Earnings season is the period of a few weeks during which most companies report quarterly earnings, give updates on the state of the business, and field questions from analysts. Investors love it. It's one of the few times you get both quantitative and qualitative information about the businesses we own. Sometimes, the news that comes out of earnings season can be earth-shattering for investors.

For example, Netflix (NFLX 1.83%) reported earnings this week that weren't just disappointing; they're causing many to rethink aspects of the business they took for granted. The stock has gotten crushed as a result. For Tesla (TSLA 0.32%) shareholders, there's a lesson that they ought not overlook.

Image source: Getty Images.

Leaders of the pack

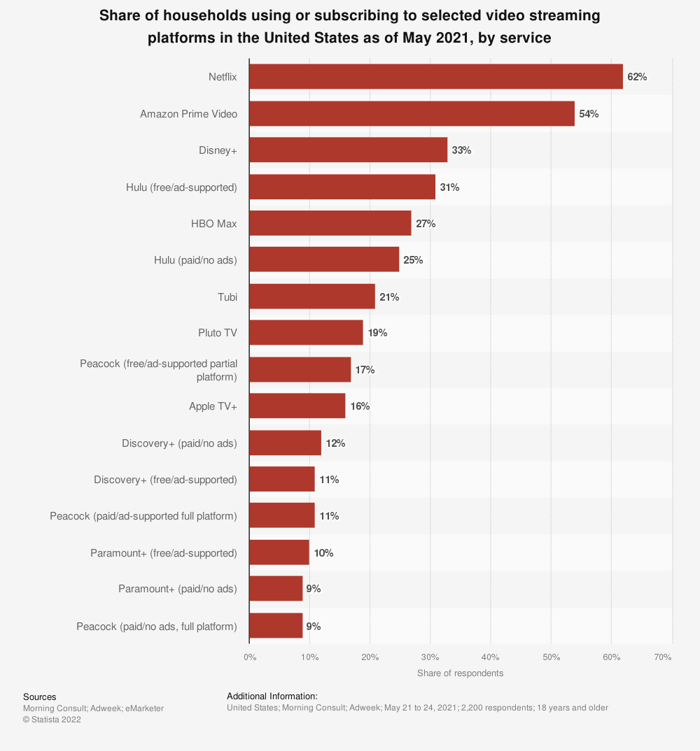

Netflix has long been the market share leader when it comes to streaming video subscription services. And the pandemic was great for business. According to an Adweek-Morning Consult poll, 2 in 5 Americans added a streaming service during the pandemic.

Netflix was a huge beneficiary. It added 55 million global subscribers from the beginning of 2020 through the end of 2021. Aptly named review site Reviews.org concluded that in the U.S. we each watched more than 600 hours of its content in 2020. But success breeds imitation. And the competition in streaming video has grown rapidly in the past few years.

Image source: Statista.

That's not even counting audio options like Spotify or free services such as Alphabet's YouTube and ByteDance's TikTok. And it's not unlike the electric vehicle (EV) market Tesla finds itself in now.

Riding the tsunami it helped start

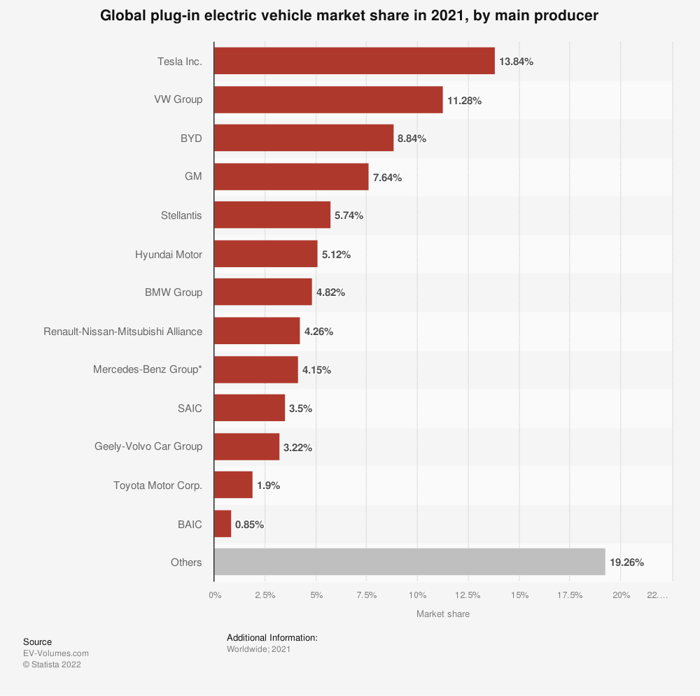

You could be forgiven for mistaking a chart of the largest EV producers for the chart of streaming services. They're quite similar. Although the Toyota Prius was introduced in the late '90s, it was Elon Musk and Tesla that made EVs cool. Now it leads the market, but competition is coming.

Image source: Statista.

Volkswagen delivered less than half the number of EVs as Tesla last year, but it has set a target of 28 million units by 2028. General Motors has committed to bring 30 new EVs to market by 2025. And Ford is spending $50 billion in the next five years to plant its flag in an EV future. That should sound similar to the flood of streaming services that hit the market during the pandemic.

Netflix is the leader, but that market is being chopped up among more participants. The same could happen to Tesla. As cool as it is, when brands with status, like Mercedes, BMW, and Porsche, launch their own EVs at scale, the company will need to find new ways of differentiating itself beyond the brand.

There is one big difference

Of course, streaming services aren't automobiles. And most households have multiple services while maxing out at one or two cars -- often of the same brand. Streaming also doesn't require the same technical expertise and capital investment that creating an EV does. For that reason, many proponents will claim Tesla is more like Apple. It's a reasonable comparison.

But technical know-how and an inspiring brand can only go so far. For Apple, an ecosystem of devices and applications keeps its customers returning year after year. For Tesla to reach its growth aspirations, it will have to convince loyal customers of legacy auto brands to switch their affiliation. Unless it can finally deliver an autonomous vehicle that differentiates the car, that may be a lot to ask.