With a potential recession on the horizon, a stock market crash could be around the corner. It's never a good idea to panic and change your investment strategy out of fear. However, it is a good idea to periodically review your portfolio allocation and consider alternatives that align with your goals and risk tolerance.

These two stocks are interesting hedges if you want to add extra protection against a market correction.

1. Kraft-Heinz

Kraft-Heinz (KHC -0.55%) is a consumer staples stock that can limit losses and still generate returns during a market downturn. The company offers a number of well-known grocery food brands, including Oscar Mayer, Ore-Ida, Jell-O, Kool-Aid, Maxwell House, and its two namesake brands. Its products are sold in numerous countries on nearly every continent.

That diversification contributes meaningfully to Kraft-Heinz's stability. Market crashes typically coincide with difficult economic conditions, and a potential recession is the most prominent risk factor for a market crash right now. When unemployment spikes and household budgets get tight, the consumer staples sector is among the least impacted. People become more price-conscious, but they still buy groceries. Businesses like Kraft-Heinz have more reliable cash flows as a result. That also translates to lower volatility for shareholders.

Image source: Getty Images.

Because of the nature of its business and some decisions by management over the past decade, Kraft-Heinz has limited growth potential, and its dividend has been stagnant for the past few years. With more exciting opportunities elsewhere in the market, Kraft-Heinz has very modest valuation ratios.

That might not seem like an attractive quality, but it actually helps during market crashes. Stocks that are cheap relative to earnings, cash flow, and dividends typically don't fall as far during a bear market. Meanwhile, growth stocks with aggressive valuations suffer larger drawdowns.

Kraft-Heinz's beta is 0.7, indicating that it's substantially less volatile than the market in general. The stock's forward P/E ratio is under 14, and its price-to-book ratio is around 1. Both of those are cheap compared to major index averages, and they limit the potential downside for Kraft-Heinz, barring a major unforeseen issue.

The stock also pays a 4.1% dividend yield, which is high compared to most of its industry peers and large-cap dividend stocks in general. A high dividend yield contributes to downside protection, and it means that shareholders can still generate a modest rate of return while the stock market experiences a temporary rough patch.

Kraft-Heinz is only forecasting 4% to 6% sales growth in 2023, with a roughly proportionate expansion in profits after adjusting for an extra week in the prior fiscal year. Under normal circumstances, that wouldn't be exciting. The stock's dividend yield is high in part because the dividend hasn't changed in years and it has a relatively high payout ratio at 83%. There's no reason to expect consistent dividend expansion, so the stock is less attractive to long-term income investors.

These factors mean that Kraft-Heinz can shine during a market crash. While expectations are being slashed for other businesses, this consumer staples leader can just chug along with minimal interruption. It might not have the most electrifying long-term prospects, but it's an effective lifeboat to retain capital in the medium term.

2. Consolidated Edison (ConEd)

ConEdison (ED -1.25%) operates regulated electric, gas, and steam utilities, along with transmission projects. Its customers are located in New York City and surrounding parts of the metropolitan area.

Utility stocks are popular hedges against market crashes because their businesses remain stable during economic turmoil. As with consumer staples, people might change consumption patterns during lean times, but they're highly unlikely to stop heating homes, using electricity, cooking at home, taking showers, and so on. Therefore, utility expenses are often among the least trimmed by consumers and businesses.

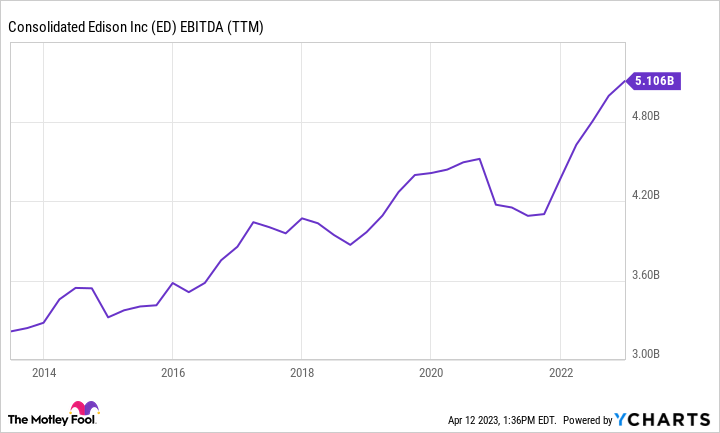

Moreover, regulated utilities generally run a monopoly that's overseen by government approval of rates and other key operational factors. As a result, ConEd doesn't have to deal with fierce competition, and it has reliable pricing and cash flows from customers. This is clear when looking at a time series chart of the company's earnings before interest, taxes, depreciation, and amortization (EBITDA), which is a measurement of operating profits.

ED EBITDA (TTM) data by YCharts

As we saw with Kraft-Heinz, stable cash flows lead to stable stock prices. ConEd is exceptional in this regard, with a beta of 0.35. If the market crashes, ConEd shares are likely to only incur a fraction of those losses. It significantly outperformed the S&P 500 and Nasdaq Composite during the 2008-09 market crash, and it was similarly robust during the 2022 sell-off.

ConEd also pays a respectable 3.2% dividend yield, so it delivers short-term returns while investors wait for the market to recover. The stock has been a reliable dividend powerhouse, having increased its shareholder distribution for 48 consecutive years. ConEd's 68% dividend payout ratio suggests that the company is having no issues generating enough profit to support these shareholder payments.

The company also has suitable financial health metrics, with a 3.0 interest coverage ratio and a 1.1 debt-to-equity ratio. These indicate that the business is able to meet all of its financial obligations without any imminent threats in the short term.

The combination of dividends, low volatility, and financial health all make ConEd stand out from its peers as a functional safe haven for investors who are looking to avoid the impacts of a market crash.