I am not a big fan of pumpkins or espresso. But smash pumpkin "spice" (which is really a bunch of non-pumpkin related spices) and espresso together to make a pumpkin spice latte, and I will eagerly waste 150 calories or so on it every day.

The statement of cash flows is similar. The balance sheet and income statement, traditional financial statements, only tell you part of the story. The income statement is full of arcane line items calculated on an accrual basis, and the balance sheet can be boiled down to a simple chart of accounts with no explanation of what caused the change in each account.

In this article, we’ll go over how to create your cash flow statement by smashing together the income statement and balance sheet.

Overview: What is the indirect method?

The income statement uses the direct method to calculate net income. You start with revenue and subtract out all expenses to discover what is left.

The cash flow statement is calculated with the indirect method: we start with net income and reconcile our way to cash flow.

How to prepare a statement of cash flows using the indirect method

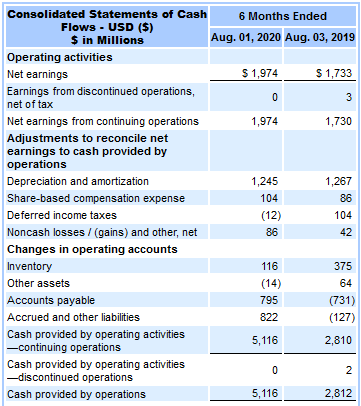

The cash flow statement is broken down into three sections: operating, investing, and financing. Let’s peruse the financials of Target Corporation (TGT) to do a cash flow analysis.

Operating

Target’s cash flow from operating activities was around $5 billion. Image source: Author

Operating activities are all transactions affecting cash related to operations. Let’s go through the line items that would likely apply to your business:

- Depreciation and amortization: Depreciation is an accounting construct. It’s a guesstimate of how much the value of a fixed asset has deteriorated over the prior year. There is no actual cash outlayed for depreciation (maintenance expenses would be a different line item) so we need to add it back to net income to include only actual cash expenses. Target had just over $1.2 billion of depreciation and amortization.

- Inventory: The income statement includes cost of goods sold, which only accounts for the cost of inventory sold during the period. If you purchased more or less inventory than you sold you won’t be correctly accounting for the cash spent during the period. If you purchased more inventory than was sold, inventory will have increased and we subtract the change from net income. If you purchased less, some of the inventory you sold came from a different period so we add the difference to net income to reflect the cash spent in this period. Target’s inventory increased by about $116 million more than it recognized in cost of goods sold, which means Target spent a ton of money adding to its warehouses and stores.

- Accounts receivable: This one actually isn’t on Target’s statement because they don’t do credit sales. For businesses that issue accounts receivables to customers, we need to adjust for those credit sales to make sure we only include actual cash collected. If accounts receivables increased during the period, subtract the change to deduct credit sales. If there was a decrease, it means you collected cash on sales recognized in a prior period, so add the change.

- Accounts payable and other operating liabilities: We adjust operating cash flow for changes in current liabilities in the opposite way as current assets. If accounts payable increased, it means that some expenses recognized on the income statement have not yet been paid for with cash, so we subtract the change. If accounts payables decrease, it means you spent more cash than what was accrued in expenses on the income statement.

Investing

Target spent $1.4 billion on investing activities. Image source: Author

Investing activities are all uses of cash for long-term assets. For your business, this would likely include purchase of capital equipment, company vehicles, and the down payment for a new building.

Target spent just over $1.4 billion on property and equipment and earned $10 million in cash from selling or disposing equipment and property. Any other cash flow from assets, such as investment income, would appear in this section.

One of the most common methods of cash flow, free cash flow, appears in the operating and investing activities section. The formula is:

Operating Cash Flow - Capital Expenditures = Free Cash Flow

Capital expenditures are the cash outflows for property and equipment. You can get a better reflection of the actual cash earned and spent by the business using operating cash flow and capital expenditures.

Using the indirect method, calculate capital expenditures by subtracting last period’s fixed assets total from this period’s.

Financing

Target had $993 million in cash from financing activities. Image source: Author

In a young and growing business, we use the operating section to see if the business broke even, the investing section to see how the business is investing in long-term assets for its future, and the financing section to see where all the money came from.

The financing section shows how cash was added to the company with new debt or capital investments and how it was spent to pay down debt or reward owners with dividends.

At the end of the graphic there is a final reconciliation of the cash account. Beginning cash is what the balance was on the balance sheet last period and we have indirectly shown how to get to the cash balance for this period.

FAQs

-

The income statement and balance sheet have their own purposes, but the cash flow statement will give you the full picture on how cash, the most important account, is flowing through your business.

-

It’s likely your accounting software can run cash flow reports. However, taking the time to produce the report on your own could help pinpoint problems, such as inventory that is growing faster than revenue or debt that could be paid down faster.

-

The most common cash flow statement is the Uniform Credit Analysis (UCA) cash flow statement. This format is widely used by lenders and is structured in a way to get a better idea of whether cash from the business can service debt payments.

Cash flow rules everything around me

Even as an accountant, I recognize many of the traditional account reports can seem superfluous. The cash flow statement is not. The popular saying that cash is king is popular for a reason, and there’s no better report to learn about how you are using and conserving cash.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.