Berkshire Hathaway (BRK.A -0.30%) (BRK.B -0.26%) CEO Warren Buffett has guided his company to incredible performance. The company's market-crushing track record has earned Buffett the nickname "the Oracle of Omaha," and he's considered by many to be the single best investor in history.

Sporting a market capitalization of roughly $700 billion, Berkshire Hathaway stands as the world's sixth-largest publicly traded company, and it's delivered phenomenal returns for long-term shareholders. Now that 2023 is here, read on for a look at two Buffett-backed stocks that are worth buying this month and holding for the long haul.

Image source: The Motley Fool.

1. Amazon

Amazon (AMZN -1.65%) has accomplished an incredible amount since its founding in 1994. Few companies have had such a far-reaching, innovative, and disruptive impact across the globe in such a relatively short period of time.

Amazon spearheaded the evolution of e-commerce, building on its early foundations as an online bookstore and creating an encompassing retail emporium. Today, Amazon's infrastructure and distribution network is the envy of the broader e-commerce space, and shoppers can purchase nearly anything they can think of through its platform.

But the technology and service innovator didn't rest on its laurels. Amazon made the push into the cloud services space, launching Amazon Web Services (AWS) to provide cloud-computing infrastructure that would ultimately go on to be the backbone for much of today's internet-communications ecosystem. While the e-commerce business accounts for the large majority of the company's revenue, it's actually the high-margin AWS segment that stands as Amazon's most important profit generator.

Of course, Amazon has also had some notable failures across its nearly three decades in operation. Its push into the mobile space with the Amazon Fire phone was a costly flop, and its efforts to become a developer and publisher of video games have yet to yield any notable successes. But the company has consistently been willing to blaze a trail and branch out in innovative new directions, and it's scored wins with this approach to developing and evolving products and services.

Lately, Amazon has been feeling the squeeze as macroeconomic pressures have led to underwhelming performance for the e-commerce business, decelerating growth for AWS, and a big drawdown for its valuation. But investors can treat the pullback as an opportunity to build a position in a wonderful company at a great price.

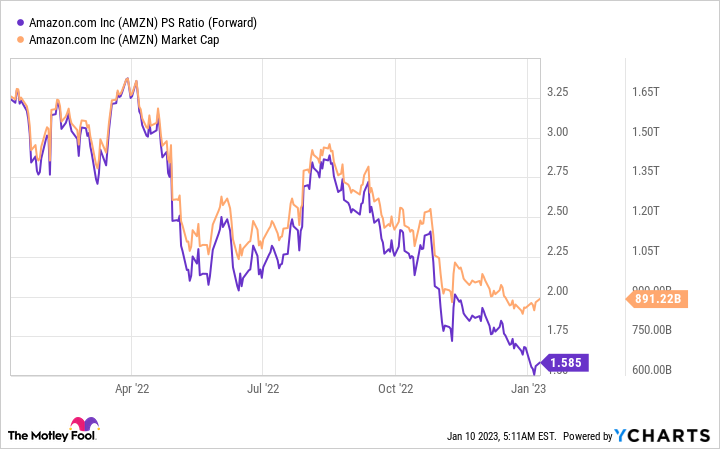

AMZN PS Ratio (Forward) data by YCharts

With the stock currently trading down roughly 53% from its high, Amazon is now valued at less than 1.6 times expected forward sales, and it looks like a great buy for long-term investors. The company maintains leading positions in the e-commerce and cloud-infrastructure industries, and its strong collection of resources and penchant for innovation have it on track to be one of the world's most influential companies for decades to come.

2. Berkshire Hathaway

If you want to invest like Buffett, owning Berkshire Hathaway stock is a no-brainer. Berkshire's value-oriented approach to portfolio composition and focus on owning companies with sturdy, dependable businesses helped it significantly outperform the broader market despite challenging macroeconomic conditions.

BRK.A Total Return Level data by YCharts

By weight, Apple, Bank of America, Chevron, Coca-Cola, and American Express rank as Berkshire's top-five largest portfolio holdings. All of these companies have a strong core business and competitive advantages that should help them continue prospering in the future.

Buffett, co-chairman Charlie Munger, and the teams of analysts at Berkshire demonstrate an impressive penchant for identifying worthwhile investment opportunities. Outside of its stock holdings, Berkshire scored consistent wins with its insurance and railway transportation businesses and subsidiaries including GEICO, Duracell, and Brooks.

The investment conglomerate's market-crushing stock performance through the decades is a testament to the company's intelligent approach to its equity-portfolio management and identifying businesses worth housing under its corporate umbrella.

BRK.A Total Return Level data by YCharts

For long-term investors seeking relatively low-risk stocks capable of delivering market-beating returns, taking a buy-and-hold approach with Berkshire Hathaway stock has been one of the best moves that you could make at pretty much any time over the last half-century. It remains a fantastically well-managed company.

Long-term investors can own shares with a high degree of confidence that the team at Berkshire has the tools and expertise needed to navigate the market and pave the way for strong returns.