I’m guilty of looking in my closet and saying something like, “Oh, I can’t get rid of this. I might want to wear this screen-printed lederhosen t-shirt for a Halloween costume one year.” For years, the lederhosen t-shirt will remain in my closet, unused and taking up valuable space.

Fortunately, it’s much easier to determine how long to keep employee payroll records.

Overview: What are payroll records?

Payroll records document anything related to employee compensation, from name and address to hours worked to payroll taxes and deductions. Your payroll software is a record-making factory, churning out a series of documents every time you run payroll. It also files quarterly and annual returns for the Social Security Administration, the IRS, and your employees.

As a business owner, you’re responsible for retaining payroll records. Government agencies dictate how long you need to hold on to certain documents. Thanks to electronic document management systems, it’s easier than ever to store mounds of payroll records.

What should you include in your payroll records?

Payroll records encompass all accounting and tax documents related to paying employees.

Employee information

Most employee files completed during the onboarding process are part of the payroll records family.

Employment records comprise:

- Full name

- Address

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Birthdate, if younger than 19

- Gender

- Offer letter

- Pay raise letters

- Employment contract

- Time off history

- Direct deposit authorization

Also, you’ll need to store a U.S. Citizenship and Immigration Services (USCIS) Form I-9 for each employee. The I-9 verifies an employee’s eligibility to work in the U.S.

Payroll register

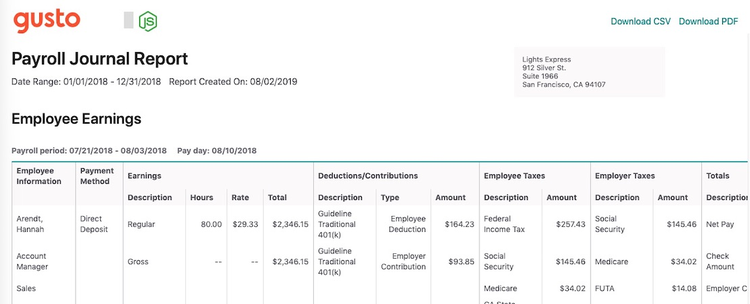

The payroll register provides a soup-to-nuts overview of all employee earnings for a payroll run, including wages, tips, hours worked, employee- and employer-paid payroll taxes, and payroll deductions. It’s your go-to document for all questions about how payroll works.

If your payroll software doesn't generate payroll registers, substitute it with a payroll journal. While payroll registers and journals are similar, payroll journals don't include sensitive employee information, such as SSNs and addresses. You have employee information stored in other documents, so don't worry about creating payroll registers by hand.

If your software doesn't generate payroll registers, substitute it with a payroll journal. Image source: Author

Pay stubs and timesheets

Every time you process payroll, your payroll software produces and saves a copy of each employee’s pay stub, which lists the employee’s gross wages, payroll taxes, and payroll deductions.

It might seem duplicative to store pay stubs and timesheets, which show an employee’s earnings and hours worked, when the payroll register has all that information in a neat package. However, pay stubs and timesheets come in handy more often than a payroll register will.

For example, if a mortgage lender ever asks you to verify an employee’s income, you’re not going to share detailed earnings information for all of your employees. A mortgage lender also doesn’t care about how much you paid in employer-paid payroll taxes, like Federal Unemployment Tax Act (FUTA) taxes. They want a pay stub, which shows how much your employee took home.

The Fair Labor Standards Act (FLSA) requires that you store employee overtime hours and earnings, which might not appear in a payroll journal. Pay stubs and time cards will satisfy the FLSA mandate.

Payroll tax forms

Retain all payroll records submitted to a government agency. Payroll software works hard in the background to file the following federal tax documents quarterly or annually:

- Form 940

- Form 941 or Form 944

- Form W-2

- Form W-3

- Form W-4

Keep a copy of the equivalent state tax forms, too. Again, your payroll software has all of this.

The list above isn’t exhaustive. You also need to keep tabs on tax forms for claiming employee-related tax credits, such as the employee retention credit or work opportunity credit.

Retirement plan records

You’ll want to keep records of your employees’ contributions to company-sponsored retirement plans, like a 401(k). When an employee separates from your business, they may opt to roll over their retirement savings into a new plan. To make sure you distribute the correct amount to your former employee, refer to the statements furnished by the plan servicer.

How long should you keep payroll records?

Record-keeping requirements differ by document type and the state(s) where your business operates.

Federal agencies set record retention rules for certain documents. However, check with your state labor department and tax authority for more specific record retention rules.

Some states, such as New York and Illinois, have lengthier payroll record retention periods than the federal government. Also, insurance companies sometimes request that you hold on to records for longer periods than federal or state governments require.

Below are the Equal Employment Opportunity Commission, IRS, and FLSA records retention requirements. Don’t toss your five-year-old payroll documents into the fire until you check your state’s and insurance company’s record retention requirements.

- Employee information (except Form I-9): three years

- Form I-9: three years after hire date, or one year after employee separation, whichever is later

- Payroll register: four years

- Pay stubs: three years

- Timesheets: two years

- Payroll tax forms: four years after filing the fourth quarter for the year

- Retirement plan records: six years

FAQs

-

Yes. Although the digital age makes it a breeze to store a virtually unlimited number of records, it’s good to offload documents that no longer serve your business.

For example, there’s no reason to store employees’ Form I-9, which contains sensitive information, such as SSNs and passport numbers, if the employees haven’t worked for your company in a decade. It becomes a liability to keep all of this useless information in your possession.

-

You should have two records for most independent contractors: Form W-9 and Form 1099-NEC. Keep both records for at least four years.

Form W-9 provides you with the contractor’s name, address, and TIN. Every January, you send to the IRS and each independent contractor a Form 1099-NEC (before 2020, you’d use Form 1099-MISC), which summarizes the contractor’s earnings of $600 or more for the previous year.

-

When you’re self-employed, you don’t earn a salary. You pay yourself an owner’s draw by writing a check from your business bank account to your personal bank account. Your bank statements, which you should never delete, reflect these payments.

Your business type determines how you report and pay tax on your earnings. In general, keep all of your tax forms for at least four years.

-

First, it’s unlikely your business will be selected at random for an IRS audit. If you should get so lucky, congrats. Please engage a tax attorney or CPA.

The statute of limitations for IRS audits is three years after filing, or the due date, whichever is later. The IRS can go further back if they catch a substantial error, or if you failed to file (or fraudulently filed) a return. Since you're supposed to retain IRS payroll files for four years, you shouldn't run into a problem.

Go paperless for easy payroll record-keeping

Record-keeping becomes less of a chore when your documents are digital. From tax forms to employee paychecks, going paperless saves physical storage space and makes them more accessible.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.