While I love collecting dividend income, I've changed my investing strategy in recent years. I initially focused on buying stocks with high dividend yields. However, after coming across some remarkable data, I've pivoted to investing in stocks that can grow their dividends.

This strategy shift has paid bigger dividends than I expected. I'm earning higher total returns due partly to rapidly rising yields on my initial investments as the companies I own grow their payouts. One of the best examples of this in my portfolio is American Tower (AMT 1.92%). The infrastructure real estate investment trust (REIT) has done a magnificent job growing its dividend. That has provided a big boost to the dividend income I now earn on this investment. With more dividend growth ahead, I couldn't resist the opportunity to add to my position recently.

Towering dividend growth

American Tower converted to a REIT in 2012 and started paying dividends. Since then, the company has grown its dividend payment at a more than 20% compound annual rate. That rapidly rising payout has really added up over the years.

I've seen that firsthand. I've owned shares of American Tower since its REIT conversion. Because of that, I've benefited from every single dividend increase. That has driven a remarkable improvement in the yield I'm earning on my initial investment. I bought my first shares at an average price of $47.32. American Tower initially paid a $0.21-per-share quarterly dividend ($0.84 per share annualized). That implies my dividend yield on this investment started at around 1.8%.

Fast forward to today, and American Tower pays a quarterly dividend rate of $1.56 per share ($6.24 annually). As a result, I'm now earning a 13.2% dividend yield on my initial investment in the stock.

Towering total returns

When I first started investing, I probably would have overlooked American Tower because it had never really offered an attractive current dividend yield until recently. However, I've redirected my focus from a company's yield to its ability to grow its dividend. One factor playing a big role in my shifting mindset is the historical returns data of dividend stocks:

|

Dividend Status |

Average Annual Total Return |

|---|---|

|

Dividend growers and initiators |

10.2% |

|

Dividend payers |

9.2% |

|

Equal-weight S&P 500 index |

7.7% |

|

No change in dividend policy |

6.6% |

|

Dividend cutters and eliminators |

4% |

|

Dividend non-payers |

(0.6%) |

Data source: Ned Davis Research and Hartford Funds. NOTE: Returns data from 1973 to 2022.

As that table showcases, companies that initiate and grow their dividends outperform the broader market and companies with static dividends (which tend to be those with higher-yielding payouts they can't grow).

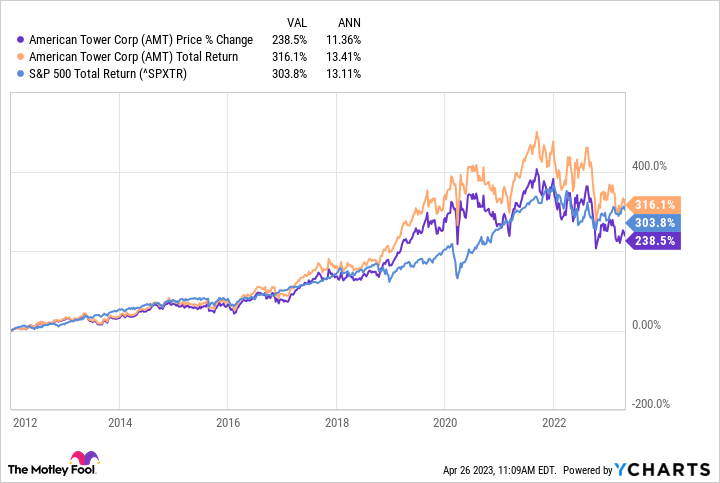

Given that data, it's likely unsurprising to learn that American Tower's rapidly rising dividend has helped power strong total returns over the years:

It has outperformed the broader market in a very strong period for the S&P 500.

Why I'm adding to my position now

Over the years, I've steadily added to my American Tower position to collect more of its growing dividend. I recently made another purchase.

A big driver is the sell-off in its share price over the past year. American Tower stock is currently about 30% below its 52-week high, weighed down by some growth-related headwinds it's experiencing. That sell-off has pushed its current dividend yield up over 3%, near the highest level in its history. I couldn't resist the opportunity to lock in such an attractive yield on a stock that should continue growing its dividend at an above-average rate.

Headwinds from higher interest rates, tenant-related issues, and foreign exchange rates will slow American Tower's growth rate this year, which has weighed on its share price. However, the company expects those headwinds to fade and give way to the long-term tailwinds driving its business, including 5G and growing data usage worldwide. These catalysts position it for a growth reacceleration in the future.

Because of that, American Tower expects to continue increasing its dividend. It plans to boost the payout by another 10% this year. While it might deliver even slower dividend growth in the future, it should still have plenty of power to keep increasing the payout.

A dividend growth juggernaut

American Tower has delivered robust dividend growth over the years. That's helped power strong total returns. While it's facing some near-term headwinds, they should fade in the future. Because of that, the company should continue growing its dividend. With American Tower now also offering an attractive current yield, I couldn't resist adding to my position in this premium dividend stock.