There has been a dramatic sea change in how some brands are reaching their customers. Instead of using wholesalers or retailers, direct-to-consumer brands sell directly to the end customer.

The resulting shift in power has been devastating for traditional retailers, and yet simultaneously, some of the most innovative and successful companies of the last decade have been born from this movement.

It’s important you understand why companies are going direct-to-consumer so that your business can build a successful brand.

The retail graveyard of the last 20 years is getting more and more crowded. Once-powerful companies such as Blockbuster, Borders, Forever 21, Sears, and Toys R Us have all filed for Chapter 11 bankruptcy, and hundreds more are either following suit, or have already begun the painful process of aggressively closing locations.

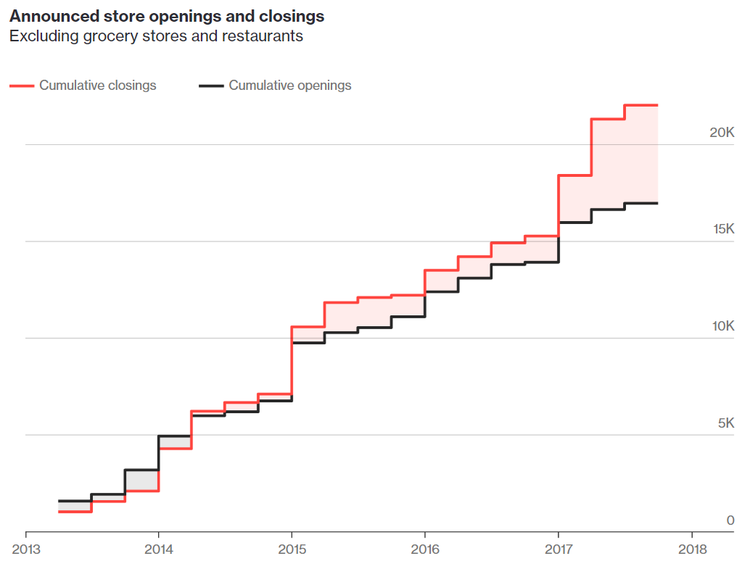

Just take a look at the number of store openings versus closings over the past five-plus years, according to Bloomberg:

Store opening and closings, 2013-2018; Image source: Author

Gone are the days when gigantic consumer-packaged goods (CPG) companies and department stores ruled the marketplace, with their intense focus on supply-chain management and first-mover advantages.

The centuries-old CPG tradition -- which relied on finding efficiencies between supplier, manufacturer, wholesaler, retailer, and distributor -- that used to crown industry titans such as Nike, Pepsi-Cola, Unilever, and P&G, is becoming less and less relevant. The sales process is less onerous, less third-party dependent, more direct marketing focused, and more customized to the end consumer.

Replacing the old stalwarts are a new crop of more nimble, more relevant companies that are better suited to thrive in the customer-centric, data-focused consumer market of 2019.

In short, the D2C model means that as a business, you sell your products directly to the customer, and in the process, going direct improves customer experience, enhances your brand voice, and you control almost every aspect of the consumer journey.

Here are a half-dozen examples of the most successful direct-to-consumer companies (all companies I’ve used in the past, or still use today):

- Warby Parker: online prescription eyeglass company, valued at over $1.75 billion

- Casper: online mattress company, valued at over $1.1 billion

- Allbirds: online athletic footwear company, valued at $1.4 billion

- Harry’s: online men’s shaving supply company, sold for $1.37 billion

- Bombas: online sock company, last valued at $15 million

- Bonobos: online apparel retailer, sold to Walmart for $310 million

Overview: What does direct to consumer (D2C) mean?

