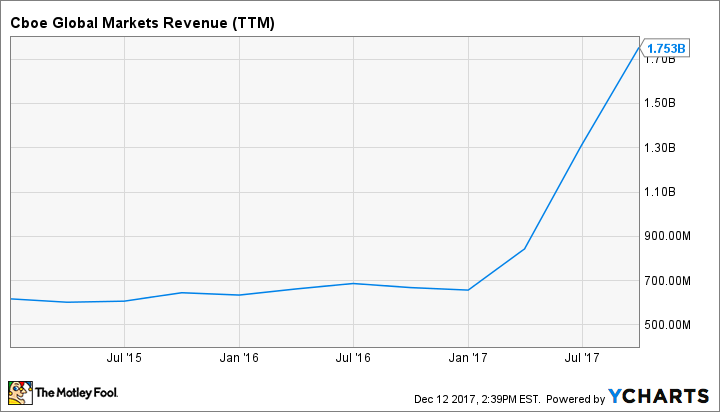

Shares of Cboe Global Markets (CBOE -0.49%) have had a great year. Investor trading activity has been on the rise during an historic winning streak for the stock market, and Cboe has reaped the benefits. The investment landscape is changing, though, but that could be good news for the company as those changes could be creating a tailwind that propel the stock even higher.

Data by YCharts.

Who is Cboe Global Markets?

Cboe is the parent organization of the Chicago Board Options Exchange, CBOE Futures Exchange, and the Bats exchanges. Cboe completed its purchase of the latter back in February of 2017 for $3.4 billion.

Cboe has 14 venues around the globe, including the largest options exchange in the U.S. and Europe's largest stock exchange. Through its various platforms, the company allows its customers the ability to trade stocks, ETFs, currencies, options, and futures. The VIX index, commonly used as a measure of U.S stock market volatility, also belongs to Cboe.

The company makes money primarily through transaction fees on trading activity on its exchanges. Simply put, the more trading volume, the more money Cboe can make. Revenue is also generated through market making -- buying and selling of a security to ensure smooth trading -- as well as from Cboe's various index, options, and futures products.

Image source: Getty.

The growing importance of derivatives

The story this year for Cboe has been rising revenue, in part because of the previously mentioned acquisition of Bats but also growth from the existing stable of investment exchanges. In the company's last quarterly report, organic revenue growth was up 15% driven by higher trading of VIX futures and index options.

Data by YCharts.

Options and futures, both of which can be categorized as derivative investments, have been getting a big boost in recent years. Exchange traded funds and their typically lower fees and ease to trade --versus traditional mutual funds -- have been increasing in popularity. With that boom has come hundreds of new ETFs, some of which utilize options and futures trading.

Another differentiator of exchange-traded funds from mutual funds is the availability of options contracts. That has also provided a boost to Cboe's business as many investors utilize options in tandem with, or in some cases to completely replace, their exchange-traded investments.

Cboe thinks that the adoption of derivatives trading will continue in the years ahead and is doing its part to increase the availability of products and tools to traders and investors interested in using them. As an example, Cboe was the first exchange to launch futures contracts on Bitcoin early in December, which was met with strong demand.

If the derivatives trend continues, the company is in a good position to benefit as it is a market leader in providing such products and services to traders and investors. After its buyout of Bats, Cboe can now further leverage that leading role overseas, and also has a sizable stock exchange business to complement it.

For investors to think about

Cboe stock has risen sharply this year along with revenues, but profits haven't followed suit as of yet. As a result, trailing one-year price to earnings sits at a lofty 67.5. The one-year forward figure is at a more reasonable at 31.5, but still high. The reason for the steep valuation are expectations that Cboe can increase growth and realize cost savings after the Bats purchase earlier in the year.

Progress is being made on that front. Management said that operating expenses and capital expenditures would be lower than previously expected for the year, but full cost savings from full integration of Bats with Cboe will be an ongoing project for some time.

While revenues are expected to continue increasing, much of the recent gains are related to the company's VIX index. Stock market volatility has been at historic lows the last two years, and investors betting on a return to norm have helped increase trading volume on VIX futures. Several ETFs that use VIX futures have had record inflows of investor money. Investors bailing on the VIX could reverse some of the positive momentum Cboe has enjoyed.

Long-term, though, other lines of business could keep Cboe on the up-and-up. The company is benefiting from new index funds listing on its exchanges, and it gets a double bump from options and futures being made available for those new funds, too. That indexing trend should be a tailwind as investor interest in the lower cost and easily traded products continues.

In the meantime, the high valuation for the company can be justified if revenues keep growing at a fast pace. Sure, there will no doubt be setbacks as there always are with a good growth story. But Cboe's stock looks like it could keep running up in the years ahead.