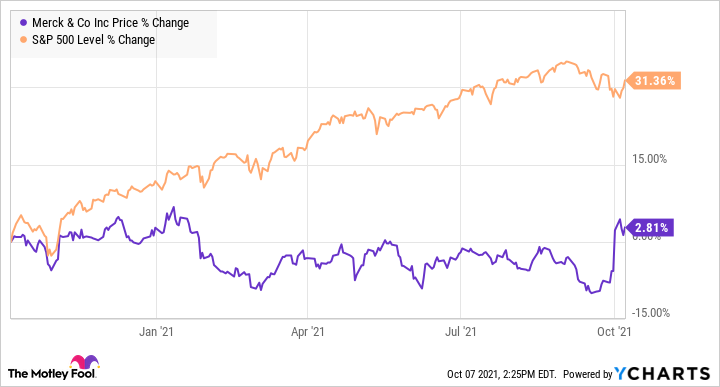

Like many of its peers in the pharmaceutical industry, Merck (MRK 2.93%) has trailed the broader market in the past year. The effects of the COVID-19 pandemic on trips to doctors' offices coupled with perceived regulatory headwinds (proposed bills that could impact drug sales have been discussed by lawmakers) are probably to blame for this poor performance.

Despite these challenges, there are excellent reasons to consider adding shares of Merck to your portfolio, and some of these are due to recent developments. Here are my top three reasons why Merck stock is a buy right now.

1. Keytruda

At the top of the list we have Merck's flagship product, Keytruda. This cancer medicine boasts an impressive number of indications. In the U.S. alone, it has earned at least 36 approvals. That's before we add the regulatory nods Keytruda has abroad. It's no surprise, then, that Keytruda continues to grow its already blockbuster sales. During the second quarter ending June 30, Merck's revenue from Keytruda came in at $4.2 billion, 23% higher than the year-ago period.

The cancer medicine's upward trajectory won't end anytime soon. It is currently undergoing more than a dozen clinical trials, and investors can expect regular label expansions. Keytruda is projected to become the world's best-selling drug within the next half a decade. This product will continue to help Merck grow its revenue and earnings, and that's good for the company and its shareholders.

2. A promising COVID-19 medicine

On Oct. 1, Merck released data from an interim analysis of a phase 3 clinical trial for molnupiravir, a potential medicine for COVID-19 it is developing with Ridgeback Biotherapeutics. During the trial, molnupiravir proved effective in reducing the risk of hospitalization or death by 50%. Importantly, all eight deaths that occurred in the study happened in the placebo arm. No patient treated with molnupiravir died.

Image source: Getty Images.

On the back of these impressive results -- and under the advice of an independent data monitoring committee -- Merck halted the study early and is gearing up to submit an application for emergency use authorization (EUA) for molnupiravir. This medicine could help the company improve its sales somewhat in the near term. Thousands of people are hospitalized with the coronavirus, and while therapy options for the disease exist, they have limitations.

Veklury, a leading COVID-19 medicine marketed by Gilead Sciences, is administered by intravenous infusion. Meanwhile, Regeneron's REGEN-COV needs to be administered via infusion or subcutaneous injection. Molnupiravir is an oral drug, meaning patients can take it from the comfort of their homes. This advantage could help molnupiravir capture a decent share of the market. At least two other companies are developing oral medicines for COVID-19 (Pfizer is one of them), but Merck has the advantage thanks to its recent announcement.

3. Merck goes shopping

Merck recently announced that it would acquire Acceleron Pharma (XLRN) in a cash-and-stock transaction valued at $11.5 billion. The deal is set to close in the fourth quarter. Thanks to this acquisition, Merck will get its hands on sotatercept, a potential treatment for a form of high blood pressure in the arteries called pulmonary arterial hypertension (PAH). The disease causes blood vessels in the lungs to narrow, among other serious problems.

Treatment options for PAH exist, but sotatercept looks to be superior to the current standards of care. Acceleron released data from 10 patients (out of 21) treated with sotatercept in a phase 2 clinical trial. During the study, these 10 patients exhibited improvement in blood flow measures, according to the company. What's striking, though, is that all of these patients had previously been treated for PAH. The disease affects roughly 70,000 patients in the U.S. and Europe.

And given that sotatercept is being investigated in other indications, it could achieve blockbuster status if approved. Another product in Acceleron's arsenal is Reblozyl, an approved treatment for anemia (lack of red blood cells) in patients with some blood-related disorders. Bristol Myers Squibb markets Reblozyl, but Acceleron is eligible for regulatory milestone payments of up to $100 million and royalty payments amounting to roughly 20% to 25% of the net sales of the medicine. Acceleron believes Reblozyl could reach peak sales of $4 billion.

The combination of Reblozyl and sotatercept could meaningfully move the needle for Merck.

A strong long-term pick

Merck may have lagged the market over the past year, but thanks to its crown jewel, Keytruda, its promising COVID-19 oral drug, and the products it will acquire once the deal with Acceleron closes, the company looks set to grow its revenue and earnings at a good clip for the foreseeable future. That's before we consider the company's booming animal health and vaccine businesses. Merck is currently trading at 14.5 times forward earnings, which makes the company reasonably valued -- the average forward price-to-earnings ratio for the pharma industry is 13.6. Investors focused on the long game cannot go wrong with this pharma stock.