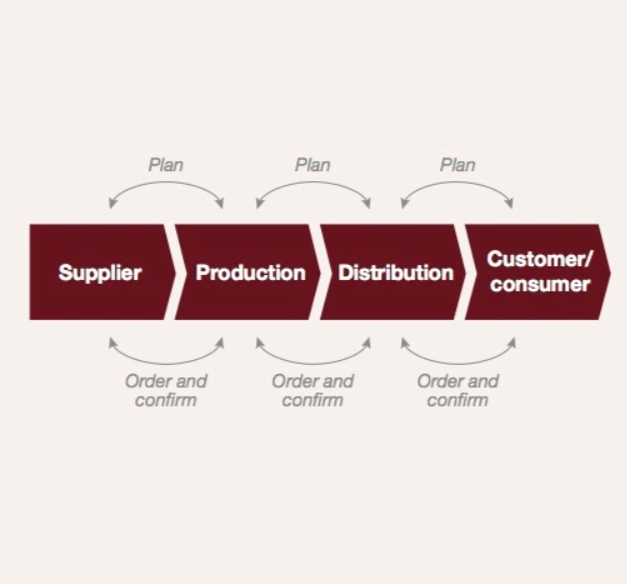

The traditional supply chain includes a supplier, manufacturer, wholesaler, distributor, and retailer. The sales model often involves lengthy negotiations at each stage of production or delivery, and it typically results in a long lead time for product launches and an even longer wait for the customer feedback loop to kick in.

Traditional supply chain overview Image source: Author

Direct to consumer ignored that traditional standard. Companies decided to cut out the middleman, the wholesalers, and the distributors and instead harnessed the power of the cloud and the rise of e-commerce to sell their products directly to end consumers.

If you could dream up a new product, produce it, build a website, and get people to buy it, you could, in a matter of months, imagine a new consumer brand, launch a product, control a brand's story, and build a million-dollar D2C brand from scratch.

Direct-to-consumer companies commonly have several (if not all) of these eight characteristics:

- They are entrants to a low-barrier-to-entry industry.

- They are capital flexible and/or can lease and rent part of operations.

- They are extremely passionate about their customers.

- They have experience harnessing first-party data and analytics.

- They cut out the middlemen so they can ship directly to consumers.

- They understand the importance of communicating directly with consumers (utilizing CRM software).

- They have more pricing flexibility than legacy retailers.

- They illustrate an increased use of digital marketing (especially email and social media).

Andy Dunn, founder of online retailer Bonobos, recently coined the term “digitally native vertical brand” (DNVB), which aptly describes most D2C companies.

A DNVB is a company that’s intensely focused on the consumer market it serves and the online customer journey, and it owns most aspects of distribution. Utilizing direct sales allows these consumer brands to build relationships with customers and to provide them with the products and services consumer expect, which ultimately means a better experience, too. Unlike a legacy or traditional retailer or an e-commerce player, the DNVB is borne in the digital era, emphasizes user experience, challenges the conventional buying experience, and creates compelling content as an integral part of its marketing funnel.

Benefits of taking your brand directly to consumers

There are many reasons you should seriously consider a direct sales model if you’re an entrepreneur or someone thinking about launching a new consumer brands business. And if you already have a business or if you have existing retail partners and are wondering if it’s too late, it’s not!

You can switch from being a traditional retailer to a direct to consumer retailer, and you can use the same tactics as a DNVB to successfully deliver your products. There’s no “it’s too late” -- the beauty of the D2C strategy is that it mostly relies on you as the founder or owner.

If you’re still not convinced of its merits, here are the top five benefits of being a DTC brand.

1. Cut out the middleman

When you eliminate the various businesses that stand between you and your customer, you’re also getting rid of entities that are taking a cut of your profit. For instance, if your business sells t-shirts, and you want to sell those goods through various wholesalers and retailers, you’ll have to sell to them at a price that’s low enough for them to mark it up again and resell it to customers. That’s eating into your profit margin, which is a measure of your profit in relation to the cost of your goods, expressed as a percentage. The lifetime value of each customer will be lower the more middlemen you have to pay to get your product out into the world.

For instance, if it costs you $5 to make a t-shirt, and you sell it to a wholesaler for $10 so they can mark it up to $20, then you’re making a profit of $5 ($10 minus $5), and your profit margin is 50% ($5 divided by $10). But if you skipped the wholesaler and found a way to sell directly to your end buyers for the same final price, then your profit would be $15 ($20 minus $5), and your profit margin would be 75% ($15 divided by $20).

2. Better connect with your customer

When you depend on other companies, distributors, and retailers to sell your product, you’re missing out on a lot of data that could be invaluable to your brand. In fact, customer data has become one of the most important assets for digitally native brands.

Let’s say you’re still selling those t-shirts through a retailer. The only information you’re likely getting from the department store where your shirts are sold is based on inventory -- volume sold, volume returned, and future demand. That may be fine for inventory management, but it doesn’t tell you much about your customers.

Now let’s say you are selling those same t-shirts through your own website. You have the opportunity to present every one of your customers with additional products at check-out (cross-selling and upselling) to inform which products may go well with your existing t-shirts.

