Want to line up $1,000 in annual retirement income? I've got good news. You can make it happen with a little less than $10,000 spread out among three dividend-paying stocks.

Of course, there are no guarantees that say these companies will never need to lower their payouts. So before anyone dives in, let's see if they have what it takes to maintain and raise their dividends over the long run.

Image source: Getty Images.

Two of these stocks offer double-digit yield percentages at the moment. If you spread $9,907 among these three stocks at their recent prices, you'll be eligible to receive dividend payments that add up to a little over $1,000 annually.

| Company (Symbol) | Recent Price | Number of Shares | Annual Payout Per Share | Upfront Investment | Annualized Dividend Payments |

|---|---|---|---|---|---|

| Annaly Capital Management (NLY 1.36%) | $7.58 | 568 | $0.88 | $4,305 | $500 |

| AGNC Investment Corp (AGNC 0.97%) | $14.42 | 208 | $1.44 | $2,999 | $299 |

| Enterprise Products Partners (EPD -0.23%) | $24.10 | 108 | $1.86 | $2,603 | $201 |

| Totals: | $9,907 | $1,000 |

Data source: Yahoo Finance!

Annaly Capital Management

Perhaps the best-known ultra-high-yield stock investors can count on to generate heaps of dividend income is Annaly Capital. This is a real estate investment trust (REIT) that doesn't buy real estate. Instead, Annaly Capital Management borrows at short-term lending rates to buy mortgage-backed securities that offer higher rates of return.

Managing a portfolio of low-interest short-term loans and mortgage-backed securities that pay much higher rates has been reliably profitable for Annaly. The company's delivered over $1 billion in dividend payments every year since 2010.

Shares of Annaly have fallen around 13% over the past few months, and now the stock offers investors a juicy 11.5% yield. The stock has been under pressure lately because investors are concerned about rising interest rates. As long as rates rise slowly enough for Annaly to adjust its portfolio of long-term assets accordingly, the company probably won't have to reduce its payout. The Federal Reserve has been clear about its intention to raise rates slowly and without surprises.

Annaly shareholders don't need to worry too much about sharp economic downturns, either. Agency-backed securities on the company's books make up 92% of total assets. If these borrowers default on their mortgages, the U.S. government will effectively step in to make Annaly whole again. This added protection is good for more than just peace of mind -- it keeps costs of capital much lower than they would be otherwise.

AGNC Investment Corp.

AGNC Investment Corp. is another mortgage REIT that offers a juicy double-digit yield, now that its stock price has tumbled. Shares of AGNC Investment fell by about 12% over the past month, and now the stock offers a tempting 10.1% yield. It's also the only stock on this list that makes dividend payments every month instead of quarterly.

AGNC Investment's business model is generally the same as Annaly's. The company aims to borrow at low short-term rates and use that capital to acquire mortgage-backed securities with longer terms and higher interest rates. AGNC Investment isn't the largest mortgage REIT out there but it does buy lots of mortgage-backed securities. The company finished 2021 with an investment portfolio worth $82 billion.

Investors concerned about general economic catastrophes will be glad to learn that agency-backed securities comprise 95% of AGNC Investment's entire portfolio. This means the company's top line isn't going to dive if another pandemic forces a lot of people to suddenly lose their jobs again.

As long as the Federal Reserve continues to slow-step monetary-policy changes, AGNC Investment won't have trouble responding to them. The mortgage-backed securities in AGNC Investment's portfolio paid an average coupon of 2.84% at the end of 2021. The average rate on 30-year mortgages at the moment is already up to 3.93% and climbing.

Enterprise Products Partners

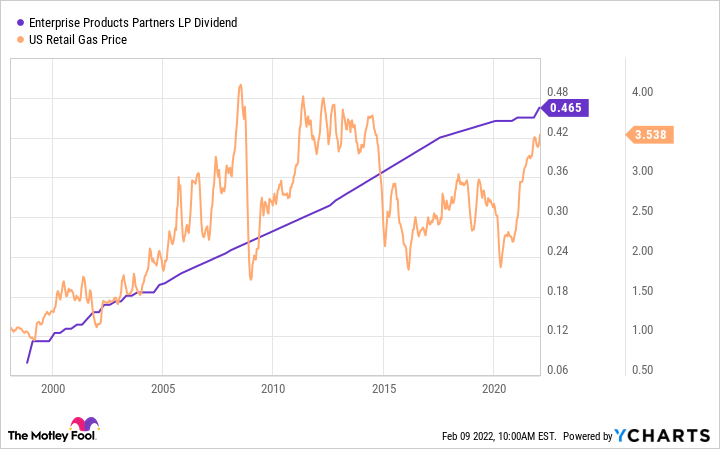

If you've been hesitant about energy stocks because you remember the string of bankruptcies among drilling and exploration companies in early 2020, there's a midstream provider you need to look at. With a 7.8% dividend yield, Enterprise Products Partners stock offers new shareholders the lowest forward yield. A history of steady payout bumps going back more than two decades suggests shares of Enterprise can deliver more dividend income to your retirement account over time than the mortgage REITs on this list.

EPD Dividend data by YCharts.

If you own a vehicle, you know that gasoline prices can quickly plummet in response to minor increases to global supply or decreased demand. Either situation can decimate companies that drill for the stuff, but Enterprise gets paid to store oil and gas and transport it through its network of pipelines.

Since the overall volume of oil and gas that needs to get from point A to point B rises fairly steadily, Enterprise can get its customers to sign long-term price and volume commitments. The steady cash flows these contracts deliver allow the company to balance its dividend obligations with constant investment in new pipelines and facilities.

At the moment, Enterprise has around 50,000 miles of pipelines and enough storage capacity for 14 billion cubic feet of natural gas. With an increasing supply of infrastructure that the oil and gas industry relies upon under its control, this company has one of the most reliable dividend programs you'll find anywhere.