One of the world's largest companies underwent a complete makeover in 2021. Social network titan Facebook changed its name to Meta Platforms (META -10.56%) and pointed its focus at developing the metaverse. Some people believe it's the next frontier, a digital economy where the physical and digital worlds come together.

Meta has three special tools that make it my favorite stock for investing in the metaverse. Today the stock is also a bargain, making it a compelling opportunity for short and long-term investors alike.

Meta's massive audience

There could be a lot of opportunities to monetize the metaverse over the long term as it grows and develops. Meta's core business is advertising on its social networks like Instagram and Facebook, so I expect this to be Meta's ultimate goal in the metaverse.

Image source: Getty Images

The critical thing for Meta will be transferring its massive audience to the metaverse. The company boasts a staggering user base of 1.93 billion that use Meta's networks each day and 2.91 billion that use them at least once per month. That's nearly four out of 10 people across the world.

Few companies on the planet have that kind of reach. If Meta can successfully build a metaverse platform where a similar size audience can interact and generate revenue through ads, the potential payoff for Meta could be staggering.

Oculus is a gateway

Of course, the question would naturally be: How do people find the metaverse? Meta is investing $10 billion over the next year into metaverse projects, but its best tool so far could be one of its earlier investments.

Meta acquired Oculus for $2 billion in 2014, and it's grown to become a leading hardware brand for virtual reality. According to estimates, Meta sold nearly 7 million Oculus headsets in 2021, signaling the brand's strong momentum.

The bigger Oculus's footprint becomes, the larger its ecosystem grows. It could eventually grow to have the same type of monopoly like dominance that Apple and Alphabet enjoy with their smartphone app stores.

Among the deepest of pockets

Meta is flexing its financial muscles in developing its metaverse business. Hearing a company is investing $10 billion on something within a single year might take you back; it's more than many public companies generate in revenue.

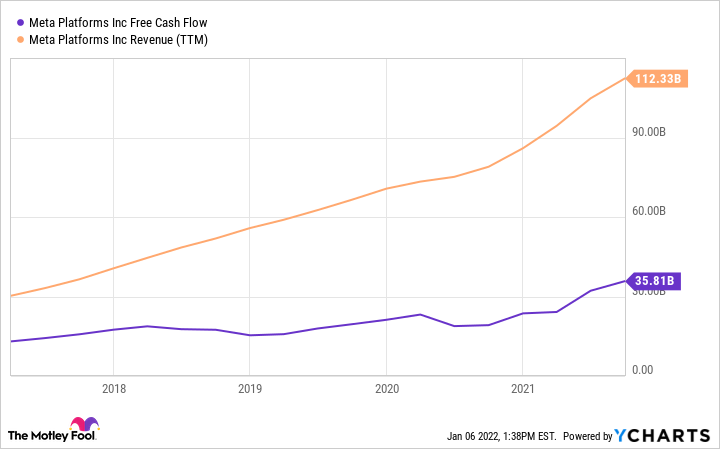

Meta's balance sheet is massive, carrying $58 billion in cash and marketable securities. It's also a free cash flow machine, churning out tens of billions of free cash flow while revenue grows.

FB Free Cash Flow data by YCharts

Meta doesn't need to spend a lot of money aside from its research and development -- its existing products are already built and require little maintenance. Revenue increases as more users join the platforms and easily outpaces Meta's costs. CEO Mark Zuckerberg has already said that the company will spend heavily over the coming years building the metaverse. Investors should not doubt that Meta can afford to take on this ambitious task.

25% upside?

The stock itself is currently just over 12% off its 52-week highs, but its price-to-sales ratio is under nine and near the lower end of its five-year range. The stock is barely up since announcing its name change and metaverse intentions in October, so investors might not have priced in the long-term potential of this opportunity yet.

FB PE Ratio data by YCharts

On the other hand, the stock's price-to-earnings ratio of 23 is below the S&P 500's (currently 29), despite superior growth. Analysts see earnings per share (EPS) growing 20% each year over the next three to five years.

Could the stock continue going lower? Sure, however, with the stock's valuation so low, I think there's a good shot at the stock moving with the actual growth of the business (20%, as noted above). I think shares have a conservative upside of 25% in the short term, requiring just a tiny valuation increase on top of Meta's EPS growth.

Meta was the subject of many negative news headlines related to its social media platforms in 2021. If investors begin warming up to Meta from future optimism around the metaverse, or strong Oculus sales occurred during the holidays, there is room for the stock to run from its current valuation.

This could mean a nice short-term return, but Meta is likely a better long-term investment. Meta's 20% growth estimates are for each year moving forward and could last as long as five years. Perhaps 25% is just the tip of the iceberg if the company's metaverse investments begin bearing fruit over the next few years.