You have the opportunity to A/B test your pricing in order to gauge if you have room to charge more, or if you might actually sell more t-shirts if you lowered your prices. You can email follow-up surveys to your customers to find out if they liked the t-shirt, if the item was delivered on time, and if it met their expectations.

If the t-shirt is returned, you have a myriad of cancellation tactics that can help you find out exactly what went wrong, so you can ultimately deliver a better product to your customers in the future and create a better experience. And finally, you have the flexibility to send follow-up emails that ask customers questions about different t-shirt colors, sizes, and styles in order to help guide you in product development.

3. Expand mindshare -- fast

In a traditional sales model, if you wanted your t-shirts to be a national brand, or a global brand, you’d have to really illustrate to wholesalers that your inventory can move.

It’d probably take a few years to show that you’ve established a local or regional presence, and then you’d have to find national distributors. The same could be said for an international presence -- show success, find new relationships, and expand -- rinse and repeat. It could take years (decades, even) to start gaining the mindshare of your customers.

In the D2C model, you can reduce the time to market because you’re eliminating all of the middlemen discussed above. Once you launch your website and your product is available, you can technically sell it anywhere (as long as you have the shipping capabilities).

For years, Gillete dominated the men's razor market, but with the launch of Dollar Shave Club in 2011 and Harry’s in 2013, that billion-dollar industry has shifted. Gillete was said to have about 70% market share in 2010, and today, it’s close to 50%. That’s the power of expanding mindshare on a digital platform.

4. Control your brand's story

When you ship those t-shirts of yours to a third-party distributor, or start asking retailers to sell them for you, you’re giving up control of your brand. It may not seem like it at the time, but little by little, you’re placing the marketing control in another company’s hands.

Three of the four marketing Ps -- price, promotion, and placement -- are directly in your control if you have a direct-to-consumer brand.

You can A/B test the price, you can increase, decrease, or do whatever you want with your pricing depending on the economics of your business (versus having to do what works for wholesalers or distribution outlets).

You can offer promotions depending on your own customer data and control the flow of sales by using a variety of sales tactics. And, the product is launched and sold on your website, so you know where it’s being placed, how it’s being presented to the customer, and how it’s (hopefully) being perceived.

5. Be everywhere, all the time

When your product goes through a traditional supply chain, you are largely dependent on a few large outlets to sell your product. Often, that means exclusivity agreements and limited price flexibility. Let’s say you’re selling your t-shirts through one retail outlet, and you want to offer a flash sale.

Chances are, you may be limited in what you can do. Or what if you want to beta-test a new product and get immediate feedback from your customers? Chances are, that same retail outlet won’t want to push a small batch of your new product.

Being D2C means you can control your product through your varies push or pull marketing techniques. These include your own site and through the various channels where you sell. You can utilize not only your website, but social media channels, email campaigns, and more.

Most D2C brands use some sort of CRM software or platform to get a 360-degree view of their customers (and leads, or potential customers) and to communicate with their consumer market on (sometimes) a daily basis.

An interaction with a customer is just a click away, and there’s nothing stopping you from talking with them, whether it’s for sales or customer support. Consumers now expect immediate action when they have an issue, and if you can respond to them immediately, it should create a better customer experience. (Even more legacy blue chip companies are picking up on this. In the last year alone, I’ve had two issues with a particular financial institution and resolved the problem not through the traditional customer support channel, but through Twitter. And it was about 10 times as fast.)

Being a D2C company doesn’t just mean you’re digital, and it doesn’t just mean you’re a multichannel retailer, either (selling in multiple digital channels). It means you can be an omnichannel retailer, too -- taking advantage of both digital marketing channels and physical outlets.

In fact, this is probably preferable since physical locations are so challenging, with high upfront capital expenditures, typically longer commercial leases, and human resource and staffing complexities. With the D2C model, you can be a digitally native brand that proves out success, product-market fit, and customer loyalty first to help ensure that a physical outlet can be effective. (Look no further than Bonobos, Warby Parker, ADAY, Away, Everlane, and Rent The Runway as prime examples of the digital-to-brick-and-mortar omnichannel mashup.)

Successful direct-to-consumer examples (and what you can take from them)

The popularity of D2C brands has affected buyers’ purchasing decisions and resulted in a shift away from traditional CPG companies and toward e-commerce. Fast-moving consumer goods (FMCG) are seeing serious growth in categories such as pet supplies, household goods, healthy and beauty, grocery items, and apparel.

