When Netflix (NFLX -0.63%) reported earnings last week, it reverberated through a significant slice of the investing world. Investors have been looking for signs of a recession. And they saw the company's subscriber miss as a potential canary in the coal mine.

As earnings season gets into full swing, we're about to hear from other companies whose business model relies on subscribers. Wall Street isn't waiting. Shares of Disney (DIS -0.04%), Amazon, and AT&T (T 1.02%) spinoff Warner Bros. Discovery -- home to HBO and HBO Max -- are down sharply. But are Americans really ready to trim their monthly bills, or is the recent scare a buying opportunity? A few charts can help answer the question.

Image source: Getty Images.

Subscription overload

There is no question the trend of cutting the cord from legacy cable services has led to a proliferation of streaming options. Consumers rebelled against one monthly fee that included channels they didn't watch. Now they're on the hook for a bill from each of the providers.

Kantar reports that 85% of U.S. households have at least one subscription service. Deloitte's Digital Media Trends survey reveals that those households subscribe to about four video services on average. It's no wonder they might be tapped out.

Image source: Statista.

That's not even counting audio services such as Spotify, news such as The New York Times (NYT -0.18%), or dating apps such as those owned by Match Group (NASDAQ: MTCH).

Some services will get dropped if budgets are tightening

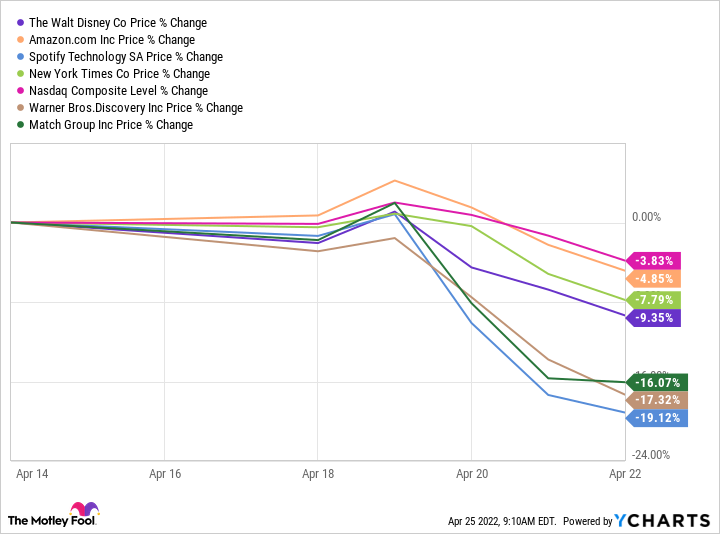

In just the past week, shares of each of the services -- video and others -- have underperformed the Nasdaq Composite Index. It's been by a wide margin for those without more to their business.

Subscription trends shouldn't be a surprise

But Wall Street might be overreacting. Plotting subscribers for the past two years show that Netflix was already stalling out in North America before the recent quarter -- especially compared to newer entrants like HBO Max and Disney+. And Netflix lost subscribers in multiple geographies during the quarter, not just the U.S. and Canada.

Data source: Netflix, Disney, AT&T. Chart by author.

Even subscription services that are more established outshined Netflix in 2021. For example, the stagnation compared to The New York Times and Match Group was in the data by the end of last year.

Data source: Netflix, Match Group, The New York Times. Chart by author. YoY=year-over-year.

Throwing the baby out with the bathwater

In investing, there's a tendency for investors to sell all companies associated with a negative trend, even the ones that should be kept. I think that's what is happening now with subscription services.

Netflix has been exhibiting signs of stalling for a while -- even when we knew the economy was good. Its value is being eroded by video games and user-created content. That doesn't affect all subscription services the same. It's actually a tailwind for some.

The fact is, Wall Street often overreacts. Instead of selling an investment after one company's poor earnings report, wait for the facts from the businesses you hold. It's a lesson that all successful investors learn eventually. For subscription businesses, the time to put that knowledge to work is now.