Amazon (AMZN 0.58%) is a company that continues to attract investor attention as the creative vision of CEO Jeff Bezos drives this retail stock's price to new heights. He has taken Amazon from humble origins as an online bookseller to one of the biggest names in retail. Its more recent foray into cloud computing also made this company both a technology innovator and turned it into a conglomerate.

The company's success has made Amazon an expensive stock. And while Amazon's growth remains elevated, it has not quite matched the rate set in previous years. Slowing earnings growth may not compromise the case for buying Amazon stock, but it does lead to questions about how much of the benefit will accrue to new investors going forward.

Image source: Getty Images.

Amazon stock will still be growing in five years

Amazon's leadership role in e-commerce has stoked both revenue growth and deep fear across the retail industry. Nonetheless, retail is not known for being a particularly profitable business. To address this, Bezos and his team have branched out into other industries, like cloud computing. Even though Amazon Web Services (AWS) makes up only about 11% of Amazon's overall revenue, it constitutes roughly 67% of the company's operating income. This allows for massive profit growth, an area in which most large retailers struggle.

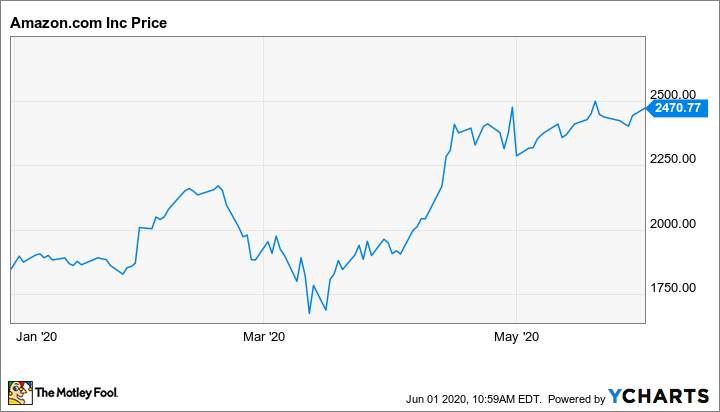

This continues to benefit holders of Amazon stock. While the stock followed the broader S&P 500 index downward in late February and early March, it didn't fall as far and a quick recovery took Amazon stock to new all-time highs.

As a result, the recent stock surge has helped to take Amazon's market cap to about $1.23 trillion. However, this may also constitute an area of struggle for Amazon shareholders. This higher market cap has taken the forward P/E ratio to approximately 98.

Earnings increases go part way to explaining the earnings multiple. For the next five years, analysts forecast that Amazon's profits will average 34% per year growth. This is an impressive growth rate for such a large company. Also, according to the Rule of 72, this would point to a doubling of earnings every 2.12 years, or more than twice in a five-year period. That strongly indicates that Amazon stock could trade at a higher price five years from now.

How much higher will Amazon stock go?

However, new Amazon shareholders may struggle to share in this growth. Here's why.

First, the current rate of profit increases lags the 100.6% annual earnings increases of the previous five years. Falling profits could point to P/E compression in future years. If the forward P/E ratio fell to about 50, it would wipe out approximately half of the stock's value. Moreover, since Amazon stock does not pay a dividend, the investment proposition for this stock hinges on growth. Hence, a significant downturn in Amazon stock would probably exacerbate any potential sell-off.

Second, Amazon is beginning to get significant competition from large retailers such as Walmart and Costco. Staying ahead of the competition comes at a cost. Recently, Amazon's earnings took a hit as the company switched to one-day shipping.

Amazon has made other investments as well. The company has spent heavily on shipping and logistics, reducing its dependence on UPS, FedEx, and the U.S. Postal Service. Further, it has developed Amazon Marketplace Web Service. This should increase efficiency as sellers can more closely integrate their platforms with Amazon.com.

This new tool is likely not the only Amazon web service that will have to handle the competition. In the most recent quarter, AWS beat Microsoft's Intelligent Cloud division on revenue growth. However, Azure increased its revenue by 57%, while AWS saw its revenue rise by 34.2%. Also, Alphabet's Google Cloud saw its revenue increase by 52.2% in the same period. Furthermore, companies such as IBM have placed an increasing emphasis on developing cloud infrastructure. Even if a rising tide continues to lift all boats, the competitive pressures may lead to slowing increases for that division of Amazon.

Can Amazon redefine itself?

In the past, Amazon circumvented slow retail profit growth by monetizing AWS, which began as an internal service for its retail operations. The question for investors is whether this conglomerate can find another profit center to speed its earnings growth.

Amazon's entry into the advertising space has stoked some optimism in recent years. However, rather than creating the industry, it merely competes with the likes of Alphabet and Facebook. Still, since earnings reports do not break down ad revenue, investors do not know what influence ads have on the top and bottom lines.

Moreover, Amazon continues to make improvements in its retail operations. Hence, both one-day shipping and the logistics and marketplace investments could help to manifest additional revenue sources in the future.

With or without a new source of revenue, the current growth trajectory makes it probable that Amazon stock will trade at a higher price five years from now. However, its already large size and continuing competitive threats make slowing growth an increasingly likely possibility for the company.