An outsized dividend can be very alluring to investors, but sometimes it's important to dig deeper. Consider VF Corp (VFC 0.16%), which sports a dividend yield of around 5.8%, and Foot Locker (FL 0.23%), which offers a yield of 6.2%. Both of these retailers are out of favor on Wall Street, with their shares down around 75% and 60%, respectively, since roughly mid-2021.

If you are a dividend investor looking to find a bargain, is one of these retail stocks a better option than the other? Let's take a look.

1. The dividend

There's bad news for both VF Corp and Foot Locker on the dividend front. VF cut its dividend in the first quarter of 2023. Foot Locker cut its dividend in 2021, following the difficult coronavirus pandemic issues in 2020. And while Foot Locker's dividend, after a series of increases, is now back to the $0.40-per-share per quarter at which it stood before the cut, it has been stuck at that level for six consecutive quarters.

VFC Payout Ratio data by YCharts

At one point, both of these retailers had a history of regular dividend increases, but that is clearly no longer the case. The yields are so high because of the steep stock price declines the shares have witnessed. That said, Foot Locker's dividend appears to be on more solid footing, with the payout ratio currently sitting in the 60% area versus well over 100% for VF Corp.

2. The foundation

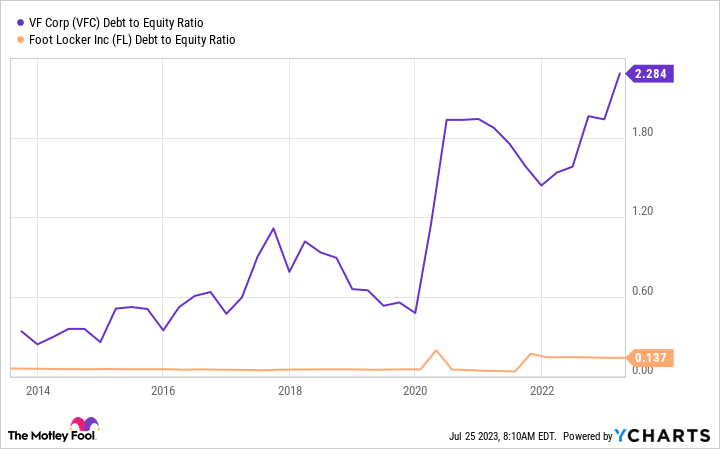

While a company's commitment to the dividend is left to the board of directors, one key factor that goes into the decision process is a company's financial health. That requires a quick look at a company's balance sheet. There's a vast difference between these two companies when it comes to leverage.

VF's debt-to-equity ratio has been heading steadily higher over the past decade, and recently sat at nearly 2.3. That's a fairly high level.

VFC Debt to Equity Ratio data by YCharts

Foot Locker, on the other hand, has a debt-to-equity ratio of just over 0.1. Lower numbers are better, but even on an absolute basis, Foot Locker has a low level of leverage.

Another view of the company's financial strength comes from looking at times interest earned, with Foot Locker able to cover its trailing-12-month interest expenses 36 times over. VF, on the other hand, only covered its interest expenses by 1.3. That's not a dire number (below 1 is a real trouble sign), but it is still worryingly low. Of the two, Foot Locker comes out on top here.

VFC Times Interest Earned (TTM) data by YCharts

3. Business model

VF Corp's business is largely driven by fashion trends, owning brands such as Vans, The North Face, and Timberland, among others. That's not an easy space to be in, since often-fickle fashion trends can lead to terrible financial results. It can also take a long time to draw consumers back after a miss.

Right now, The North Face is doing quite well, with sales in fiscal 2023 up 11%. The problem is that the rest of the brands the company owns aren't doing nearly as well, with Vans actually down 12%. Overall, the company's sales dropped 2% for the fiscal year. The outlook for fiscal 2024 is weak, with the potential for sales and adjusted earnings to be flat to lower.

Foot Locker, meanwhile, is a retailer that largely sells other companies' products, though it is attempting to increase the reach of its in-house-made clothing brand. The company started out 2023 on the back foot, with comparable store sales down 9.1%. It has a heavy reliance on trends in the sneaker space, noting that during difficult financial times, an old pair of sneakers can probably be made to last just a little longer as customers look to save money.

It looks like 2023 is going to be a transition year, with the company materially cutting its sales and earnings forecast for the year after just a single quarter. To put a number on that, adjusted earnings guidance fell from between $3.35 to $3.65 per share to just $2.00 to $2.25.

That said, Foot Locker is working to rejigger its store footprint, which it hopes will support stronger long-term performance. The goal is to better differentiate its nameplates, connect better with customers, and position its stores in the locations where its customers want to shop (which increasingly means non-mall locations). The plan seems reasonable, assuming the economy doesn't fall into a recession.

Still, a lot needs to go right for Foot Locker to get back on track, given the material drop in earnings expected in 2023. It looks like 2024 will be the year to watch here.

A tough call

Neither VF Corp nor Foot Locker are operating from a position of strength today. However, given the leverage at VF, it seems to be even further behind the eight ball. Conservative investors should probably avoid both of these stocks until there are clearer signs of improvement.

But for more adventurous types, Foot Locker's stronger financial position suggests it will have an easier time muddling through the current headwinds to come out the other side a stronger company.