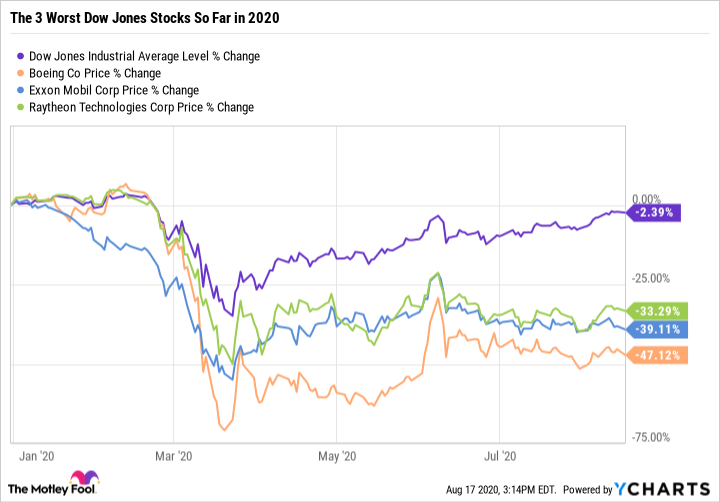

2020 has been one of the craziest years on record for the Dow Jones Industrials (^DJI 0.40%). After suffering a lightning-fast bear market in February and March due to the COVID-19 pandemic, the Dow has recovered nearly all of its losses.

Other stock market benchmarks have already set new all-time record highs, but the Dow still has a long way to go. That's largely because of some terrible performance from some of the DJIA's components, including what was once the most influential stock in the average. Below, we'll reveal the three worst performers in the Dow so far in 2020 to see whether now's the right time to buy shares of these beaten-down companies.

Flying lower

Boeing (BA 0.25%) has been the worst performer in the Dow, losing almost half its value in 2020. Helping set the stage for the aerospace manufacturer's descent were the woes that the company had in 2019, as it went most of the year with its new 737 MAX line of aircraft stuck on the ground in the wake of two fatal accidents.

Despite best efforts to get the planes flying again, regulators at the U.S. Federal Aviation Administration and similar bodies overseas weren't as interested in a speedy resolution.

Image source: Boeing.

Yet the stock held up well until the COVID-19 pandemic hit, bringing air travel to a near halt and calling into question the future viability of airlines' business models. Even now, more than six months after the coronavirus began its spread across the globe, airlines face huge uncertainty.

As buyers of Boeing planes, carriers need to be healthy for the aircraft manufacturer to be successful. Until there's a permanent resolution to the coronavirus crisis, Boeing could have trouble maintaining any strong bounce from its worst levels.

Losing energy

ExxonMobil (XOM -2.78%) has also plunged, falling almost 40% in the first 7 1/2 months of the year. Relatively low oil prices had plagued the entire energy industry for years, but coming into 2020, it appeared that the market might finally have started to turn the corner. With its massive operations and diverse set of oil-producing assets, ExxonMobil was better-positioned than many of its peers to deal with a sustained period of below-normal crude prices.

Yet no one was prepared for the impact of the pandemic on energy demand. A halt to nearly all industrial activity led to a massive glut of crude oil in the energy markets, briefly sending prices into negative territory as storage proved insufficient. Those days are over, but oil remains stubbornly locked around $40 per barrel.

So far, ExxonMobil has preserved its dividend, but many worry that the impact on profits could hurt even the oil giant's long-term prospects. Until the global economy gets back on its feet and energy demand rises, ExxonMobil's stock could continue to languish.

Playing defense -- and failing

Finally, Raytheon Technologies (RTX -0.29%) weighs in as the third-worst performer in the Dow in 2020. The defense contractor entered the Dow as a result of Raytheon's merger with the aviation arm of United Technologies, creating a defense and aerospace powerhouse.

The problem is that the combination came at a terrible time for the aerospace industry. As noted above with Boeing, terrible conditions stemming from the pandemic have called into question long-term demand for commercial aircraft. Raytheon's defense business is less vulnerable to the whims of the commercial aerospace industry, but even government buyers face financial challenges. Raytheon will likely survive the crisis intact, but it could be a while before things get back to normal for the aerospace and defense company.

Expect a longer wait

As attractive as these three blue chip stocks might look from a valuation standpoint, all three face tough times ahead. It looks as though you'll have better opportunities to buy these stocks than you're getting now, especially with no assurances as to when the problems they're dealing with will start to fade.