It's been a rough 16 months or so for many growth stocks. Many COVID-19 pandemic darlings saw high inflation, rising interest rates, and economic anxiety come in and turn on the lights in the party. However, this recent bear market could be a great buying opportunity for investors looking for beaten-down growth stocks.

If you have $5,000, consider these two growth stocks that could make great long-term investments.

1. PayPal

After being a huge beneficiary of the mid-2020 bull market, PayPal (PYPL -1.91%) has since seen its stock price slashed by over three-fourths, bringing it down to 2017 levels. Part of this is a byproduct of the broader declines seen across many industries (especially fintech), but part is also because of investor fears over broader economic conditions.

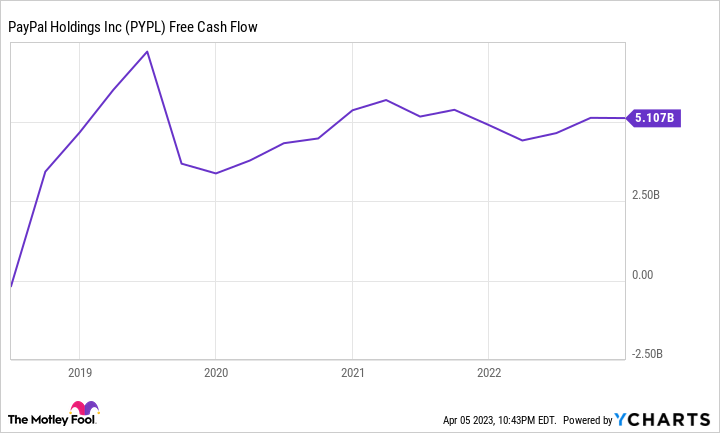

In its fiscal year 2022, PayPal's revenue grew 8.5% year over year to $27.5 billion, but the company's management has made it known that it's focusing on its free cash flow (FCF) amid slowing revenue growth. That seems to be paying off, with the company's FCF increasing by around $200 million to $5.1 billion. Its five-year compound annual growth rate (CAGR) from 2017 to 2022 is 22%.

FCF is important to businesses because it's the money they have available for paying down debt, paying dividends, repurchasing shares, and for research and development. PayPal plans to use around 75% of this year's FCF to repurchase shares, creating additional value for shareholders by lowering PayPal's number of outstanding shares, which will increase its earnings per share.

Data by YCharts.

What also shouldn't be overlooked with PayPal is its first-mover advantage and reach. Among the 1,500 largest retailers in North America and Europe, PayPal is accepted by 79%. For perspective, Apple Pay and Alphabet's Google Pay are second and third, with 28% and 16%, respectively.

The long-term potential remains strong for PayPal, and considering its current price levels, it's getting a little too hard to pass up.

2. Crowdstrike

Cybersecurity company Crowdstrike (CRWD 2.20%) is another company that's had a snap back to reality, down almost 55% from its November 2021 highs. The good news, though, is that the company is looking far more reasonably priced now. Despite the company's rocky stock performance, it's hard to argue against its financials.

In its fiscal year Q4 2023, the company made $637.4 million in revenue, up 48% year over year. Its annual recurring revenue (the amount it receives annually from subscriptions) also increased 48% year over year to $2.56 billion.

The company's increased operating expenses (up 54% year over year to $523.3 million) hurt its bottom line, but this can largely be attributed to the company's management playing the long game. While many companies are cutting expenses, Crowdstrike ramped up its research and development by more than 82% and sales and marketing by more than 51%.

Crowdstrike is an industry leader in an industry that's become a necessity for any business operating online. According to Fortune Business Insights, the company handles endpoint security, an industry projected to grow from $13.9 billion in 2021 to $24.5 billion in 2028 (8.3% CAGR). It's hard to imagine that Crowdstrike won't grow at the industry pace, at minimum. However, I would bank on it outpacing the overall industry.

Crowdstrike does a great job getting its customers to buy into its ecosystem of products (called modules), with 62% of customers having five or more and 22% having seven or more. As the company expands its offerings and retains customers, it should set itself up nicely with a customer base unlikely to drastically cut spending on cybersecurity.

Although the stock is up more than 21% year to date (as of April 6), it's still only trading at just over 13 times sales, making now a good time for investors to begin taking a stake in the company.

DATA BY YCharts. PS Ratio = price-to-sales ratio.