Stock splits have gotten a lot of attention this year with several prominent companies deciding to take this step in a bid to, among other things, make their share prices more attractive for retail investors.

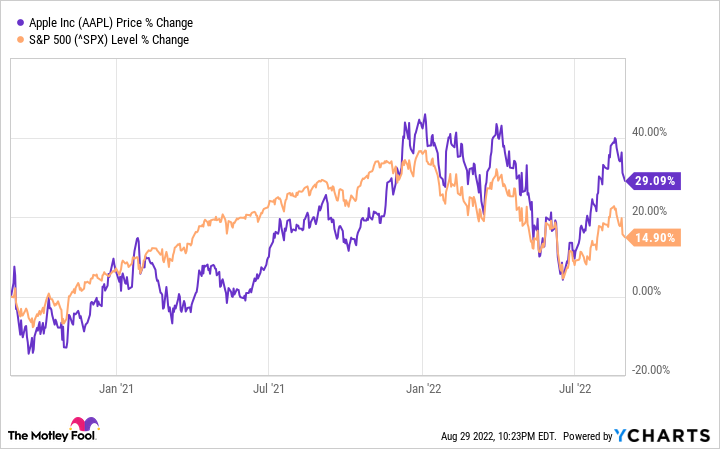

Apple (AAPL 7.41%) and Nvidia (NVDA 3.96%) are two companies that initiated stock splits relatively recently. It's been two years since Apple executed its 4-for-1 stock split on Aug. 28, 2020. The company's share price is up 29% since the stock started trading on a split-adjusted basis, beating the S&P 500 handsomely despite the recent volatility in the market.

Nvidia's stock price also took off following its 4-for-1 split on July 20, 2021. But 2022 has been terrible for the chipmaker thanks to an oversupply in the graphics card market that has dealt a body blow to its gaming business.

A stock split is more of a cosmetic move that simply increases the number of shares outstanding while reducing the price proportionally. This move doesn't change the prospects of a company or its intrinsic value. But it does make shares more accessible to a wider pool of investors. That could lead to an increase in demand for a company's shares, and send the price higher.

A stock split shouldn't be the sole reason to buy shares in a company. However, stock-split stocks such as Apple and Nvidia are coincidently great buys considering the opportunities they are sitting on and their valuations. Let's look at the reasons why buying these companies looks like a good idea amid the market sell-off.

Apple and Nvidia have solid long-term growth potential

Apple and Nvidia operate in markets that have impressive long-term growth potential and both companies are dominant players in their respective sectors.

Apple, for instance, is benefiting from the rapid adoption of 5G smartphones. It led the 5G smartphone market in 2021 with a 31% share, according to Strategy Analytics, and seems to have sustained its dominance in 2022 as well. Apple has shipped 101 million iPhones in the first six months of 2022, up slightly from 99.7 million units in the same period last year. That slight increase has come at a time when overall smartphone shipments have contracted 8.8% year over year during the same period.

The higher prices of 5G smartphones are playing in Apple's favor. Android users are switching to iPhones, and the company's installed user base is also upgrading to its new devices. With global 5G mobile subscriptions expected to hit 4.4 billion in 2027 from an estimated 1 billion this year, Apple's largest product line seems to have a bright future ahead.

Throw in other catalysts such as the services business, Apple's move into nascent but potentially lucrative areas such as the metaverse and self-driving cars, and its growth could improve in the long run. Analysts are currently anticipating 9.5% annual earnings growth from Apple for the next five years, but it wouldn't be surprising to see it grow at a faster pace thanks to multiple catalysts.

Nvidia, on the other hand, is the leading player in the discrete graphics card market. These chips are deployed in personal computers and laptops for gaming. Nvidia controlled 78% of this space in the first quarter of 2022, according to Jon Peddie Research. However, the graphics card market is currently in bad shape on account of oversupply, which is forcing the company to reduce prices and inventories.

Nvidia's fiscal 2023 second-quarter revenue was up just 3% year over year to $6.7 billion. The company expects a major contraction in its top and bottom lines this quarter. But investors shouldn't forget that Nvidia is expected to regain its mojo in the next fiscal year. Analysts expect the company's top line to increase 14.5% in fiscal 2024 following an increase of just 2% this year. The five-year annual earnings growth forecast of 22.8% is also bright.

These estimates are not surprising, as the discrete graphics card market is expected to generate annual revenue of $57 billion in 2025, up from the trailing twelve-month revenue of $46 billion. More importantly, Nvidia has other notable catalysts in the form of the data center and automotive businesses.

The data center was its largest business last quarter, accounting for 57% of the top line. The segment produced $3.8 billion in revenue, up 61% from the prior year. Automotive revenue was up 45% year over year to $220 million. These businesses could sustain their impressive momentum thanks to their increasing appetite for chips, as well as Nvidia's design wins in automotive and its efforts to expand the product lineup in the data center business to tap into new opportunities.

The valuations are enticing

Apple stock is down 9% in 2022. Nvidia has taken a bigger beating, with its shares declining nearly 47%.

Apple's decline has brought the company's price-to-earnings (P/E) ratio down to 27, which is lower than its 2020 and 2021 multiples of 40 and 31, respectively. If the stock market sell-off continues in the near term, investors will have an opportunity to buy shares of Apple at a more attractive valuation.

Nvidia's trailing P/E ratio of 46 represents a huge discount to its 2021 multiple of 90. The company is facing near-term headwinds thanks to the weakness in the gaming segment, but the points above indicate that it is built for long-term growth. That's why investors should be keeping a close eye on Nvidia if the stock market sell-off intensifies thanks to a hawkish Federal Reserve, as there may be opportunities to buy this semiconductor stock at a cheaper valuation.