What happened

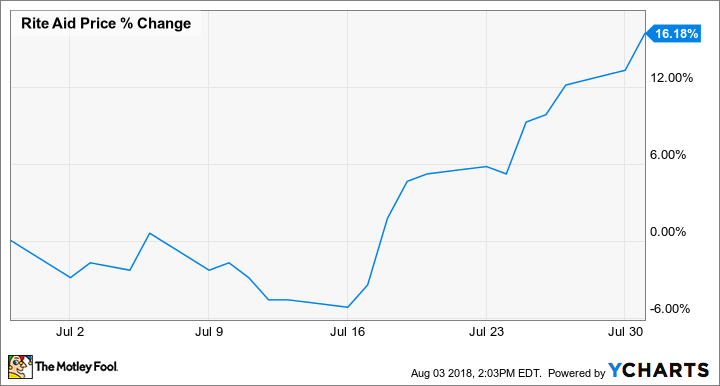

Shares of Rite Aid Corporation (RAD 15.38%) got a boost in July heading into a merger vote with Albertson's later in August. There was little news out on Rite Aid during the month, though the company made a push for the merger in a letter to shareholders, and prospective owner Albertson's turned in a strong earnings report. As a result, the stock gained 16%, according to data from S&P Global Market Intelligence.

As you can see from the chart below, the gains came in the second half of the month as the August 9 shareholder vote date moved closer.

So what

On July 10, Rite Aid issued a letter to shareholders arguing for the merger and asking shareholders to vote in favor of it. Among the arguments the company made were that the tie-up with Albertson's, one of the country's biggest supermarket chains, would create greater scale and efficiency, reduce leverage and increase cash flow, and allow for compelling synergies including $375 million in annual cost savings and $3.6 billion in incremental revenue.

Image source: Getty Images.

The following week Albertson's, which merged with Safeway in 2015 under the direction of majority owner private-equity firm Cerberus Capital Management, reported adjusted EBITDA grew 5.7%, to $814 million, in its most recent quarter. The results seemed to signal that Rite Aid shareholders wouldn't be inheriting a lemon in the merger deal, which gives them an approximate 29% stake in the combined company.

On July 24, Rite Aid sent another letter to shareholders, urging them to vote for the merger and arguing that Albertson's was the best partner available and that now is the right time to go through with the combination.

Now what

Despite the rally at the end of July, Rite Aid stock fell during the first three days of August, sliding 7%, and shares are likely to remain volatile heading into the merger vote. As my colleague Rick Munarriz argued, the deal appears to be Rite Aid's best option after its merger with Walgreen Boots Alliance was blocked and resulted in a sale of nearly 2,000 Rite Aid stores. Some institutional investors have lined up against the merger, however, and the company's shareholder letter seems to show it's afraid of the deal failing through.

Keep August 9 circled on your calendar as we should know the fate of Rite Aid at the shareholder meeting. The stock is likely to move wildly one way or another.