Desktop Metal (DM -1.50%) is slated to report its fourth-quarter and full-year 2021 results before the market open on Tuesday, March 8. An analyst conference call is scheduled for the same day at 8:30 a.m. ET.

The 3D printing company's report will follow those of the two more established players in the industry, 3D Systems and Stratasys. (3D Systems reported its Q4 results on Feb. 28, five days after Stratasys released its Q4 results.)

Reiterating what I wrote in last quarter's earnings preview: "Desktop Metal's management has not been providing organic revenue growth, which excludes contributions from acquisitions made within the last year. ... Therefore, investors don't have quantitative data about how the company's internally developed metal 3D printing product portfolio is performing in the market." This transparency issue along with the company's cash-burn rate remain reasons for caution.

On the positive side, on Feb. 28, the company announced it had shipped its first Production System P-50, as we'll further explore in a moment.

In 2022, shares of Desktop Metal (which went public in December 2020 via a special purpose acquisition company, or SPAC), are down 25.9% through March 4. The S&P 500 (including dividends) has lost 8.9% over this period.

Here's what to watch in Desktop's upcoming Q4 report.

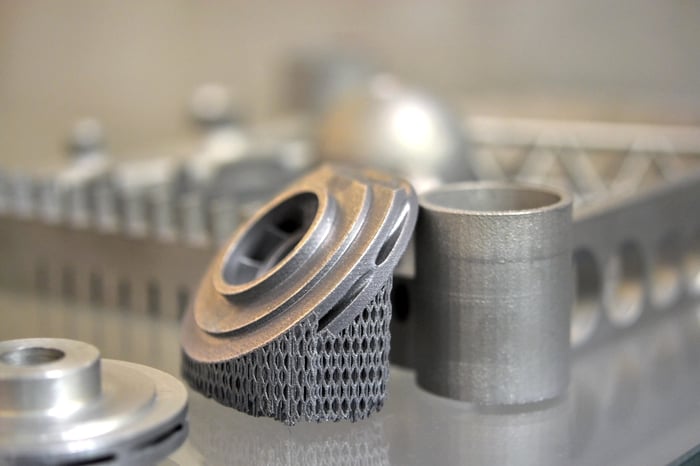

Image source: Getty Images.

Key numbers

|

Metric |

Q4 2020 Result |

Q4 2021 Wall Street Consensus Estimate |

Projected Change |

|---|---|---|---|

| Revenue | $8.4 million | $46.4 million | 452% |

| Adjusted earnings per share (EPS) |

N/A* |

($0.09) | N/A |

Data sources: Desktop Metal and Yahoo! Finance. *Quarterly adjusted number not provided in the 2020 report.

Management didn't provide Q4 guidance per se, but it has been issuing a full-year 2021 outlook. Last quarter, it lowered its 2021 guidance for both revenue and the key profitability metric it provides. For 2021, management expects revenue of $92 million to $102 million; and earnings before interest, taxes, depreciation, and amortization (EBITDA) of negative $90 million to negative $80 million. (This outlook excludes the impact of the ExOne acquisition, which closed in the middle of the fourth quarter, on Nov. 12.)

For context, in the third quarter, the company's revenue soared 907% year over year to $25.4 million. This result (which includes a large undisclosed amount from acquisitions) fell short of Wall Street's expectation of $27.1 million.

Adjusted for one-time items, last quarter's net loss widened 57% year over year to $27.3 million. This translated to loss per share narrowing 9% to $0.10. That result slightly missed the loss of $0.09 per share that analysts had projected. (The net loss and loss per share percentage changes seem out of sync because of the big increase in the number of shares outstanding last quarter compared with the year-ago period.)

Cash burn

Investors will want to keep an eye on cash burn. In the first nine months of 2021, Desktop Metal used $110.1 million running its operations. That compares with using $58.9 million in the year-ago period.

This $110 million figure is only the cash burn from operations, as it doesn't include any cash the company has been using for acquisitions. The company's biggest deal to date -- the $561.3 million acquisition of ExOne -- was financed by about 34% cash and 66% through the issuance of new shares. That works out to cash of about $191 million.

Desktop Metal ended the third quarter with $423.9 million in cash, cash equivalents, and short-term investments.

Production System P-50 data

Last week, Desktop Metal announced that it has shipped its first P-50, its flagship 3D printing system for mass production of end-use, metal parts. The customer is Stanley Black & Decker, the maker of industrial tools and other industrial and household products.

The target launch date of the P-50, which is reportedly speedy and uses the company's proprietary single-pass binder-jetting technology, has been pushed back several times in recent years. So, investors were no doubt pleased to see progress on the P-50's commercialization.

It's typical for companies to book sales of pricy production equipment after installation and a customer's final approval. On the earnings call, hopefully we will learn when Desktop Metal expects to book this sale. Ideally, investors will learn if the system was sold at a discount (which isn't unusual at this early stage) to what will be its regular price and a rough idea as to the size of the discount.

When can investors feel at least fairly confident that the P-50 will be successful or at least semi-successful in the market? When you see some repeat sales (without huge discounts) to the same customer or customers.

Guidance

It seems likely management will provide revenue and adjusted EBITDA guidance for full-year 2022.

For 2022, Wall Street is modeling for revenue of $246.9 million and an adjusted loss of $0.32 per share. That said, consensus estimates are of limited value as benchmarks for companies that make frequent and/or larger acquisitions and don't provide organic numbers.