Developed with smaller businesses in mind, Wave Payroll offers basic payroll capability. Designed to be used in conjunction with Wave Accounting, Wave Payroll lets small business owners easily pay their employees.

-

Ease Of useRating image, 4.00 out of 5 stars.4.00/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

SupportRating image, 2.50 out of 5 stars.2.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

PricingRating image, 2.50 out of 5 stars.2.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

FeaturesRating image, 2.50 out of 5 stars.2.50/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

-

- Complete integration with Accounting by Wave

- Easy setup

- Ability to print checks in-house

- Only one payroll report available

- No mobile apps

- Full-service payroll limited to 14 states

Wave Payroll, an add-on option available from Wave Accounting, offers basic payroll services, with full-service payroll available in 14 states.

Who is Wave Payroll for?

Wave Payroll offers basic payroll processing capability and is best suited for smaller businesses with fewer than five employees who are currently using or planning to use Wave Accounting. It's also a good fit for businesses that pay seasonal employees.

Designed to integrate with Wave Accounting, Wave Payroll offers good integration between applications for automatic recording of any payroll-related expenses.

Wave Payroll's features

If you're still a bit unsure about how payroll works, but your payroll needs are simple, Wave Payroll could be a good fit for your small business, particularly if you're already a Wave Accounting user.

This is because all payroll-related expenses incurred in Wave Payroll will automatically post in your Wave Accounting general ledger (G/L). Wave Payroll also includes an easy setup process and offers some nice features, including an employee access feature.

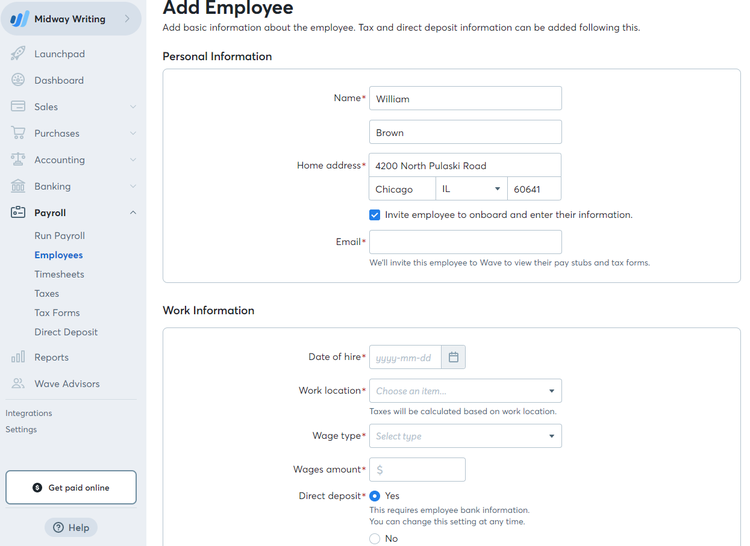

The Add Employee screen lets you add basic details including direct deposit information. Image source: Author

If you include an employee's email address when entering their information in Wave Payroll, they'll receive an invitation to connect to it. After they register with a password, they'll have access to their pay stubs and other payroll details, such as bank accounts and routing numbers for direct deposit.

Wave Payroll also includes direct deposit capability and allows you to pay contractors, though they're not paid through Wave Payroll, but rather through Wave Accounting.

Unfortunately, Wave Payroll only offers full-service payroll in 14 states: Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin. If your business is in one of those states, you can subscribe to the full-service payroll option, but businesses in the other 36 states will have to opt for the self-service option.

Wave Payroll also offers PTO tracking and the ability to print payroll checks in-house. Workers' compensation insurance is included in the application.

There are some drawbacks to Wave Payroll. Employee garnishments are not supported in the application, and it only offers a single payroll report. Imputed income capability is not available in the application either, and currently, Wave Payroll does not offer an app for iOS or Android devices.

In addition, although bookkeepers and accountants who are currently using Wave Accounting may appreciate Wave Payroll's integration capabilities, the product does not offer any other integration options for other third-party applications.

Here are some additional features found in Wave Payroll.

Dashboard

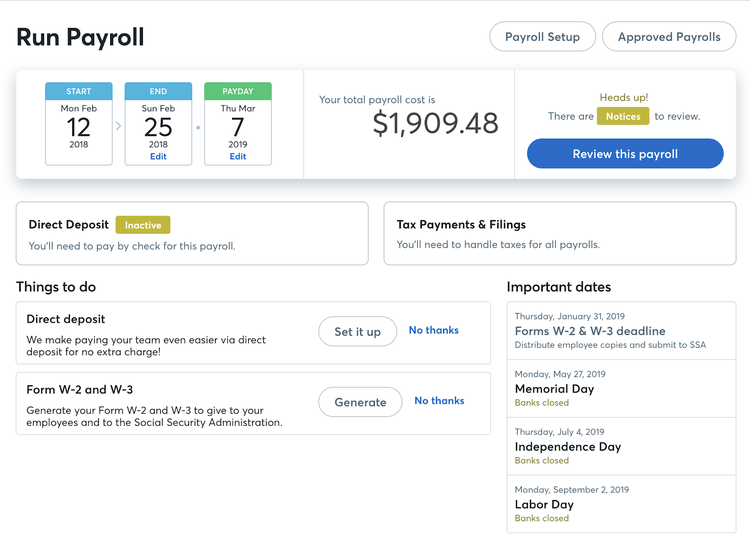

Wave Payroll's dashboard offers a quick summary of payroll-related information, including upcoming start and end pay dates as well as a pay date. Also included on the dashboard is a Things to Do list as well as quick access to payroll setup and approved payroll.

