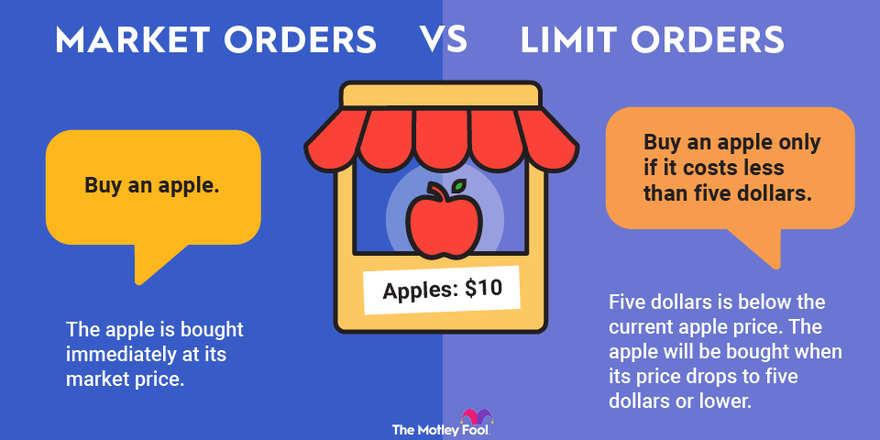

Market orders and limit orders are the two primary order types investors can use to buy or sell a stock. A market order directs the broker to buy or sell a stock at the prevailing market price, while a limit order tells the broker to purchase or sell a stock at a specified price.

Here's a closer look at the similarities and differences between these two types of broker orders.

Market orders

Market orders

A market order directs a broker to buy or sell a stock immediately after an order is placed. Investors use market orders when they want to enter or exit a position right away, no matter the price. A limit order directs a broker to buy or sell a stock only if it hits a specified price.

A market order guarantees that the broker will complete the stock trade, while a limit order does not. However, a market order doesn't guarantee the trade will execute at a price that makes the investor happy.

For example, after thoroughly researching a company, you believe it's an excellent long-term investment. Since you want to simply buy and hold the stock, you are not overly concerned about the stock's starting price. You submit a market order, and the trade executes at around the current trading price. If you instead place a limit order, even using a price near the current trading price, your stock order might not be completed. That can happen if the stock's price moves away from the price specified by the limit order just as you place the trade.

Another example of a market order being preferable to a limit order is when an investor has lost confidence in a company. If you want to exit a losing position now rather than waiting for a potential rebound that may never materialize, you can submit a market order to sell all of your shares. If you were to place a limit order in this scenario, the trade might not execute, which could result in even greater losses if you continued to hold the stock.

The biggest risk of using a market order over a limit order is that you have no control over the price you pay for a stock or the amount of money you receive from a sale. If a stock's price suddenly moves right before you place a market order, you could pay much more or receive much less than you expected.

Limit orders

Limit orders

While investors who place market orders aren't too concerned about pricing, investors who prefer limit orders direct their brokers to only buy or sell a stock at a specified price or better. A limit order to buy is only executed at or below the limit price, while a limit order to sell is only completed at or above the specified limit price.

Imagine that you have carefully researched a value stock that you believe trades below its intrinsic value, which you estimate as $50 per share. The stock's current market price is just below $40 per share, and to make sure you capture enough value as the share price rises to make investing in the stock worthwhile, you set a limit order with a strike price of $40 per share.

While you could place a market order to be sure the trade executes right away, setting this limit order guarantees you don't overpay if the stock's price jumps unexpectedly. If the trade doesn't execute, you can either set a new limit order at a different price or use a market order to execute the trade.

Now imagine that you own a stock whose price you believe is approaching its intrinsic value, which you peg at $75 per share. Based on the belief that the stock would be fully valued at $75 a share, you set a limit order to sell your shares when the stock's price reaches $75.

With the stock currently trading for around $72 a share, your limit order will only be executed if the stock price is at or above $75 per share. If not, you continue to hold your shares unless you set a new limit order or use a market order to sell your holdings.

The biggest risk of using a limit order instead of a market order is that a trade might never execute. A stock's price could suddenly rise or sharply decline based on a variety of factors.

Related investing topics

Which one?

Should you place a market or limit order?

Investors can use a simple litmus test to determine whether to use a market or limit order to buy or sell a stock. If completing a trade is of utmost importance to you, then a market order is your best option. However, if obtaining a specific price on a purchase or sale of a stock is a determining factor, then a limit order is the better order type.

Your preference can change over time, even for the same stock. You might initially set a limit order to buy a stock at an attractive price, and if that trade doesn't execute, you can decide to cancel your limit order and place a market order instead.

Deciding which order type to use might seem like a daunting task for a beginning investor. Our approach at The Motley Fool is to always use market orders, which are both simpler and ensure that the trade you want is executed. Using market orders coincides with our emphasis on buying and holding only the stocks of quality companies for the long term, which is the most reliable way to build wealth.

FAQ

Market orders vs. limit orders: FAQ

Which is better, limit order or market order?

Limit and market orders are better in certain circumstances. A limit order is better if you want to make sure you get your desired price for a stock. Meanwhile, a market order is better if you want to make sure you buy or sell a stock immediately. At the Motley Fool, we advocate that market orders are better because they are simpler and ensure you execute your trade. Market orders also align with our emphasis on buying and holding high-quality stocks for the long term.

What are the disadvantages of a market order?

The disadvantages of a market order are that you don't have control over the purchase or sales price. It's possible that your trade could be executed at a much higher or lower price than anticipated.

When should you use a limit order?

You should use a limit order when you want to execute a trade at a specific price. For example, you'd use a limit order if you only want to buy a stock if it gets below a certain price or sell if it hits your targeted sale price.

What is the disadvantage of using a limit order?

The disadvantages of using a limit order are that the trade might hit your target price and execute. That could cause you to miss out on buying a stock that goes on to rally sharply or sell a stock right before a big drop.