Average American Credit Card Debt in 2025

KEY POINTS

- Rising credit card debt: Credit card debt in the U.S. reached $1.233 trillion in Q3 2025, a steady increase since 2021.

- Average household debt: The average American household now holds approximately $9,326 in credit card debt.

- Manage credit utilization: Keep your credit utilization rate below 30% to maintain a healthy credit score.

At first glance, credit card debt numbers in the United States look enormous. Consumers owe an astounding $1.233 trillion on their credit cards, and the average American credit card debt balance is $6,523.

We've reviewed research from government agencies and credit bureaus to get the most up-to-date data on U.S. credit card debt. Keep reading for the latest credit card debt statistics.

Average credit card debt: $6,523

How much credit card debt does the average American have? The average credit card balance is $6,523 as of the third quarter of 2025, according to TransUnion. That's a 2% increase from the previous year.

| Period | Average Credit Card Debt |

|---|---|

| Q3 2025 | $6,523 |

| Q2 2025 | $6,473 |

| Q1 2025 | $6,371 |

| Q4 2024 | $6,580 |

Total credit card debt: $1.233 trillion

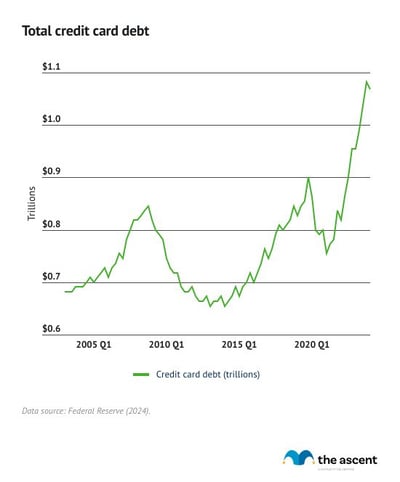

Total U.S. credit card debt rose to $1.233 in the third quarter of 2025, from $1.209 trillion in the previous quarter. While credit card debt fluctuated during the pandemic, it began to steadily rise in 2021 as inflation took off.

Over the last decade, credit card debt has typically accounted for between 5.5% to 6.5% of total household debt.

What is the average American credit card debt per household?

The average American household has about $9,326 in credit card debt, based on the most recent U.S. credit card debt and household data.

Average credit card debt per household was calculated by dividing U.S. credit card debt in the third quarter of 2025 ($1.233 trillion) by the most recent data on the number of households (132.216 million as of 2024). This number is higher than the average credit card debt per borrower because multi-person households are likely to have more than one credit card.

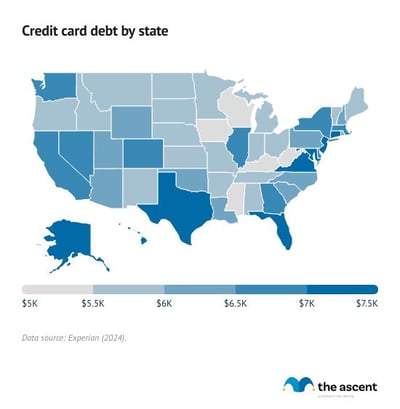

Average credit card debt by state

Alaska has $8,077 in average credit card debt, more than any other state. Kansas and Wisconsin have the smallest average balances at $5,329 and $5,370.

Credit card debt numbers vary quite a bit by state. Here's a full list of each state's average credit card balance as of 2024.

States with the highest credit card debt

- Alaska: $8,077

- Florida: $7,861

- New Mexico: $7,605

- Connecticut: $7,568

- Idaho: $7,560

States with the lowest credit card debt

- Kansas: $5,329

- Wisconsin: $5,370

- Louisiana: $5,399

- West Virginia: $5,427

- Missouri: $5,553

Average credit utilization rate

The average credit utilization rate is 29% as of 2024, level with 2023 and up 1% from 2022.

This metric, also known as a credit utilization ratio, is your credit card balances divided by your credit limits. If you have one credit card with a $1,000 balance and a $10,000 credit limit, then your credit utilization would be 10%.

| Year | Average Credit Utilization Rate |

|---|---|

| 2020 | 25.4% |

| 2021 | 25.5% |

| 2022 | 28.0% |

| 2023 | 29.0% |

| 2024 | 29.0% |

Lower credit utilization is better for your credit score. The conventional wisdom is that you should keep it below 30%, so consumers are doing well managing their credit cards.

