It's been a tough year for Roblox (RBLX 1.35%) shareholders. Although the stock started 2023 on a bullish foot, it didn't remain on that foot for very long. A big dose of reality upended the stock in August. The shares are down more than 40% from their late-July peak -- and more than 80% below their late-2021 high. Indeed, the stock just hit a new 52-week low after toying with that floor since the middle of last year.

This is one of those cases, however, where a young company and its even-younger stock don't necessarily have to suffer a post-public-offering obliteration. The recent sell-off is a great buying opportunity for any interested investor that (1) is looking for an aggressive growth pick and (2) can stomach the volatility that's sure to still be in the cards.

Doing what it's supposed to be doing

If you're not familiar with it, Roblox is an online video-gaming platform, allowing players to enter a virtual world where they compete with or against other gamers.

That's not quite the core of its investment thesis, however. In a more philosophical sense, Roblox is a metaverse platform, hosting a variety of virtual worlds that aren't necessarily used to play video games as most people understand the term. Indeed, Roblox is arguably the world's premier metaverse service.

Nike, Hyundai, and cosmetics company Fenty Beauty are just some of the once-unlikely brands now leveraging Roblox's technology to offer consumers an immersive, virtual experience.

So why is the stock in such a slump?

The answer is complicated, but it can be simplified down to a couple of words: unfair expectations. Roblox is still growing, but it's not growing nearly as quickly as it used to or was expected to be growing at this point in time. Case in point: The company's second-quarter bookings of $781 million were up 22% year over year. But analysts and investors were expecting a figure closer to $785 million.

That's it. OK, that's not quite it. The market's worried about the company's rising costs too. Roblox is also facing the same consumer-spending headwind most other companies are facing here in the shadow of steep inflation. Moreover, the virtual-universe operator continues to lose money, leaving it vulnerable to even the slightest of missteps. Never even mind the lousy market environment creating a bearish tide for most tickers.

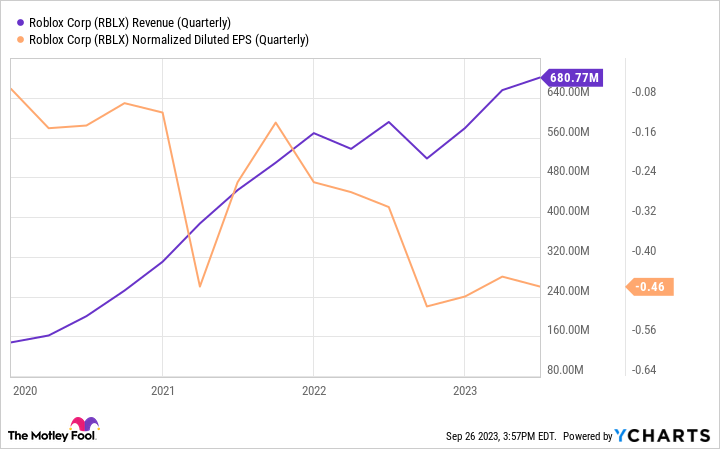

Take a step back and look at the bigger picture. Bookings were still up 22% year over year last quarter, while revenue itself was higher to the tune of 17% on a constant-currency basis. The analyst community still believes this year's top line is on pace to grow nearly 18% this year and another 15% next year.

RBLX Revenue (Quarterly) data by YCharts.

Next year's revenue growth, in fact, is expected to start reducing Roblox's losses instead of widening them; that's an important step toward viability. Besides, most realistic investors and analysts quietly knew this company would still be in the red at this stage of its existence anyway.

The metaverse opportunity is still real

Perhaps the best argument for stepping into Roblox stock while it's down so much, however, is that the underlying metaverse opportunity is still a big one.

Oh, there's no denying the metaverse market isn't what it was supposed to be by now. After changing its name to Meta for this very reason back in 2021, the company formerly known as Facebook recently dialed back its prioritization of metaverse investments. Other metaverse companies are doing the same. Walt Disney is outright giving up on its metaverse endeavors altogether -- at least, for the time being.

The underlying opportunity, however, is still intact and still big. Analysts with research outfit GlobalData believe the metaverse market will swell from a little more than $80 billion this year to over $600 billion by 2030. Precedence Research's figure is even more optimistic, pegging 2030's market size at $1.3 trillion, translating into an annualized growth rate of more than 44%.

The keys to this growth are lower hardware costs, better education on the technology's benefits to consumers, and the development of more media that make the most of this technology.

The only catch? These are multi-year projects that won't show much in the way of measurable progress for at least a few of those years. Roblox stock could continue getting bumped around during this time even if the company's arguably the leading pure-play name in the business.

Not for everyone, but maybe for the risk-tolerant

And that's why Roblox stock isn't right for every investor or for every portfolio. At best, there are still several unknowns about the metaverse market's future. At worst, the market could price in the worst-possible-case scenario into Roblox stock for each of these unknowns. In the meantime, the company remains largely dependent on more conventional video gaming -- a fickle market in its own right -- to generate the bulk of its revenue.

Still, Roblox's revenue-sharing model (with people who design and manage video game "rooms") has made it a popular -- and growing -- destination for anyone looking for a diversion. Last quarter's daily active user count of 65.5 million was up an impressive 25% year over year. This traffic ultimately, eventually leads to revenue.

If you can handle the volatility and uncertainty, Roblox stock is an interesting near-term-into-long-term prospect. This might help: The stock's current price near $27 per share is almost 40% below analysts' consensus price target of $36.82. And most of these analysts rate Roblox stock a buy, or better.