Selling directly is largely acknowledged as the best way to fuel a new company, and it’s one of the fastest ways to reignite growth if you’re an existing company.

Here are three examples of D2C companies that have found incredible success and how they utilized three of the more common strategies to maximize the effectiveness of the D2C model.

Warby Parker

Eyewear was once completely dominated by $58 billion French luxury brand Luxottica. Buying quality eyeglasses was expensive, and there were only a handful of retailers. Insurance was outlet-specific, and Luxottica owned the supply chain. As such, it often charged 10 to 20 times the cost of goods sold (COGS) with an average pair of glasses costing upwards of $300.

Warby Parker, an online eyeglass retailer that was founded in 2010, has completely disrupted the industry. It went direct to consumer, offering $95 glasses, a home try-on program, and seamless delivery. Through smart pricing, viral marketing, and a simple value proposition, Warby Parker gained momentum and market share, and it’s now a $1.2 billion company.

Main takeaways from Warby Parker:

Solve a customer problem

Prior to Warby Parker, customers had to find an outlet that accepted their insurance (if they even had eye insurance), make an appointment, and pay for an eye exam (not cheap). Then they had a variety of eyeglasses to choose from, most of which were >$150. It was costly, logistically annoying, and if you happened to break your pair, you could count on expensive repair costs or a full replacement.

Warby Parker saw an opportunity to improve upon this and aimed to not only simplify the process, but to lower the price of what seemed like a pretty common consumer good. Other companies had tried to compete with existing corporate giants by fitting into the same supply chain, and once Warby Parker went D2C, it freed itself of those same supply chain constraints.

Focus on content

Warby Parker famously timed the launch of its brand to coincide with an article coming out about the company in GQ magazine. The result was that it ended up with a waiting list of 20,000 people, creating an insane amount of buzz and scarcity.

We all can’t get a GQ press narrative, but we can create our own buzz and excitement. Use social media, use testimonials, use customer advocates and loyal customers to spread your brand -- word-of-mouth marketing is free, authentic, and effective. In addition, find new and interesting ways to create content.

It doesn’t just have to be marketing material or email blasts. Warby encouraged potential customers to post pictures of themselves trying on their glasses with the #warbyhometryon hashtag, and in doing so, the customers got “free style advice.” According to some sources, those customers converted higher and purchased 50% more than other groups of customers.

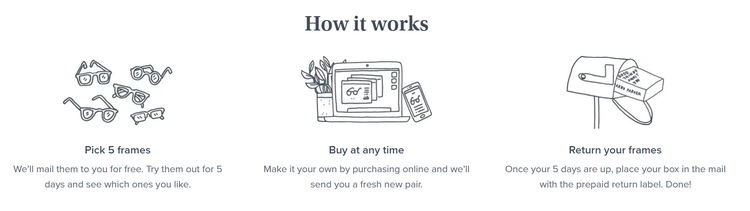

Create a frictionless buying process

It’s 2019. I can get most things with one click and same-day delivery. CPG companies have to embrace the age of seamless buying and delivery unless they have a product so unique, so expensive, and so interesting that customers would be willing to insert friction into their lives for it.

Warby Parker realized early on that the process of going to eye exam locations, picking out glasses, and often waiting weeks for them to arrive was a consumer nightmare. But people didn’t want to buy glasses without seeing them first, so Warby created the “home try-on” system, where consumers receive five pairs in the mail for free.

This almost entirely eliminated the risk associated with online purchases, and my guess is that getting a great product into customers’ hands actually increased conversions in the long run, too.

Casper

I remember well the mattress-buying process. It was a nightmare. Incandescent lights, crowded malls, confusing descriptions, and overly aggressive sales reps. Not to mention, it was near impossible to get an actual mattress you liked -- or walk away without a hole in your pocket.

Enter Casper in 2014, a direct-to-consumer mattress company that today does over $400 million in sales. The company cut out the retail overhead and middlemen (which allowed them to lower costs but maintain decent margins) and clarified the value prop, which meant it soon gobbled up market share in the multibillion-dollar industry.

Main takeaways from Casper:

Solve a customer problem

Similar to the eyeglasses industry, the mattress industry was dominated by a few players who also controlled the supply chain. Between Serta and Tempurpedic, they managed the entire vertical, and with their rumored 50%-plus margins, they were content selling through their wholesalers and distributors despite the terrible consumer journey.

