It's hard to escape the COVID-19 alarm bells. But shrewd investors surely hear Warren Buffett's wise words echoing in their heads: "Be greedy when others are fearful."

Undeniably, this is easier said than done. Summoning the courage to invest in stocks while the market plunges is no easy feat; however, it's times like these when savvy investors can plant the seeds that will translate to long-term gains -- perhaps even ones that will be the most successful of all their investments.

For those investors looking to pick up shares during these fearful times, there are several infrastructure-related stocks that represent compelling opportunities, including American Water Works (AWK 0.16%), Brookfield Infrastructure Partners (BIP -1.33%), and NV5 Global (NVEE 0.03%).

Image source: Getty Images.

Come on in, the water's fine!

With roots stretching back more than 130 years, American Water Works is the largest publicly traded water and wastewater treatment utility company in the United States. Providing its services to about 15 million customers in 46 states, the company recognizes acquisitions as a key component of its growth strategy -- something it has excelled at executing recently. From 2015 through 2019, for example, American Water Works has closed on 83 water and wastewater transactions in 10 states, adding about 173,000 customers to its base. And management doesn't see a slowdown in acquisitions anytime in the near future; in fact, the company recognizes acquisition opportunities that have the potential to add 695,000 customers.

American Water Works gave investors a lot to be happy about when it released its fourth-quarter earnings report. The company reported operating revenue of $3.61 billion, representing year-over-year growth of more than 4.9%. Growth on the bottom line, however, was even more impressive as the company reported diluted earnings per share of $3.43 for 2019 -- an 8.9% increase over EPS of $3.15, which it reported in 2018 -- and management foresees EPS continuing to rise over the next five years at a compound annual growth rate (CAGR) of 7% to 10%.

Some of this, some of that

For infrastructure-oriented investors who are seeking a diversified approach, Brookfield Infrastructure Partners is a viable option. With assets under management totaling about $81 billion, Brookfield Infrastructure is a master limited partnership whose global reach extends into several different sectors: utilities, energy, transportation, and data infrastructure. Unlike companies such as Apple, which foresee a material impact to earnings due to the COVID-19 outbreak, Brookfield Infrastructure management appears confident that its business will not suffer.

In its recent Q4 letter to unitholders, management stated: "[W]e do not anticipate any material financial impact from the Coronavirus situation and remain optimistic regarding the business outlook for the regions where we operate. We do not have any operations in China and potential disruption to commodity supply chains should not have a significant impact on our overall activities."

Besides those seeking exposure to several sectors with one stock, Brookfield Infrastructure will appeal to dividend-minded investors. The company's board of directors recently approved a 7% increase to the quarterly distribution, which is now $0.54 per unit. This marks the 11th consecutive year of distribution increases, and unitholders can expect the raises to continue for the foreseeable future as management has a target of 5% to 9% annual distribution growth. Lest investors worry that management is willing to sacrifice the company's financial health in order to grow the distribution, Brookfield Infrastructure has targeted a conservative payout ratio of 60% to 70% of funds from operations.

Flowing in the right direction

For investors less interested in dividends and more focused on growth stocks, NV5 Global should be at the top of the list. Offering engineering and consulting services to both the public and private sectors, NV5 Global has seen its top line rise at a noteworthy clip -- a 31.5% CAGR -- over the past three years, and management expects growth to extend considerably into 2020. Should the company meet the midpoint of its guidance and report revenue of $715 million in 2020, it will represent year-over-year growth of more than 40%.

Besides the presumed sales growth this year, the company's success in growing its backlog should be especially encouraging to investors, as it indicates the company's continued growth beyond 2020 seems likely. NV5 ended 2019 with a backlog of $567.4 million, representing a 46% increase over the $389.9 million which it had in backlog at the end of 2018. Not since 2015 has NV5 achieved such a considerable year-over-year increase in its backlog.

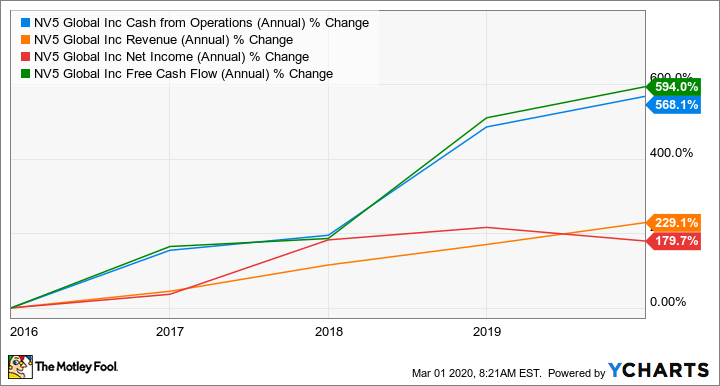

A quick look at the company's cash flow provides further evidence of management's prowess.

NVEE Cash from Operations (Annual) data by YCharts.

While NV5 has grown its profit at a similar clip to revenue, the company has grown operational cash flow and free cash flow at a significantly faster pace. And for many investors (like yours truly), cash flow generation is more favorable than profits as it is a truer indication of the company's financial well-being.

Final insights into these infrastructure powerhouses

Whether yearning for dividends or looking to dip their toes in the water utility sector, investors would be wise to consider American Water Works -- especially since the company aspires to grow its dividend between 7% and 10% from 2020 through 2024 while maintaining a conservative payout ratio between 50% and 60%. On the other hand, investors seeking a more diversified approach should consider Brookfield Infrastructure and NV5, both of which are bargains at the moment. Brookfield Infrastructure is currently trading at 6.7 times operational cash flow, well below its five-year average multiple of 9.3; likewise, NV5 is also valued at a discount, trading at 16.8 times operating cash flow, notably lower than its five-year average of 34.7.