Ever wondered what's a good dividend yield?

Here's what I believe: If you can find a fundamentally strong dividend-paying stock offering 3% or higher yield, you've hit the mark. "Fundamentally strong" are the keywords here, for you want to ensure the stock's yield is durable and has potential to grow, which is possible only if the underlying company is growing and is committed to shareholders.

Here are three such stocks yielding 3% or more that you'd want to bet on today.

Catch the renewable energy train before it's too late

NextEra Energy Partners (NEP 0.86%) currently offers a dividend yield of 3.7%, and there's plenty of room for the dividends to grow.

As a clean energy company, NextEra has massive growth potential. Renewables accounted for nearly 27% of global electricity generation capacity in 2019, according to the International Energy Agency. IEA believes renewables could account for 50% of electricity generation by 2030 if "significant" investments are made globally.

Dividend stocks yielding 3% or more are a great avenue for earning passive income. Image source: Getty Images.

NextEra Energy Partners could be a major beneficiary of the clean energy revolution as it acquires interest in clean energy projects, particularly wind, solar, and natural gas infrastructure from parent NextEra Energy or third parties under long-term contracts. Such contracted cash flows are stable and can support regular dividends. NextEra currently operates more than 5,000 megawatts of renewable capacity.

Growth expectations from NextEra Energy Partners remain high. Its dividend per share has more than doubled in the past four years and is projected to grow at a compound annual growth rate of 12% between 2018 and 2022. Combine that with a strong pipeline of growth projects and the backing of NextEra Energy -- the largest utility in the world -- and NextEra Energy Partners makes for a great dividend stock to buy and hold, especially in the high-potential renewable energy space.

