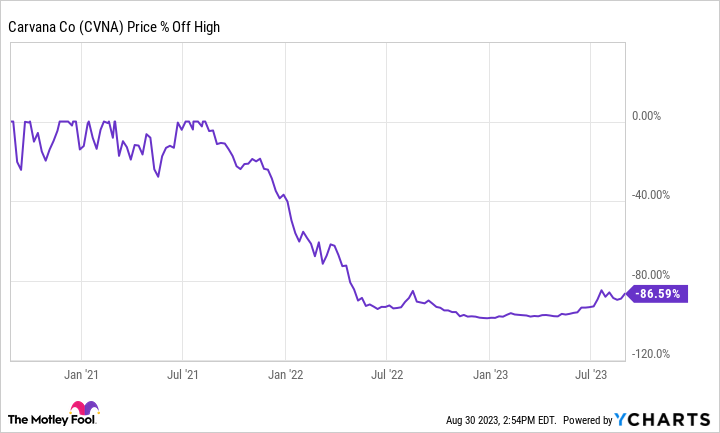

Carvana's (CVNA 8.79%) stock is up nearly 950% so far in 2023. That's pretty incredible, but if you pull back and look at the longer-term picture it is still down around 85% from its mid-2021 high water mark. Those two figures should cause investors to pause just a second and ask, "What is going on?" There's good news and bad news to digest.

Carvana bought itself some time

Heading into 2023, one of the biggest problems facing the used-car dealer was found on its balance sheet. The company's debt rose dramatically over the last few years, as the chart below shows. However, the graph also shows that Carvana is an unprofitable company. That clearly makes it hard to carry so much debt.

CVNA Total Long Term Debt (Quarterly) data by YCharts

In fact, in the car retailer's 2022 10K filing, the "risks related to our liquidity" section of the report started with: "Our substantial indebtedness could adversely affect our financial flexibility and our competitive position and prevent us from fulfilling our obligations under our credit agreement." Right after that cheerful highlight was another one, just as worrying: "Despite current indebtedness levels, we may incur substantially more indebtedness, which could further exacerbate the risks associated with our substantial indebtedness."

The company was being very clear and investors listened, given that debt was the headline-grabbing news item for the stock earlier in the year, at least until the company worked out an agreement with lenders in July on a debt exchange. While that agreement doesn't completely remove the debt issue from the picture, it effectively buys Carvana some time.

Carvana is still working on turning reliably profitable

That last point is why Carvana isn't out of the woods just yet, and why, despite the massive price advance, the stock is still down dramatically from its highs. After all, it is still bleeding red ink, and investors want to see it get into the black sooner rather than later. Companies can't lose money forever. And it's worth noting that CarMax, another major used-car retailer, is soundly profitable.

Sure, Carvana is still working to build its business, and the costs associated with that can be material. But here's the interesting thing: Carvana's car sales have been falling. In the second quarter of 2023, it sold 35% fewer vehicles than it did in the same quarter of 2022. That's a huge difference. But the directional change actually happened in the third quarter of 2022.

Up until that point, the company's volume trended generally higher. But for the last four quarters the company's volume has been steadily declining. What changed here is that Carvana stopped pursuing a "growth at any cost" approach, shifting to one that focuses on actually making money. There's nothing wrong with that -- it needed to happen. And still, Carvana isn't making money.

You can argue that the volume decline is about the company trying to find the right business balance. That's fine. But how low does volume have to go? It appears that management pushed too hard on the accelerator and overplayed the growth theme. As it looks to cut costs, which includes reducing advertising (a key way to attract new customers for a product that lasts many years), it seems reasonable to believe that there is a point at which volume declines leave the business model uneconomic. Given the company's short operating history, there's nothing to compare the current trends to for guidance. There is a lot of uncertainty, which helps explain the still-depressed stock price.

Carvana's future remains murky

To be fair, Carvana is making progress in its efforts to become reliably profitable. Getting the debt deal done was a very big positive in that regard. But there's still no clear indication of what a sustainable business looks like here. Most investors will probably want to park themselves on the sidelines until the company is in the black. For those who are watching it (and those who own it), one key metric to monitor (other than earnings) is the volume of cars it sells. If that number keeps falling, Carvana may have no business at all.