T-accounts are used as an aid for managing debits and credits when using double-entry accounting. Used more as a support mechanism, accounting T-accounts can be helpful for small business owners and entry-level bookkeepers who are making the move to double-entry accounting.

Overview: What are T-accounts?

T-accounts are called such because they are shaped like a T. A representation of the accounts in your general ledger, T-accounts can serve as a visual aid for bookkeepers and accounting personnel who are learning accounting processes, as well as those moving from single-entry to double-entry accounting.

The T-account, like all accounting transactions, always keeps debits on the left side of the T and credits on the right side of the T. Like a journal entry, T-account entries always impact two accounts.

T-accounts can also impact balance sheet accounts such as assets as well as income statement accounts such as expenses.

T-accounts are called such because visually, they resemble a T. Image source: Author

How are T-accounts used?

No matter what type of accounting you are using, you can use a T-account as a visual aid in recording your financial transactions.

T-accounts can be particularly useful for figuring out complicated or closing entries, allowing you to visualize the impact the entries will have on your accounts.

For instance, prior to processing closing entries, you can create a revenue T-account in order to check for accuracy. T-accounts also provide a tool for helping to ensure that your entries will balance.

Example of using a T-account

Before you can begin to use a T-account, you have to understand some basic accounting terms.

Debit: A debit is a transaction that increases asset and expense account balances. For instance, your bank account is considered an asset, while rent, payroll, office supplies, and utilities are considered expenses.

Credit: A credit is a transaction that increases liability and equity accounts. Accounts payable and loans are considered liability accounts, while capital is considered an equity account. The chart below provides you with additional information on common account types, as well as when you would use a debit or credit when recording your transactions.

| Type of Account | To Increase Balance | To Decrease Balance |

|---|---|---|

| Assets: Cash, accounts receivable, inventory, furniture, and computers are all assets | Debit | Credit |

| Liabilities: Accounts payable, notes payable, and bank loans are all liabilities | Credit | Debit |

| Revenue: Money you receive from customers for goods or services provided is considered revenue | Credit | Debit |

| Expenses: Rent, payroll, office supplies, insurance, postage, and utilities are all expenses | Debit | Credit |

| Capital/Owner Equity: This represents the financial interest in the business of all owners and investors accounted for | Credit | Debit |

For instance, when you receive a payment from a customer, you would always debit your cash account, because the customer payment that you deposited increases your bank account balance.

On the flip side, when you pay a bill, your cash account is credited because the balance has been reduced since you recently paid a bill.

Double-entry accounting: Double-entry accounting simply means every transaction has an equal impact on at least two different accounts. Referring back to debits and credits again, every debit entry has to have an equal credit entry.

General ledger: The general ledger is where all of your financial transactions are recorded. Maintaining the general ledger helps to ensure that your books remain in balance. The general ledger also helps you identify any erroneous entries and correct them. Finally, all of your general ledger transactions are used to create financial statements for your business.

The shaded area in an accounting journal is designed to resemble a T-account. Image source: Author

When you’re ready to use T-accounts, you can use them separately, in order to view journal entry details, or you can enter the transaction directly into your journal.

As you can see by the area shaded in the table above, accounting ledgers are designed to resemble a T-account, making it easy to post journal entries when you’re ready, with the only difference being that journals do not have an account name at the top of the T.

Like your journal entries, all entries to a T-account should always balance. In other words, the debits entered on the left side of a T-account need to balance with the credits entered on the right side of a T-account. Here is an example:

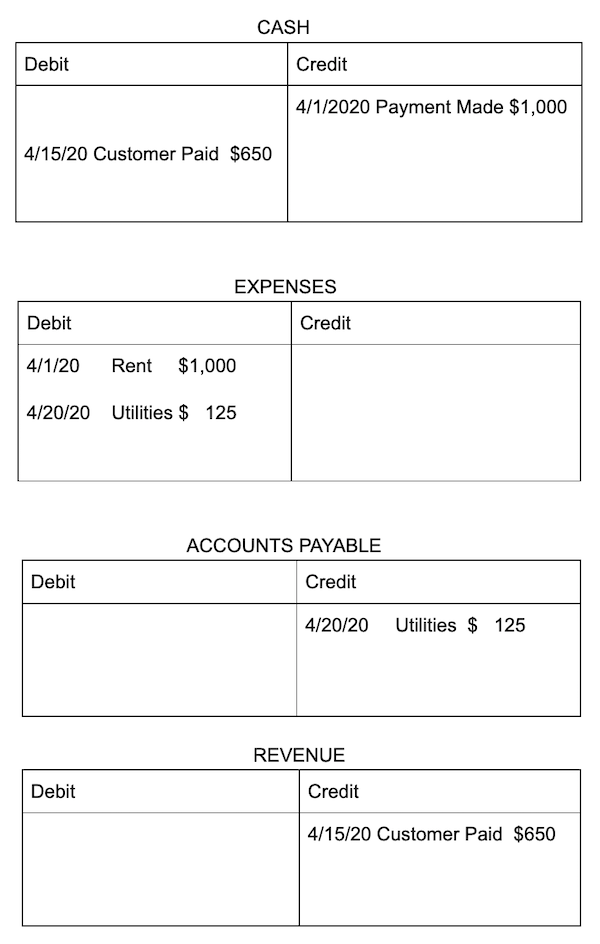

For example, Sam needs to record the following financial information:

- Rent payment made in the amount of $1,000 on April 1.

- Cash payment received in the amount of $650 from a sale on April 15.

- Recording a utility bill of $125 due next month on April 30.

Here is how each of the above transactions would be recorded using T-accounts:

If you add up the totals of the debits and credits in all four T-accounts, you will see that they balance. If you go even further, you will see that each debit entry has a corresponding credit entry.

For instance, we debited our expense account when we made the rent payment, while we credited our cash account in the same amount.

That’s because we increased our rent expense for the amount of the rent. In turn, by paying the rent, we also decreased the amount of cash available in the bank. While we only completed one transaction (paying the rent), two accounts were affected.

When should you use T-accounts?

T-accounts are typically used by bookkeepers and accountants when trying to determine the proper journal entries to make. Here are some times when using T-accounts can be helpful.

1. When teaching accounting or bookkeeping

Accounting principles can be difficult to understand, but using T-accounts to explain accounting principles can be helpful, particularly for those who may be struggling with understanding debits and credits and how to record them properly.

2. When first learning accounting

T-accounts can be extremely useful for those struggling to understand accounting principles.

Even if you currently use or plan on using accounting software for your business, using T-accounts to record practice entries can be particularly helpful for those looking to better understand debits and credits and how they impact your financial statements.

3. When trying to understand a complicated entry

If you’re still recording journal entries in various accounting journals or tracking financial transactions using spreadsheets, using T-accounts can guide you through the entry process, allowing you to see exactly how your entries will affect your accounts.

This can help prevent errors while also giving you a better understanding of the entire accounting process.

T-accounts can be a useful resource

T-accounts can be a useful resource for bookkeeping and accounting novices, helping them understand debits, credits, and double-entry accounting principles. Unfortunately, any accounting entries that are completed manually run a much greater risk of inaccuracy.

If you’re ready to automate the entire accounting process for your small business, be sure to check out The Ascent’s accounting software reviews.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.