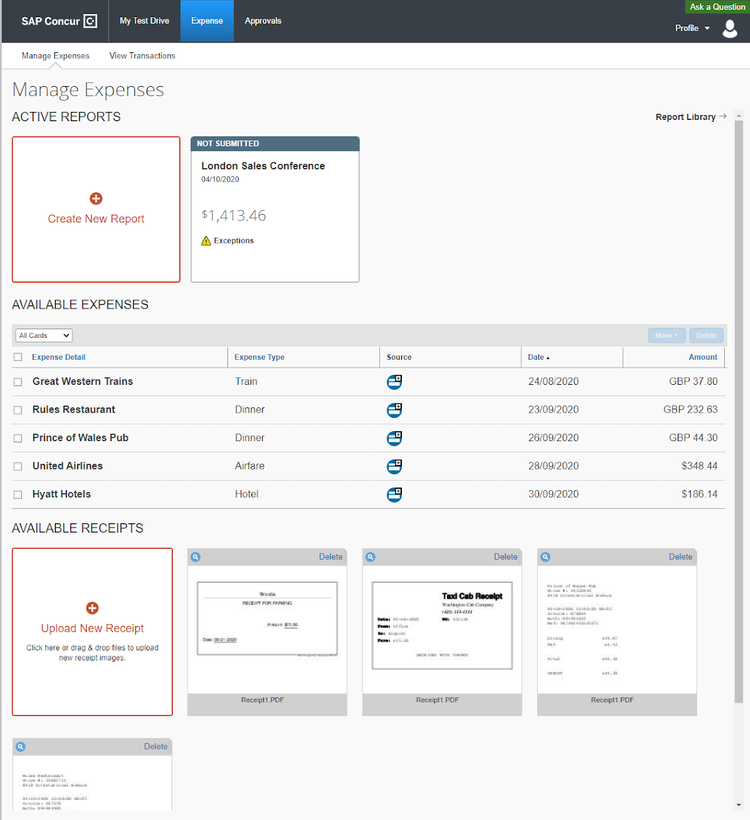

If you’re tired of carrying around stacks of receipts every time you travel -- or worse, sorting through the stack of receipts your employees bring back every time they travel -- it might be time to consider using an expense management application like Concur Expense from SAP Concur.

Concur Expense is suitable for any size business, but it’s a much better fit for midsize businesses whose needs are different from that of a small business or startup.

Concur Expense can take the pain out of managing expenses, snapping a photo of any receipt, whether from a restaurant, an office supply store, or a four-star hotel.

Concur Expense also manages those receipts from initial submission to expense report creation and lets you itemize expenses, track mileage, separate personal and business expenses, and automatically submit the report for approval.

The Manage Expenses page provides a list of expenses and receipts. Image source: Author

While Concur Expense makes it easy to handle expenses while traveling, you don’t have to travel to take advantage of its features. Lunch with colleagues or just a trip to the office supply store will suffice.

But perhaps the best part of Concur is the option to add a bunch of other cool apps that make it easy to manage travel, create expense budget categories, and even automatically calculate your mileage without lifting a finger.

If you’re looking for an easy-to-use expense management application that can grow with your midsize business, Concur should be on your list.

What The Ascent looks for in a great expense management software

Remember those big, bulky expense reports with pages and pages of receipts, handwritten expenses, and sometimes notes explaining why there is no receipt attached for a specific expense? Remember what fun it was to reconcile all of your credit card transactions to the expenses on the expense report?

Today's expense management applications say goodbye to all that. Expense reports are streamlined, and receipt images match nicely with credit card transactions. Reports are automatically funneled to the correct parties for approval and then submitted for reimbursement, which usually takes only days, instead of weeks.

These expense apps allow you to snap a photo of a receipt, eliminating the need to carry it around for eternity. Receipts are then scanned, and using OCR technology, are automatically matched with transactions uploaded from your financial institution or credit card company.

Expense tracker apps are also easy to use, with most including a powerful mobile app for recording business expenses from anywhere in the world. They make your employees' lives a lot easier, which means your life is a lot easier.

Most expense management software applications are loaded with features, but some are more important than others. Let's have a look at some of them.

Optical Character Recognition

Optical Character Recognition (OCR) works with receipt scanning software to read the details on a scanned receipt and autopopulate the appropriate fields with the data. Designed to eliminate much of the data entry needed to record expense details such as a merchant, transaction date, amount, and item, OCR technology is included in all expense management applications reviewed by The Ascent.

Robust mobile app

Unless you're doing a ton of online shopping, the majority of your business expenses occur while you're out. That's why a robust mobile app with the same features found in the online expense management application is so important.

And yes, being able to use a receipt tracker app to snap a photo of a receipt is important, but it's just as important to be able to submit an expense for approval, complete an expense report, or approve an employee's expenses using your mobile app.

Expense policy rules

It's great having expense management software to track and categorize your expenses. But as with anything, with no rules in place, chaos may ensue. Specifying parameters your employees need to follow is helpful, but even more helpful is that you can warn them before they violate rules. Rules and policies serve as the backbone of every good expense management application. Take advantage of them.

Credit card transaction feeds

Similar to the credit card feeds available in many accounting software applications, this feature can save you time. Once transactions are imported, they are usually automatically matched with receipts that have been uploaded, without any data entry required. You can then investigate any transactions unmatched to an expense.

How your business can benefit from using expense management software

The biggest benefit small business owners derive from expense management software is the elimination of hours reviewing pages and pages of expense reports to ensure everything has been submitted properly. But there's plenty of other benefits as well. Check out just a few of them.

Eliminates the "lost receipt" problem

Who hasn't lost a receipt? I always used to lose the receipts I needed, while the ones I didn't need were busy starting a colony at the bottom of my purse. By letting employees snap a photo of a receipt when they get it, you'll never have to worry about missing receipts, and neither will your employees.

Automates the expense reporting process

I've never met anyone who liked completing an expense report. With expense management software, the application does all the hard work for you. Your employees can create a report for a single expense or wait and submit multiple business expenses on a single report, all nicely reconciled.

Prevents overspending and unauthorized charges

It's one thing to give employees spending limits, but it's another to enforce them. Expense management software lets you do just that. It lets you create spending guidelines and limits, flagging non-compliant employees. In some cases, you can even impose spending limits on specific items such as per diems, hotels, and even rental cars, ensuring your employees spend within the set policies.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.