Casper wanted to solve that by offering direct sales via its website and providing buyers with a quality mattress at a reasonable price. Not to mention, if you’ve ever dragged a mattress up three flights of stairs, there’s a lot to be said for fitting one inside a 16x16x42 box.

Focus on content

I could write an entire book on Casper’s content marketing machine, but in short, it built a great brand that consumers associate with the word “Casper.” The company made sure every time someone searched for “casper” or “casper mattress” on the internet, they landed on a very intentional landing page (with a carefully crafted conversion funnel).

According to SEMrush, over 75% of the company’s organic search is from branded queries, yet it has still dedicated a lot of time and energy into more “long-tail” keywords such as “king bed dimensions in feet,” “things to do in the middle of the night,” and “dog size mattress” (Casper ranks No. 1 for all of those keywords).

The takeaway here is to find what your customers are interested in -- what problems they’re having, what questions they’re asking -- and make sure when they search for those items, they’re finding your product or your brand.

Create a frictionless buying process

One of the toughest parts of buying a mattress pre-D2C was that they cost thousands of dollars, and you were basing your information off a 30-minute visit to the mattress store.

If you’ve ever tried to return a mattress, you know this was near impossible, and a complex system of policies and fine print was there to ensure you were stuck with that mattress. Casper countered this by creating a no-frills, transparent return policy. Arguably its greatest innovation was making the economics work for a 100-day return policy and picking up the mattress for the consumer.

Similar to Warby Parker, the company is eliminating friction, reducing the risk for the buyer in order to ultimately increase conversions.

Casper’s 100-day return policy; Image source: Author

Harry’s

The men’s razor industry was a $3.5 billion market. Controlled by P&G’s Gillette brand (“The Best a Man Can Get”), the market was essentially a duopoly alongside Schick. Similar to some of the other stories, dominant players owned the supply chain, controlled vast swaths of advertising dollars, and consequently, owned the consumer mindshare.

Then Harry’s launched in 2013, reportedly raised more than $450 million, according to Crunchbase, and then purchased a factory overseas so it could control product and process. It’s quickly become the No. 3 online razor company and leads digital rival Dollar Shave Club in growth. According to Rakuten, it’s enjoying more than 6 times the growth of the industry average.

Main takeaways from Harry’s:

Solve a customer problem

The problem for consumers of razors was that they were too expensive, and the experience was terrible. Buying razors at a grocery store or drug store often meant waiting for a clerk to unlock the razor products, then feeling rushed as they stood by you, waiting anxiously to close it back up and hide the key.

Once you got the one you wanted, no doubt confused by the similar-sounding “Mach3,” “Mach3 Turbo,” “Fusion5,” or “Fusion5 with Flexball Technology,” you hustled to the check-out line to pony up a sum of money you were no doubt increasingly wary of. Harry’s solved that by selling directly to the consumer, by offering singular products with a clear value prop, and by avoiding product confusion.

Focus on content

Harry’s originally got a ton of attention for the referral program it used at launch that helped the company get a rumored 100,000-plus emails in a single week. Using a simple two-page microsite and an easy-to-understand referral milestone program, the company went completely viral and launched with 20,000 emails and about 65,000 referred emails.

Harry’s kept busy, though, and soon after, it took another page out of the social media playbook when it created “National Shave Day,” on December 1st, to capitalize on the Movember movement that emphasizes men's health awareness. Harry’s sent razors to men who would take part in the day, chronicled stories, and partnered with barber shops. Not only did it raise brand awareness, but it drove a 360% lift in traffic on that day.

Create a frictionless buying process

Avoid the mistakes of past players. Don’t launch products with confusing names and hint that right around the corner, there will be something better. Sometimes simple really is better.