Wave Payroll's Run Payroll dashboard offers a summary of payroll-related activities. Image source: Author

You can also click on the Review this Payroll button to take a look at your current payroll, with the total payroll amount displayed prominently. If you need to make any changes to the displayed payroll, you'll need to delete the current payroll in order to enter any changes.

Timesheets

Wave Payroll includes an easy-to-use timesheet that can be used to track hours worked for both hourly and salaried employees, though you'll only want to track vacation or sick hours for your hourly employees.

Wave Payroll includes a timesheet for both hourly and salaried employees. Image source: Author

You'll use the same process when entering hours worked for hourly employees, though you'll also be filling out the regular hours line.

Unfortunately, Wave Payroll does not offer a timesheet for your employees to fill out on their own, so employees will have to track their hours separately, and you'll later have to enter them manually prior to running payroll.

Automatic journal entries

One of the more convenient features available in Wave Payroll is the ability to create a payroll journal entry that will be automatically posted in Wave Accounting.

Wave Payroll creates journal entries to adjust banking totals once payroll has been run. Image source: Author

The payroll journal entry is automatically posted on the Transactions page in Wave Accounting. If you currently pay your employees using direct deposit and have your bank connected in Wave Accounting, you don't have to do anything else.

Keep in mind that any benefits or deductions from an employee's pay will display as an uncategorized expense, which you'll need to categorize properly in Wave Accounting.

Status

Ideal for part-time or seasonal employees, you can complete the offboarding process in Wave Payroll as easily as you complete the onboarding process.

The Employee Status option lets you change the status of any employee. Image source: Author

This option works great for businesses that only pay certain staff during part of the year, such as the holiday season or the summer months.

Wave Payroll's ease of use

Wave Payroll is designed for smaller businesses and is ideal for those with no experience processing payroll. The setup process is completed in easy-to-follow steps, but you only have the option to choose one payroll schedule, which includes weekly, bi-weekly, semi-monthly, and monthly options.

Adding a new employee is more time-consuming than it should be, with the process divided into multiple steps. There are separate options for adding salary, vacation details, tax details, benefits and deductions, direct deposit, and bank details.

Another overly complicated feature is entering time for your employees, including any sick or vacation time, with each option displayed on a separate line instead of in a grid, which would simplify the data-entry process considerably.

In fact, It feels like the entire data-entry system could be simplified, especially when considering that Wave Payroll only offers basic payroll processing.

Wave Payroll's pricing

Wave Payroll offers two payroll service plans: the Tax Service plan, which is available in 14 states, and self-service, which means you'll be directly responsible for filing all related tax forms in a timely manner.

Wave Payroll offers both self-service and full-service payroll depending on your state. Image source: Author

Full-service plan: Wave Payroll currently offers full-service payroll in 14 states: Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin. Full-service pricing is currently $35 per month, plus $6 per active employee or contractor.

Self-service plan: Only self-service payroll is available in the other 36 states. The self-service plan requires that you process all reports and remit taxes directly. Wave's self-service plan is currently $20 per month, with a $6 per active employee or contractor fee required.

Wave Payroll's support

Support for Wave Payroll subscribers is the same as it is for Wave Accounting users. Unfortunately, while many accounting questions may be able to wait for answers, payroll questions frequently carry a bit more urgency.

Wave Payroll currently only offers chat support, though a good knowledge base with numerous payroll-related articles and step-by-step instructions is also available. For less urgent inquiries, you can also submit a support request directly from the Wave website.

Benefits of Wave Payroll

The biggest benefit of using Wave Payroll is obviously reserved for those already using Wave Accounting, since the application automatically tracks and posts all related payroll expenses directly in the accounting application.

If you're not using Wave Accounting, you'd be better served using another payroll services provider.

Good for basic payroll needs

If you're currently using Wave Accounting and are looking for easy integration with payroll, Wave Payroll may be a good fit. However, if you're in one of the 36 unlucky states that don't have full-service payroll available through Wave Payroll, you might want to seriously look elsewhere.

There are several comparably priced payroll applications on the market today that offer full-service payroll processing and include a lot more features and functions than Wave Payroll offers.

How Wave Payroll Compares

| Online Access | Direct Deposit | Prepares Federal Tax Forms | Employee Access to Payroll Documents | |

|---|---|---|---|---|

| Wave Payroll |

|

|

|

|

| TRAXPayroll |

|

|

|

|

| Gusto |

|

|

|

|

| Paycor |

|

|

|

|

FAQs

-

Yes, it can, although it offers more benefits if used in conjunction with Wave Accounting.

-

Wave Payroll currently does not offer a mobile app for either iOS or Android devices.

-

Only if your business operates in Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, or Wisconsin.

If your business operates in any of the other 36 states, you will be responsible for calculating taxable wages and filing your own state and federal tax reports and remittances.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.