Brookfield Renewable (BEPC 0.09%) (BEP 0.19%), as one of the largest renewable energy producers in the world, is helping lead the charge in the global race against climate change. However, despite its importance to the future of energy, shares of Brookfield have tumbled more than 30% from their peak over the past year. Here's a look at the tailwinds and headwinds that could impact Brookfield's ability to create shareholder value in the coming years.

A renowned value creator

Matt DiLallo (Bull): While shares of Brookfield Renewable have lost ground in the past year, it has a long history of creating value for investors. Since its inception, Brookfield has generated an annualized total return of around 19%. That has significantly outperformed the S&P 500's roughly 7% annualized total return during that timeframe.

Powering Brookfield's returns has been its ability to steadily grow its funds from operations (FFO) and dividend per share. From 2010 to 2020, Brookfield Renewable grew its FFO per share at a more than 10% annual rate, powered by higher power prices, acquisitions, and renewable energy development projects. Meanwhile, it has increased its distribution by a 6% annual rate since 2012.

The company expects to continue growing at a healthy pace for the next several years. A combination of inflation-escalators on existing power contracts, higher power prices, and new renewable energy development projects should support 6% to 11% FFO per share growth through 2026. Meanwhile, Brookfield sees acquisitions powering up to 9% of additional FFO per share growth each year. That forecast suggests Brookfield should be able to continue delivering double-digit annual FFO growth in the coming years. That should easily support its plan to grow its 3.7%-yielding distribution by 5% to 9% each year.

Investors can get all that growth at a much lower valuation following Brookfield's sell-off over the past year. With shares of Brookfield recently around $34.50 apiece, it trades at around 20.4 times its 2021 FFO per share. I think that's an extraordinary price for a company that could grow at a 20% annual rate in the coming years.

Image source: Getty Images.

Can the tailwinds make up for the headwinds?

Jason Hall (Bear): I actually own Brookfield Renewable -- it's one of my larger holdings. But as an investor, I have learned that understanding the bear case is equally, maybe more important, than your bull thesis. That's especially true as an investment becomes a larger portion of your wealth.

Brookfield Renewable has been a wonderful long-term investment, because its management has been very good at navigating the capital markets, finding high-quality assets to acquire and invest in at reasonable multiples, and using the cash flows to reward investors with a growing dividend. Along the way, it has certainly benefited from some of the lowest interest rates we have seen, while also benefiting from the decline in costs for renewable assets that have made it far more profitable to sell renewable energy at utility scale.

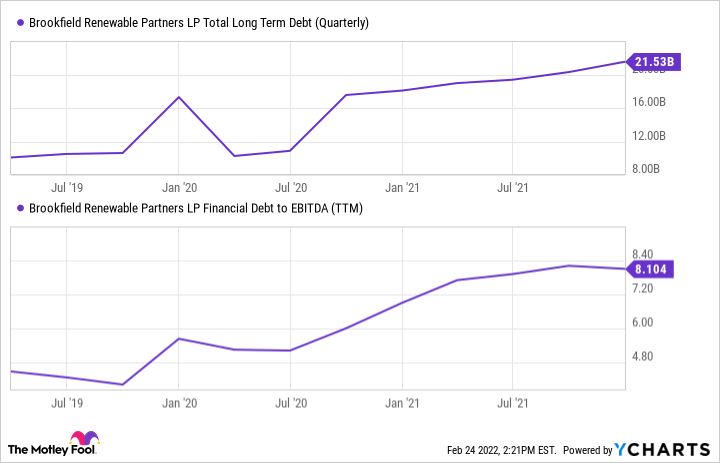

But going forward, rising interest rates could put pressure on its returns. We have seen its debt load grow significantly over the past few years, and the weight of serving that debt has also increased:

BEP Total Long Term Debt (Quarterly) data by YCharts

Let me be clear: I don't view rising rates as a risk to Brookfield Renewable as a business. It has a very long track record of navigating asset cycles and has an investment-grade rating. The bigger trend for growth is still very much in favor for renewables, and at the large scale that Brookfield Renewable is an expert at investing in and owning. But rising interest rates could take a bite out of its return on capital, resulting in lower returns and slower dividend growth over the next five-plus years.

While the future looks bright, an emerging headwind bears watching

Given the dire need for more renewable energy to stave off the potential impacts of climate change, Brookfield should be able to continue growing at a brisk pace in the coming years. How well that growth translates into increasing shareholder value depends somewhat on the impact rising interest rates will have on its business. That's something investors should keep an eye on in the coming years since it could affect Brookfield's ability to reach its full growth potential.