Inflation, supply chain bottlenecks, semiconductor shortages, labor woes, and heightened international tensions are just a few of the conditions that businesses and investors have on their minds these days. In this climate, it's not surprising that the major U.S. stock indices are down several percentage points in 2022, and stability may still be a ways off. But this doesn't mean investors should throw in the towel.

There are many investments, including the three featured in this article, that could thrive during and after a market downturn. Let's take a closer look at them.

Image source: Getty Images.

1. Vici Properties

One way to fend off a bearish market is to buy companies that pay dividends and have been stress-tested in the past. A steady stream of dividends makes it easier for shareholders to patiently wait for the market to return to its bullish ways while continuing to bank income. A company that has withstood headwinds before is often a safe bet to continue this in the future. These two attributes describe Vici Properties (VICI -0.28%). Vici is one of the world's leading operators of gaming and entertainment properties.

Vici Properties is a triple net lease real estate investment trust (REIT). REITs have multiple models, but they are generally an entity that buy commercial properties and then lease them out. In order to qualify for certain tax advantages, REITs are required to return 90% of their net income to shareholders (usually in the form of dividends). A triple net lease REIT means the lessee not only pays rent, but is also responsible for the building's taxes, insurance, and maintenance costs.

There are several reasons why Vici is a terrific buy after a market downturn. First, Vici is a survivor. It kept operations going despite one of the worst disasters to hit in-person gaming -- the COVID-19 pandemic. Casinos around the world were shut down for extended periods or open only under stringent restrictions for months at a time in 2020 and 2021. The casino operators (the leasees) lost billions of dollars in revenue but still managed to pay their rents. That allowed Vici to increase its revenue and its dividend during this time.

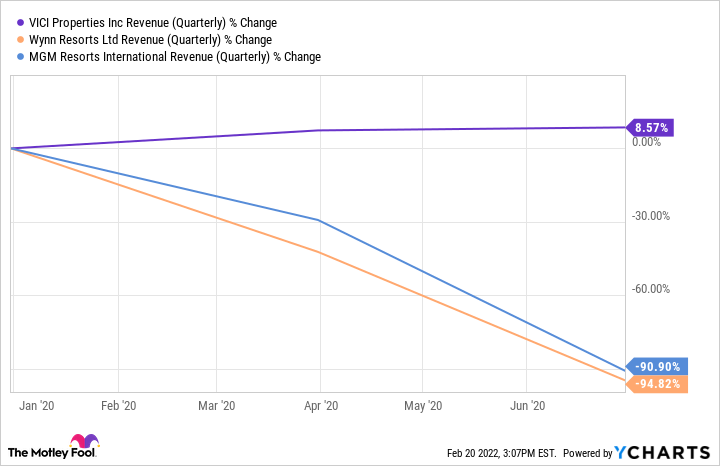

The chart below shows the change in Vici's revenue for the first six months of 2020 juxtaposed with major casino operators Wynn Resorts and MGM Resorts. As you can see, the landlord continued collecting the rent, even during the crisis.

VICI Revenue (Quarterly) data by YCharts

Vici increased its dividend from $0.2975 per share per quarter in June 2020, to $0.33 in the following quarter. So Vici is still paying out a dividend and it happens to be yielding over 5% because the stock price has been underperforming due to the broader market issues mentioned above. Vici's operations are also inflation-resistant. According to the company, 97% of its leases are subject to rent escalators that are tied to the consumer price index. This means that when prices rise, so will the rent.

These are just a couple of the reasons that Vici is a stock that investors can confidently invest in during market turmoil.

2. Microsoft

Microsoft (MSFT 1.82%) has made itself essential to businesses globally. It is the largest software company by revenue in the world and its products and services are heavily relied upon by businesses of all types. That gives Microsoft tremendous pricing power. As inflation rises, the company is able to pass the costs on and maintain its profitability. That makes Microsoft a high-conviction pick for investors when the market is down.

In Q2 of fiscal 2022, Microsoft revenue reached $51.7 billion, a 20% jump year over year. Operating income was up 24% year over year and reached $22.2 billion. That's an impressive 43% operating margin. Much of the growth was driven by cloud products and services and Microsoft Azure, which collectively grew 29% year over year.

Microsoft also supports shareholders with a small dividend and significant stock buybacks. Stock buybacks reduce the number of shares available, increasing each shareholder's piece of the pie. Share buybacks also support the stock price by providing demand in the marketplace. A company will often increase share repurchases if the stock price dips. Microsoft returned $10.9 billion to its stockholders through dividends and buybacks in Q2 fiscal 2022 alone.

Microsoft keeps looking for further growth, and its latest effort involves the planned acquisition of Activision Blizzard for $68.7 billion. This will make Microsoft the world's third-largest gaming company by revenue. It also strengthens the company's foray into the metaverse.

Microsoft stock currently trades down more than 17% from its 52-week high. I'm confident this stock can hit new highs once the broader market begins its recovery.

3. O'Reilly Automotive

The auto industry has faced significant headwinds recently, including a shortage of semiconductors chips that has slowed new-vehicle production. New vehicles these days use an average of 2,000 chips to manage a wide variety of functions, from seat warming to navigation systems. This shortage, along with shortages of other essential parts caused by broad supply chain issues, has created significant price inflation for new vehicles.

Price inflation and vehicle shortages are combining to force many Americans to hold on to their current vehicles longer. These vehicles require more maintenance and that could significantly benefit auto parts supplier O'Reilly Automotive (ORLY -0.97%).

O'Reilly is already firing on all cylinders, as evidenced by its impressive 2021 results released earlier this month. It posted $13.3 billion in sales for fiscal 2021, a 15% increase over 2020. Gross profit increased from $6.1 billion in 2020 to $7 billion in 2021. The gross profit margin (GPM) increased from 52.4% to 52.7%. The fact that O'Reilly was able to increase the GPM during a period of inflation is a sign that the company can maintain its profitability under the current conditions.

Like Microsoft, O'Reilly also supports shareholders through stock buybacks. In 2021, the company repurchased $2.48 billion in stock, which amounts to over 5% of the current market cap. The current automobile market should continue to benefit O'Reilly and its long-term shareholders.