This one's a top dividend growth stock

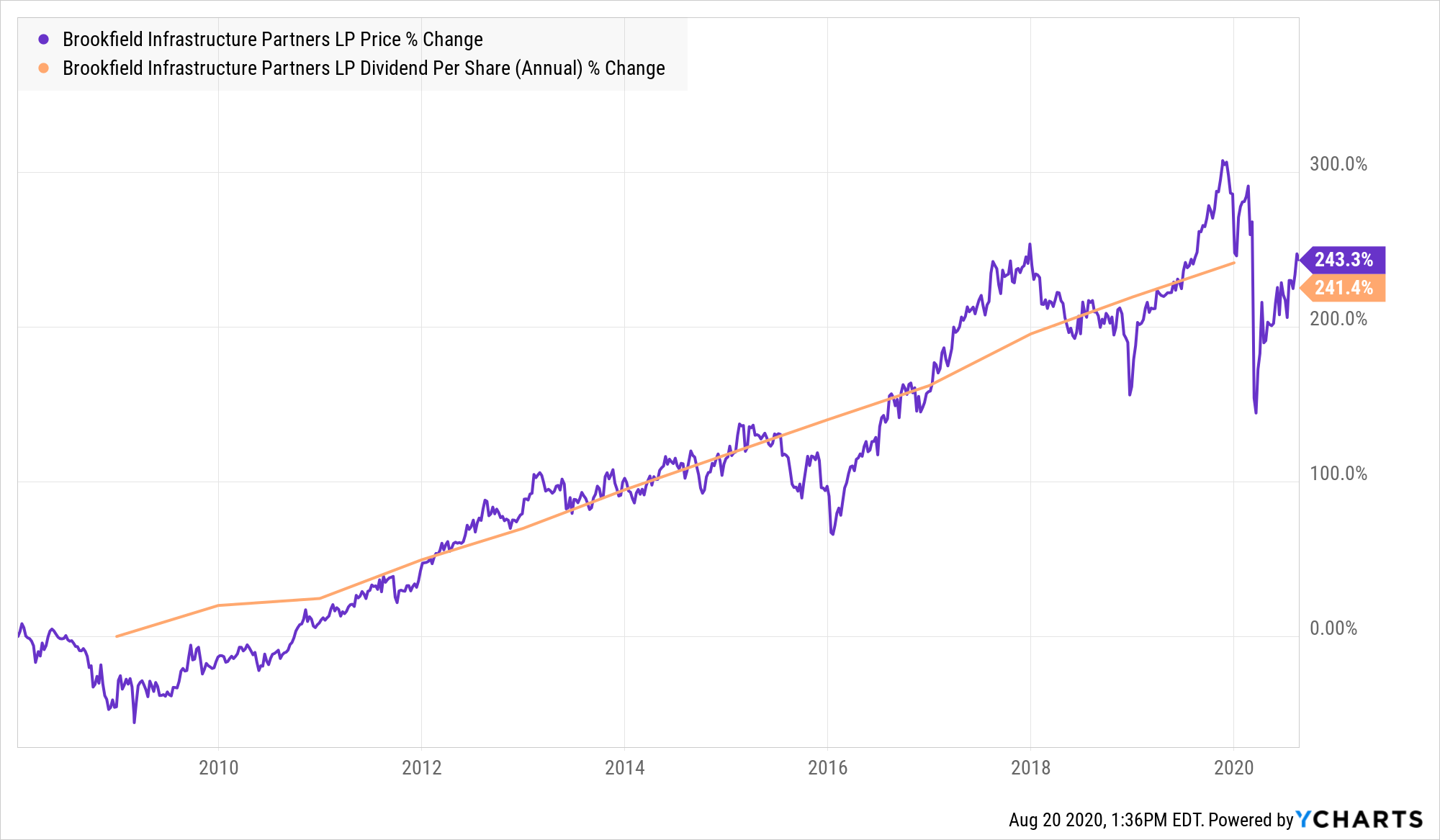

Brookfield Infrastructure Partners (BIP -0.22%) (BIPC -0.45%) doubles as a dividend growth stock, with an attractive current yield of 4.4%. As a dividend growth stock, Brookfield's high dividend yield is underpinned by a regularly rising payout, making it a reliable addition to an income investor's portfolio.

These are exciting times to own Brookfield shares. The coronavirus pandemic could open up a lot of acquisition opportunities for Brookfield as the cash crunch may compel businesses to put up assets for sale. Brookfield is a "tolling" moneymaking machine: It buys assets in transport, utilities, telecommunications, and energy sectors at depressed prices and operates them under long-term fixed-rate contracts, often to resell the assets as they mature and reinvest the proceeds opportunistically. Assets in these sectors are typically stable cash-flow generators that can support regular dividends.

Brookfield already has some big acquisitions in the pipeline worth $1.3 billion, including 130,000 telecom towers in India from Reliance Jio, the same company that recently raised money from the likes of Facebook.

A promising pipeline, 95% cash flows originating from regulated or contracted sources, a strong balance sheet, the backing of parent Brookfield Asset Management, a growing dividend, and management's commitment to growing it even further makes for a compelling investing thesis for Brookfield Infrastructure Partners.

This company counts Amazon.com as its biggest client

The real estate investment trust (REIT) space offers plenty of high-yield options to investors, primarily because REITs can dole out fat dividends since they're required to pay 90% or more of their taxable income as dividends to shareholders. Not every dividend-paying REIT is worth your money. One that is, though, is STAG Industrial (STAG 0.85%), a pure-play industrial REIT yielding 4.5% today.

There are two things income investors might like about STAG: It pays a dividend every month and has increased its dividend annually for the past five years.

There's a lot to like about the company as well.

STAG acquires and operates single-tenant industrial properties across the U.S., with 457 buildings and 91.8 million square feet of area under its belt as of June 30. Diversification is STAG's key strength -- it has tenants across 45 industries. E-commerce giant Amazon.com (AMZN 0.75%) is currently STAG's largest tenant, accounting for 2.5% of its annual base rent (ABR). The General Services Administration, freight and logistics player XPO Logistics, and auto giant Ford Motor are other notable tenants. Over the next five years, STAG aims to pump $800 million to $1 billion into acquisitions.

Its top 20 tenants, though, contribute less than 20% to STAG's ABR, again reflecting how the company is diversified across not just industry but also tenancy. That might explain why STAG didn't stumble despite the ongoing coronavirus pandemic slowdown: It clocked 97% occupancy during the second quarter and collected 98% of its Q2 base rental billings as of July 28. With a laser focus on smaller, niche markets and tenants, STAG should be able to generate strong cash flows and reward dividend lovers richly in the long term.