Led by CEO Warren Buffett, Berkshire Hathaway has an incredible history of market-beating performance and stands as one of the world's most successful conglomerates. Buffett's focus on identifying undervalued companies with strong long-term outlooks played a key role in that success, and the holding company has managed to significantly outperform the S&P 500 index despite the recent market volatility.

If you're seeking quality stocks with big rebound potential, checking out stocks in the Berkshire Hathaway portfolio that have actually underperformed the market over the last two years could be a great starting point. With that in mind, read on for a look at two beaten-down stocks in the Berkshire portfolio that look poised to enjoy incredible comebacks.

Image source: The Motley Fool.

1. Paramount Global

Berkshire added to its stake in Paramount Global (PARA -2.63%) in Q3, increasing its position in the stock by 16% on a sequential quarterly basis. With the shares rallying roughly 34% in January, Berkshire has already seen a strong return on its most recent investment in the stock, but the stock is still down big from the peak it reached in March 2021. As of this writing, the media company's share price is down roughly 75.5% from its all-time high.

Paramount's multichannel distribution model gives the company the flexibility and resource justification needed to produce high-quality content. For example, its blockbuster film, Top Gun: Maverick, came out in theaters last May and grossed roughly $1.5 billion globally across its theatrical run. It then went on to be a significant draw on the company's Paramount+ streaming platform after being released late in December, becoming the platform's biggest-ever debut in terms of viewership.

No doubt about it, streaming is at the heart of the company's long-term growth strategy, but being able to also release content through theaters and traditional television distribution channels is an advantage in terms of both justifying higher production budgets and profit potential. The ultra-long-term outlook for the theatrical and linear-television distribution models might not be great, but these revenue streams aren't going to dry up overnight, and they should help Paramount navigate the shift to a more streaming-oriented business model. Furthermore, the company is already seeing some strong momentum in the streaming space.

Paramount's streaming-driven direct-to-consumer business saw revenue increase 38% year over year in the third quarter. Meanwhile, sales for the Paramount+ service were up 95% compared to the prior-year period, and overall subscription revenue rose 59% to reach $863 million. Paramount estimates that it should be able to reach over 100 million streaming subscribers and over $9 billion in direct-to-consumer revenue by 2024, up from 56 million subscribers and roughly $4.2 billion in 2021.

With the company rapidly gaining ground in the streaming space and still serving up income from its theatrical, TV media, and licensing segments, Paramount Global continues to look like a worthwhile play for long-term investors.

2. StoneCo

StoneCo (STNE 2.99%) is the leading provider of payment processing services for small and medium-sized businesses (SMBs) in Brazil. The fintech also started a credit segment to provide loans for SMBs, but performance on that front has been disastrous over the last couple of years and tanked the company's valuation.

Thanks to high levels of inflation, weakness in the Brazilian economy, and poor credit assessment standards due to using loan underwriting data from the country's national registry system, operations for the credit segment were put on hold and StoneCo has had to write off hundreds of millions of dollars in bad loans. Even after discharging most of this bad debt and managing to sell off a small portion, the company still carries roughly $92.5 million in bad loans in its portfolio.

Despite rallying 6% in 2023 so far, StoneCo stock is down roughly 89% from the high that it reached in February 2021. While the need to discharge outstanding bad debt in its credit portfolio will essentially negate some earnings in the near term, I think the Brazilian financial services stock actually presents an attractive upside for risk-tolerant investors at current prices.

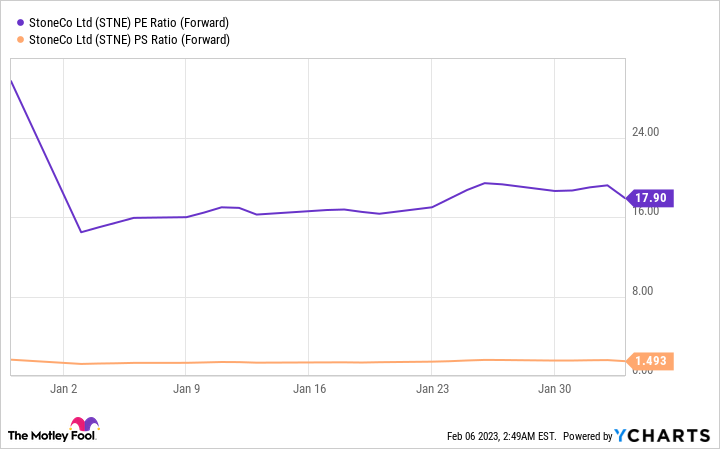

STNE PE Ratio (Forward) data by YCharts

With a market cap of roughly $3.3 billion, StoneCo is valued at approximately 18 times forward earnings and 1.5 times forward sales -- levels that suggest room for significant upside given that the business is still growing at an impressive clip. Powered by strong performance for the payment-processing business, StoneCo's revenue and non-GAAP (adjusted) net income climbed 71% and 90.5%, respectively, on a year-over-year basis in the third quarter.

StoneCo isn't a low-risk stock, but the company's valuation multiples look enticing given that it's actually still growing sales and earnings at a rapid pace. This is a comeback play that could potentially deliver explosive returns.