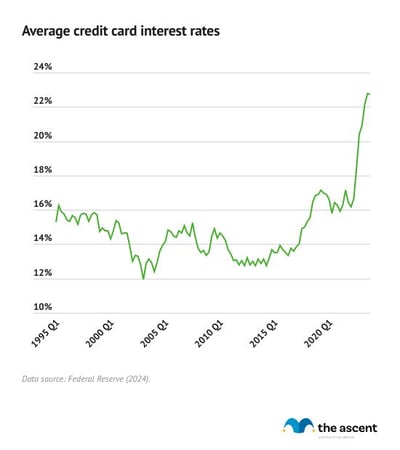

Average credit card interest rates: 22.25%

The average credit card APR on interest-bearing accounts is 22.25% as of the third quarter of 2025. Credit card interest rates have risen quickly since 2021, as the Federal Reserve hiked its benchmark interest rate.

Interest-bearing accounts include all credit cards that charge interest. It excludes credit cards that aren't charging interest at that time, so 0% intro APR credit cards don't count until the introductory period ends.

Credit card interest makes up a significant chunk of card issuers' earnings. Interest rates have shot up since 2021 from 15.91% in the first quarter of that year.

READ MORE: How Does Credit Card Interest Work?

Credit card delinquency rates

Data from the Federal Reserve shows credit card delinquencies stabilizing.

The 30-days past due delinquency transition rate for credit cards rose to 8.88% in the third quarter of 2025 from 8.58% in the previous quarter. The serious delinquency rate, in which balances are 90 days or more past due, was 7.05%, up from 6.93%

Overall, 12.41% of credit card balances are 90 days or more delinquent, up from 12.27% in the second quarter.

Average credit card debt by income

Americans in higher income brackets carry higher credit card balances on average.

However, it's the middle class and the upper-middle class that are more likely to have credit card debt. Among Americans in the 60th through 79th income percentiles, 54% have credit card debt. Those in the 40th through 59th income percentile are more likely to have credit card debt, as 57% carry a balance on their card.

It's the Americans in the highest (90th to 100th) and lowest (under 20th) income percentiles who are least likely to carry balances on their credit cards. A third of Americans in the lowest income percentile carry credit card debt, while a quarter of those in the highest income percentile have credit card debt.

| Income Percentile | Median Annual Income | Median Credit Card Debt | Average Credit Card Debt | Percentage With Credit Card Debt |

|---|---|---|---|---|

| Less than 20% | $20,540 | $1,400 | $3,630 | 33.40% |

| 20% to 39% | $43,240 | $1,600 | $3,840 | 46.40% |

| 40% to 59% | $70,260 | $2,500 | $5,950 | 56.90% |

| 60% to 79% | $115,660 | $3,500 | $7,440 | 54.40% |

| 80% to 89% | $189,160 | $5,000 | $8,900 | 44.60% |

| 90% to 100% | $390,210 | $6,000 | $11,210 | 25.40% |

| All families | $70,260 | $2,700 | $6,120 | 45.20% |

Average credit card debt by race

White Americans have average credit card debt of $6,930 and a median credit card balance of $3,000, the most of any racial identity/ethnicity.

Hispanic Americans have the lowest average credit card debt at $4,150, and both Hispanic and Black Americans share the lowest median credit card debt at $1,700.

| Race/Ethnicity | White, Non-Hispanic | Black, Non-Hispanic | Hispanic | Other | All Families |

|---|---|---|---|---|---|

| Median credit card debt | $3,000 | $1,700 | $1,700 | $2,970 | $6,000 |

| Average credit card debt | $6,930 | $4,360 | $4,150 | $5,910 | $11,210 |

| Percent holding credit card debt | 42.20% | 56.30% | 55.80% | 43.30% | 45.20% |

Average credit card debt by age

Generation X carries the highest average credit card balance at $9,600. That's over $2,500 more than millennials, who have the second-highest average credit card balance of $6,961.

