There are two big problems when it comes to investing in Kinder Morgan (KMI -0.64%). The first is trust, thanks to a surprise dividend cut in 2016. The second is a less-than-spectacular total return history relative to peers like Enterprise Products Partners (EPD 0.45%). Here's why investors will probably be better off looking at options other than Kinder Morgan in the midstream space.

Kinder Morgan has let investors down

Although 2016 may seem like a very long time ago, it is still relevant today because of the way the dividend cut happened. On Oct. 21, 2015, Kinder Morgan raised its dividend to $0.51 per share per quarter, up 16% year over year. The subhead on that news release stated, "KMI Remains on Track to Meet its Full-Year Dividend Target of $2.00 Per Share with Substantial Excess Cash Coverage." That sounded very positive.

Image source: Getty Images.

Further down in the release, the company explained, "Additionally, while we are at the beginning of our budget process for 2016, we currently expect to increase our declared dividend for 2016 by 6 to 10 percent over the 2015 declared dividend of $2.00 per share. We expect this range will provide the flexibility for us to meet our dividend and have excess cash coverage." So investors were likely expecting a healthy dividend increase in 2016.

But on Dec. 8, 2015, the company announced that, "KMI expects to declare dividends of $0.50 per share for 2016 and use excess cash to fund growth investments." In just a couple of months the company went from a dividend increase of up to 10% to a massive dividend cut. The energy sector was in a difficult place at the time, so it was probably the right move for the company. But investors were not only blindsided but also hurt by the move, given the significant drop in the income they would receive.

A similar situation unfolded in 2020 when the company opted for a 5% dividend increase because of the coronavirus pandemic. It had been telling investors to expect a 25% hike. Although not nearly as bad as a dividend cut, the company once again went back on its word.

There are better options for investors

Trust should be an issue here, particularly for conservative income-oriented investors looking to live off the dividends their portfolios generate. But there's another consideration, given that Kinder Morgan isn't the only pipeline company you can buy. One of its most prominent peers is Enterprise Products Partners. This midstream master limited partnership (MLP) has increased its dividend annually for 25 consecutive years, in both good markets and bad. That has material implications for investors.

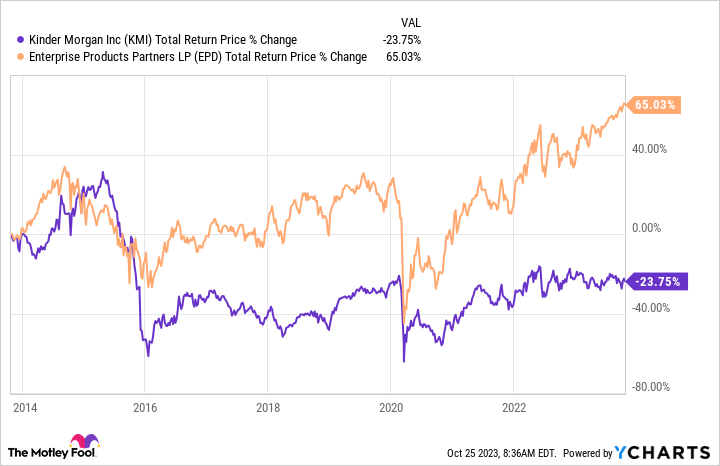

KMI Total Return Price data by YCharts

The chart above shows total returns, which assume the reinvestment of dividends. As the chart highlights, Kinder Morgan left investors with a loss over the past decade. Meanwhile, Enterprise has provided positive returns. The difference between the two is nearly 90 percentage points, which is massive.

Basically, it all stems back to the dividend cut in 2016, which resulted in a steep stock price decline for Kinder Morgan. The stock simply hasn't been able to get back to pre-cut levels. What's interesting today is that Kinder Morgan's dividend yield is 6.7% while Enterprise's distribution yield is 7.2%. So not only does Enterprise have a better record of rewarding investors, but you'll generate more income if you buy it over Kinder Morgan right now.

Seriously consider the alternatives

History suggests that there are better options than Kinder Morgan if you are looking to create a reliable stream of income from your portfolio by investing in income-producing stocks. The future could be different, of course, but with two broken dividend promises from Kinder Morgan, conservative investors will probably find the reliable increases from Enterprise, and its higher yield, a much more appealing option.