Companies like to see their stock prices rise. However, there are times when they may want to bring their stock prices down without affecting valuation, which sometimes leads a company to split its shares. In July, tech giant Apple (AAPL 0.52%) announced a 4-for-1 stock split, and less than two weeks later, electric vehicle manufacturer Tesla (TSLA 0.40%) also announced a split on a 5-for-1 basis.

Today, we'll look at whether virtual care provider Teladoc (TDOC -0.45%) will follow suit and be the next company to split its shares. The telehealth company's stock is performing well this year, rising more than 130% year to date, well above the S&P 500's 5% returns. And at a price tag of around $195, its share price is high enough that a split could be justifiable. Let's take a look at why the move could make sense for Teladoc and why the choice would pique investor attention.

A split gets people talking about a stock, in a good way

A stock split technically does nothing for investors. If they invested $10,000 in a company, they'd own the same value after a split. The only difference is that a stock split changes the number of shares that an investor owns.

What a stock split does truly accomplish, however, is propelling a company into the spotlight, and for good reason -- a stock that's ready for a split is probably doing well and rising in price compared to other companies in its industry. There's no golden rule about if or when a company should enact a stock split, but it typically does not happen if a stock is performing poorly. In those cases, a reverse stock split would be more appropriate.

Image source: Getty Images.

Press releases, especially positive ones, can help drive bullishness for a stock. And while Teladoc shares aren't trading in the thousands like Tesla's stock was when it split its shares, it's still a move that could work for the company. A more modest 2-for-1 split would get Teladoc's stock price down to about $97, which is not far from the ~$130 that Apple shares trade at today. At a minimum, the announcement of a stock split can be seen as positive news -- that the share price is so high that the company feels the need to reduce it and make each share accessible to more investors. A reverse split is usually not a good sign and happens when management believes a stock is undervalued.

Teladoc's already gotten people talking this year, since the coronavirus pandemic has led to a surge in virtual visits through the telehealth service. In its Q2 earnings report for the period ended June 30, the company recorded 2.7 million virtual visits on the platform, a 203% increase from the prior-year period. On Aug. 5, Teladoc announced it would be merging with Livongo Health, a medical device maker that helps people with diabetes share their readings with their doctor and family, in a cash-and-stock deal worth $18.5 billion.

The Livongo deal will complement Teladoc's existing online services well and expand its customer base. In 2019, Teladoc did $553.3 million in revenue, while Livongo generated $170.2 million in sales. The companies expect the deal to close in the fourth quarter, and it will leave Teladoc shareholders owning 58% of the combined company. The successful completion of the merger could help lift Teladoc's stock, which took a dip after the announcement. Some investors may have turned away from the stock because the deal means that their ownership will be diluted by the issuance of additional shares.

A stock split can improve liquidity

Another reason a split could be beneficial for Teladoc is that it can encourage more people to buy its shares. This a key reason why companies initiate stock splits -- the price of a single share gets low enough that it becomes more affordable and attractive. While it's possible to own fractional shares of a company, it's not as impressive for investors to tell people they own 0.251343 of Tesla shares, as opposed to say 10 or 100, which would make for simple math and easy explanation. This is a mostly psychological factor of investing. But a lower price can help stimulate more trading activity, as investors will feel as though they can afford to own more shares.

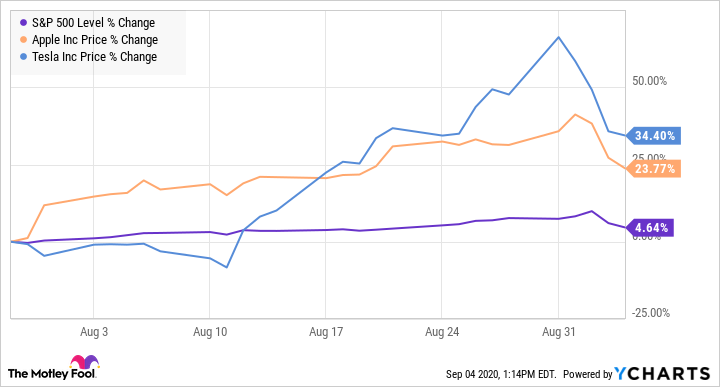

Whether it's due to liquidity or the positive press, since Apple announced a stock split on July 30, its shares have soared. The same has held true for Tesla, which announced its stock split on Aug. 11:

A lower price combined with a bright future for the virtual care market could make Teladoc an attractive investment. And the excitement surrounding a stock split could propel its shares to new heights.

Is a stock split inevitable for Teladoc?

Although there are some good reasons for Teladoc to split its shares, that doesn't mean that it's a guarantee. After all, if price alone were a reason to split shares, Berkshire Hathaway would've done so ages ago on its class A shares. Trading at $326,525, the stock could do a 1000-for-1 split and its share price would still be higher than Teladoc's.

The bottom line is that some companies may never opt to do a stock split. Then there are companies like Apple, which has now completed five splits. The important thing for investors to remember is that a stock split doesn't really matter. Your investment is worth the same amount after a split as it was before -- a split is a corporate move that doesn't itself affect the valuation or market cap of a company. While Teladoc could justify a split at its current price, there's by no means a guarantee that it will do so, and investors shouldn't expect it from the healthcare company at this stage.