The lowest average credit card debt by age is the silent generation with $3,445, followed closely by Gen Z, which has an average credit card balance of $3,493. Since young adults have lower incomes on average, they also have a lower average credit limit, which at least helps with avoiding credit card debt.

| Year | Generation Z (18–28) | Millennials (29–44) | Generation X (45–60) | Baby Boomers (61–79) | Silent Generation (80+) |

|---|---|---|---|---|---|

| 2012 | — | $2,974 | $6,434 | $6,872 | $4,076 |

| 2013 | — | $3,119 | $6,621 | $6,905 | $4,089 |

| 2014 | — | $3,286 | $6,790 | $6,892 | $4,068 |

| 2015 | — | $3,499 | $6,981 | $6,862 | $4,023 |

| 2016 | $1,867 | $3,809 | $7,260 | $6,863 | $3,985 |

| 2017 | $1,779 | $4,195 | $7,632 | $6,926 | $3,989 |

| 2018 | $2,000 | $4,539 | $7,921 | $6,943 | $3,954 |

| 2019 | $2,230 | $4,889 | $8,215 | $6,949 | $3,894 |

| 2020 | $1,947 | $4,331 | $7,302 | $6,254 | $3,302 |

| 2021 | $2,135 | $4,350 | $6,937 | $5,836 | $3,223 |

| 2022 | $2,692 | $5,309 | $7,781 | $6,134 | $3,305 |

| 2023 | $3,148 | $6,274 | $8,870 | $6,601 | $3,434 |

| 2024 | $3,266 | $6,642 | $9,255 | $6,648 | $3,375 |

| 2025 | $3,493 | $6,961 | $9,600 | $6,795 | $3,445 |

| Change: 2012-2025 | 87% | 134% | 49% | (1%) | (15%) |

Recent trends in credit card debt

Credit card debt has edged up to $1.233 trillion. Credit card debt rose in six out of the last eight quarters and now accounts for 6.6% of all debt held by Americans.

New credit card delinquency rates have begun to stabilize, although the overall outstanding credit card balance that's seriously delinquent continues to grow -- a sign that Americans are still leaning on their credit cards to cope with the lingering effects of inflation.

Even as credit card debt and delinquencies rose in 2023 and 2024, the average FICO® Score remained stable at 715.

Credit card utilization held at 29% -- combined with rising delinquency rates and stubborn inflation, these are worrisome signs about just how much consumers are relying on credit.

How to get out of credit card debt

Owing money to a credit card issuer isn’t uncommon: the data shows that more Americans are falling behind on their credit card payments.

Motley Fool Money personal finance expert Joel O'Leary suggests these tips to help beat credit card debt:

- Pause interest with a 0% intro APR card: Transferring balances to a 0% intro APR card can stop interest charges temporarily, letting payments go directly toward principal. Just watch for transfer fees (typically 3–5%) and note that good credit is usually required.

- Pick a payoff strategy: Use the debt snowball method to build momentum by clearing the smallest balances first, or the debt avalanche method to save more by targeting high-interest debts first-both are proven ways to pay down credit faster.

- Trim spending and redirect savings to debt payments: Cutting even $100 a month by canceling unused subscriptions, switching to a cheaper phone plan, or cooking at home can help chip away at balances more quickly.

- Seek nonprofit guidance: Certified credit counseling agencies like Money Management International (MMI) and the National Foundation for Credit Counseling (NFCC) offer free, trusted advice and customized repayment plans without sales pressure.

Rising credit card balances, high interest rates, and growing delinquencies underscore the challenges that many households face in managing debt, making careful financial planning more important than ever.

-

Sources

- Experian (2025). "Experian 2024 Consumer Credit Review."

- Experian (2025). "Experian Study: Average U.S. Consumer Debt and Statistics."

- Federal Reserve (2025). "Commercial Bank Interest Rate on Credit Card Plans, Accounts Assessed Interest-Federal Funds Effective Rate."

- Federal Reserve (2025). "Quarterly Report on Household Debt and Credit."

- Federal Reserve (2023). "Survey of Consumer Finances."

- TransUnion (2025). "TransUnion Report Reveals Diverging Credit Risk Trends Among U.S. Consumers."

Our Research Expert

Motley Fool Stock Disclosures

Jack Caporal has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Avalanche and Target. The Motley Fool has a disclosure policy.