There's a good chance you've had a lucrative investing year if you own Nvidia (NVDA 6.18%). The chip company has been the face of the artificial intelligence (AI) craze that gripped Wall Street in 2023.

Up over 12,000% over the past decade, Nvidia stock surprised quite a few people with its performance, and it has probably minted its fair share of new millionaire investors. The news is out about Nvidia and it won't sneak up on anyone today. It's now one of the world's largest corporations with a $1.1 trillion market cap.

But Nvidia may not be done creating immense wealth for shareholders. Let's look at Nvidia's potential secret sauce for monster investment gains over the coming years.

Nvidia has become a cash cow

Nvidia as a company enjoyed one of the sharpest growth accelerations ever over the past few years. The company's processor chips specialize in high-performance jobs like gaming. But numerous new industries have taken off in recent years, such as cryptocurrency, autonomous vehicles, and AI, which all require lots of computing power.

That's significantly boosted Nvidia's business, which has become the go-to brand for these applications. Nvidia has an estimated 80% share of the AI market. Annual revenue has nearly quadrupled over the past three years.

NVDA Free Cash Flow data by YCharts

The growth spurt has had a similar impact on the company's free cash flow, which ballooned to over $17 billion in the past four quarters, 39% of revenue. The rise of AI spending seems real, and analysts believe Nvidia's annual sales could approach $180 billion by 2030. That could be $70 billion in cash flow at the same conversion rate.

Will Nvidia cannibalize itself?

What's a company to do with all that cash? Nvidia's balance sheet is in great shape; there is $18 billion in cash against just $10 billion in long-term debt. There isn't a huge need for some expensive acquisition since it has already dominated the AI market. Nvidia tried to acquire chip design company Arm Holdings for $40 billion but abandoned the deal due to regulatory hurdles.

Technically, Nvidia pays a dividend, but it's more symbolic than practical. It only yields 0.03% at today's share price and costs Nvidia under $400 million annually out of its $17.5 billion in cash flow. The most logical choice for its cash could be share repurchases, lowering its outstanding shares over time to increase the company's per-share profits.

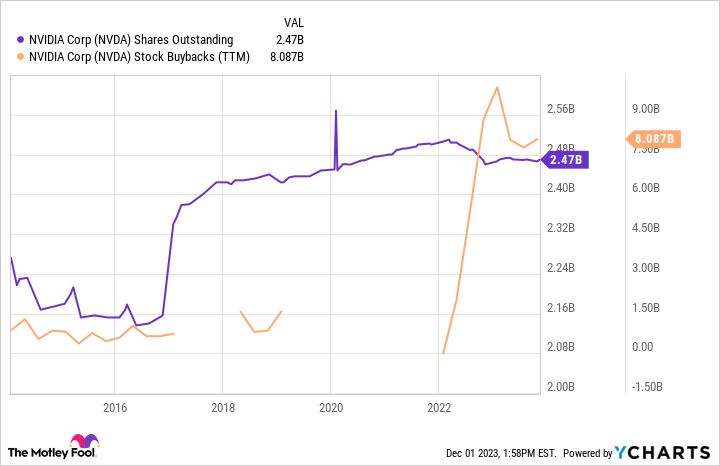

NVDA Shares Outstanding data by YCharts

It looks like Nvidia has already started. It's spent $8 billion on repurchases over the past four quarters, its most ever by a mile. Management also announced a new $25 billion repurchase program with second-quarter earnings over the summer.

What share repurchases can do for you?

Investors should hope that Nvidia's share repurchases have a similar outcome as Apple's (AAPL -0.35%), which has aggressively repurchased its shares for years. Apple had 25 billion outstanding shares a decade ago but only 15.55 billion today.

That's far fewer shares to spread Apple's $97 billion net income. Consider that Apple's earnings per share (EPS) would be just $3.88 instead of $6.12 without all the repurchases. At the same valuation, the share price would be more than 35% lower today.

AAPL Shares Outstanding data by YCharts

Wall Street expects years of continued growth from Nvidia, and there isn't any reason to doubt that the future is bright. But Nvidia's increasing focus on share repurchases could be the secret sauce to continued life-changing investment returns.

There's a real possibility that Nvidia stock will trade far higher a decade from now because of current and future share repurchases.