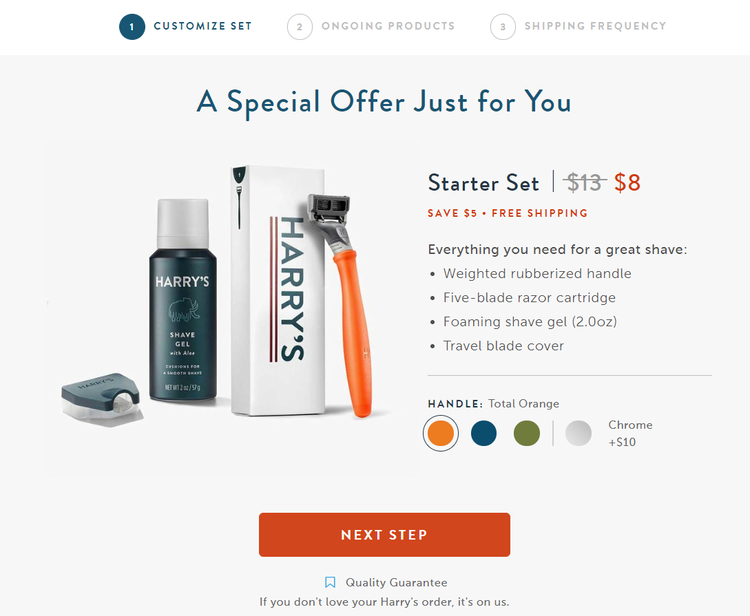

That’s what you get with Harry’s: a simple product line, a clear buying process, and easy delivery. It’s $13 (or $8 for this holiday special) for the handle, a 5-blade cartridge, and shaving cream -- pretty good. And I can put this on re-order so I don’t have to even think about buying them again -- they just show up like clockwork at my door. I’m not constantly bombarded with upsell and cross-sell emails, they have a purpose, and they serve that purpose well.

Harry’s simple offer and simple buying process; Image source: Author

Top 5 tips for switching to direct to consumer

With competition increasing and potentially hundreds of brands per category, the retail space is becoming more and more crowded (and expensive). If you’re looking for new ways to reach your existing customers and/or ways to reach new customers beyond the geographic and economic constraints you may currently be facing, moving to a D2C model could be a great idea. Companies need a relentless focus on the customer experience and they'll significantly benefit from a direct sales model that allows them to control brand voice, product development, distribution, and ultimately, the lifetime value of their customers.

Make sure you’re willing to address the following five factors before you get started.

1. Survey the current market landscape

Be sure to look at the current market conditions and see if there’s room for a D2C business model to take advantage of legacy conditions. Is there room to improve customer pricing?

To what degree do legacy brands communicate directly with their customers? Are customer expectations changing? Are current products hard to find or hard to purchase? Can you envision your company with the perfect product launch?

2. Focus on simplicity

It doesn’t always have to be the case, but a large majority of D2C disruptors have offered simple products. Think about Casper offering just one or two mattresses when it began, versus the dozens a store might present. Think about Harry’s razor versus the myriad Gillete variations.

Think about Away’s luggage product line, or Allbirds’ logoless sneakers (originally with only one shoe option). Sometimes it’s about demystifying an existing category of products and making things easier for the end user.

3. Be ready to embrace data

Being a direct-to-consumer brand means you’ll have to spend a lot of time thinking about data, so it better be something you’re passionate about.

You’ll have to set up your platform in a way that integrates your product data and your customer data so you know which products to launch, who to sell them to, and when. Just a few examples of data you’ll collect are buyer behavior (meaning conversion rates) by age group, gender, and geography; engagement by day of week or time of day; and refund data by buyer type. If this doesn’t get you excited, you might want to think again about moving to a D2C model!

4. Find a CRM you love

Customer relationship management (CRM) software helps companies manage their interactions with current and prospective customers.

There’s no shortage of CRMs on the market, so take the time to find the one that best suits your business's needs, then figure out how to maximize its capabilities to help your brand.

5. Get serious about customer service

There aren’t any D2C brands that don’t have a relentless focus on customer service. Creating brand-loyal -- and oftentimes diehard -- customers is an integral part of word-of-mouth marketing.

In addition, more and more companies are realizing that repeat customers and retention (in the case of subscription-based businesses) is a much more economic way of increasing sales than trying to constantly acquire new customers. Be prepared to hire a customer support team, and be willing to teach them the keys to success.

Is direct-to-consumer worth it?

You might be wondering if it's worth it to go through the hassle of switching your business to a new model. And it’s a good question, because you certainly can’t make the change on a whim or decide to do it without having all of your stakeholders on board.

It’s a significant shift in strategy for any business, one that entails a different set of skills that will necessitate input from tech, sales and marketing, data, and operations.

That said, the majority of our economy is now internet-based, and the lifeblood of that economic engine is data. According to a recent IAB study, over two-thirds of consumers have come to expect direct access to a brand, and about 67% of customers have used a company’s social media for customer support.

So if you want to keep up and reach more customers in more parts of the world in a more relevant way, you’re going to have to make the change.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.