Master investor Warren Buffett's favorite holding period is forever. Let your winners run and give your struggling investments some time to right the ship, he argues. Thanks to the magic of compounding returns, time, and patience are an investor's best tools. And the more you believe in a business, the longer you'll want to own its stock.

So when I buy a new stock, I generally aim to hold it for several years at the very least. A handful of the stocks in my portfolio have earned lifetime seats by my side. I have grown to know these companies well over the years, and I'm convinced that they will deliver market-beating business results and shareholder returns for the very long haul. I might sell a few stubs here and there if I need the money, but I'm not closing these positions in the foreseeable future.

For me, that exclusive club has six members so far. Today, I'll show you why I plan to own Roku (ROKU 0.57%) and Alphabet (GOOG 0.92%) (GOOGL 0.93%) forever, for all intents and purposes.

Image source: Getty Images.

How to find a long-term winner

Google parent Alphabet and Roku have a few crucial attributes in common:

- These two companies are both willing and able to change with the times, entering new markets as the business landscape takes a new shape.

- Until the environment changes form, they are addressing consumer markets on a global scale with tons of untapped growth left to explore.

- Their search for large-scale growth is easy to see in their financial results. Alphabet's top-line sales have grown at a compound annual average rate of 23% over the last five years. In the same period, Roku's revenue posted annual growth of 41%.

- They are impressive cash machines. Alphabet turned 26% of its 2021 revenue into free cash flow. Roku's cash-based profit margin landed at 10.6% over the last four quarters.

- Their balance sheets are rock-solid, with ample cash reserves and limited long-term debt.

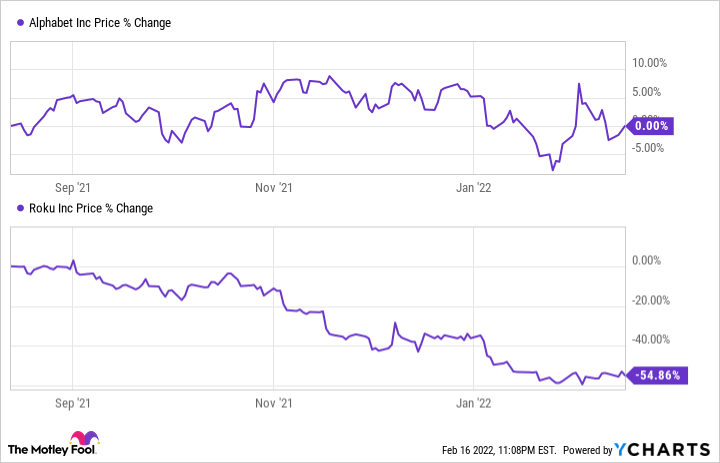

It's true that the stocks also share some not-so-favorable qualities. Alphabet's stock is on the expensive side of fairly valued and Roku has set up shop in Wall Street's nosebleed section. Their valuations range from challenging to lofty even though the stocks ran into a market-wide retreat from growth-oriented investments in recent months. Alphabet shares have traded exactly sideways over the last six months while Roku's stock fell 55%. Many investors avoid buying into stalled or falling stocks because they don't want to be harmed by a falling knife.

What's next for Alphabet and Roku

The bullish bullet points listed above are more than enough to outweigh my concerns about high stock prices and negative chart patterns. In the long run, I expect Alphabet to evolve into a multi-talented technology conglomerate with many decades of staying power. Long after we've all moved on from Google searches and Android phones, we'll be using Alphabet products and services to meet needs we haven't even heard of yet. Likewise, Roku may eventually move on from serving up content produced by other companies and become a full-fledged entertainment titan in its own right.

That's the kind of wide-open business attitude it takes to stay relevant and thriving for a very long time, across whatever unexpected challenges might turn up along the way. Roku and Alphabet have that pivotal property in spades. And so, the mathematical sorcery of annual gains multiplied dozens of times over can take full effect, and I want to make sure that I own these durable tickers for the very long run.

You can also do your own research

Your analysis may differ from mine, and your investing targets are probably not quite the same, either. That's fine. Whether or not you agree that Alphabet and Roku are picture-perfect models of flexibility and long-term growth, you can apply the same thinking to other companies in your own wheelhouse. Invest in the stocks you expect to stick around and grow for the next couple of decades, based on your own research, and watch the game-changing stock returns roll in. And it's alright if there are speed bumps and slowdowns on that long road to riches, because successful investing is more like a marathon than a sprint.

Alphabet and Roku are two of the very few stocks that fit that bill for me. You're free to follow in my footsteps, or to find your own long-term winners. Either way, your best Warren Buffett impression requires an eye for high-quality business and a ton of patience. That's how you build true wealth in the stock market.