With stocks trading in the neighborhood of record highs, some growth-focused names have been putting up eye-catching performances. However, investors can also strengthen their portfolios by adding sturdy, lower-risk companies that regularly return value to shareholders through dividends.

With that in mind, three Motley Fool contributors have identified three top dividend stocks that are primed to deliver big wins. Read on to see why they think Verizon Communications (VZ -0.10%), Brookfield Infrastructure (BIP 2.95%) (BIPC 2.52%), and Texas Instruments (TXN 1.77%) are great buys right now.

Image source: Getty Images.

Enjoy big dividends as 5G changes the world

Keith Noonan (Verizon Communications): Try to imagine a world in which the internet becomes less central to daily life. If you're a science or science fiction enthusiast, you might think of a scenario in which a solar flare or electromagnetic-pulse device knocks out technology hardware and software infrastructure. On the other hand, it's far more likely that the world will continue to increasingly rely on network communications. Verizon is a top player in the telecom space, and it looks poised to benefit from growing demand and emerging service opportunities over the long term.

Verizon operates the United States' largest and best-rated mobile wireless network, and the company is in the early stages of facilitating and benefiting from a major upgrade cycle. 5G networks will enable vastly improved upload and download speeds, and these advantages should spur demand from consumer and enterprise customers and allow Verizon to continue cutting big checks to shareholders.

The company consistently generates strong free cash flow and has raised its payout on an annual basis for 14 years running. While the business will need to continue investing to build out its 5G infrastructure and pursue other growth initiatives, it's likely that investors will continue to enjoy regular payout growth.

With the stock trading at roughly 11 times this year's expected earnings and boasting a 4.4% dividend yield, Verizon is attractively valued and stands out as one of the best income plays in the telecommunications industry. The business might not look particularly flashy compared to high-growth names in the tech sector, but it could prove to be a big winner for patient investors.

The invisible glue that connects the modern world

Jason Hall (Brookfield Infrastructure): Investors are -- for good reason -- always looking for the next big growth trend. For years to come, that means e-commerce, data, and social media. The world is getting wealthier and smaller, and hundreds of millions more people will be shopping and interacting with one another online in the years ahead than do today.

But one of the best investments in this megatrend-trend isn't an e-commerce or social media company, but rather a provider of the data centers, 5G and fiber communications, and operators of the transportation infrastructure that makes it all work: Brookfield Infrastructure.

Brookfield operates on every continent but Antarctica. Its business generates steady cash flows from long-term contracts, often with escalators for inflation, and is largely recession-resistant. Moreover, the megatrend-trend of global middle class growth is set to fuel a "super-cycle" in infrastructure spending. With investment-grade credit, and billions of dollars in low-cost capital on hand, Brookfield Infrastructure is a best-in-breed company worth buying.

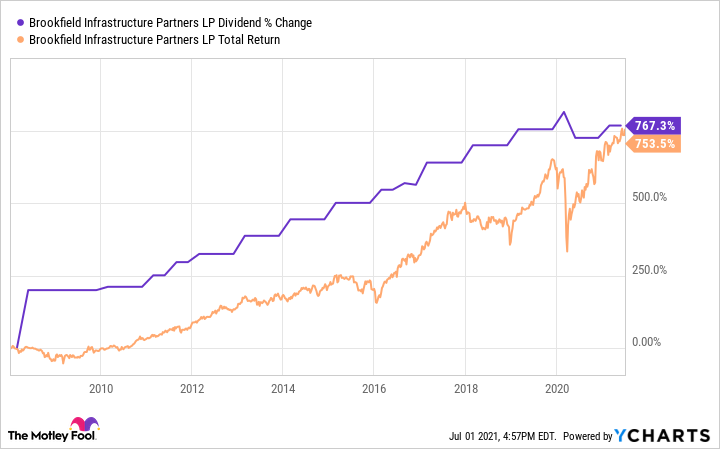

For dividend-seekers, it doesn't get much better. Since going public in 2008, it has generated almost 15% compounded annualized total returns, much of that powered by a dividend payout that's increased almost 800%, driving over 750% in total returns:

BIP Dividend data by YCharts

Texas Instruments is an overlooked free-cash-flow giant

Jamal Carnette (Texas Instruments): Texas Instruments faces a perception problem. The company specializes in analog chipsets and embedded processors, technologies considered last generation when compared to digital and mobile chipsets.

However, Wall Street's focus on higher-growth end markets allowed Texas Instruments to fly below the radar. Texas Instruments isn't a growth stock, but the company arguably has the best capital return policy in the S&P 500.

Instead of foolishly (small "f") pursuing top-line growth, Texas Instruments' management focuses growing free cash flow per share and returning all cash to shareholders via dividends and share buybacks. Against that backdrop, management is excelling: Since 2004 Texas Instruments grew free cash flow per share 12% per year and used that cash to reduce outstanding shares by 46% and grow dividends 26% per year.

Unfortunately, shares of Texas Instruments are no longer as cheap as they once were on account of the company's stock price advancing more than 50% in the last year, but shares still yield 2.1%. That's higher than the average S&P 500 yield, and the company has nearly $10.5 billion -- or nearly 6% of its current market cap -- left in its share-buyback authorization. Investors can expect more dividends and share buybacks from this free-cash-flow growth juggernaut.