C3.ai (AI 3.02%) is a pure-play artificial intelligence (AI) business. It helps provide AI solutions to companies in various industries, which suggests it should benefit from more businesses showing an interest in AI this year.

But the company's performance doesn't appear to suggest that, at least not yet. Coming off another disappointing quarterly result, shares of C3.ai continue to fall. Has this become a cheap AI stock to own, or are there too many problems to make this an investment worth taking a chance on today?

C3.ai's revenue rose last quarter, but so did its losses

On Dec. 6, C3.ai posted its second-quarter numbers for the period ending Oct. 31. And while the company's top line increased by 17% to $73.2 million, its bottom line actually got worse. The increase in revenue was more than offset by rising expenses.

Image source: Company filings. Chart by author.

The company says that customer engagement rose by 81% compared to the same period last year. And it also closed on 62 agreements during the period. The hope is that in the long run the company may be able to benefit from an increase in demand due to heightened interest in AI. But as of now, the company doesn't appear to be getting a boost from the hot tech trend.

Why C3.ai's sales growth wasn't overly impressive

Although C3.ai reported double-digit sales growth in Q2, there are a couple reasons that's not all that impressive.

First of all, on a quarter-over-quarter basis, the top line hasn't shown much improvement at all. In the previous quarter, its revenue totaled $72.4 million, which means C3.ai's top line improved by less than $1 million. And for the next quarter, the growth may not be all that better; the company projects that revenue for the third quarter will be between $74 million and $78 million.

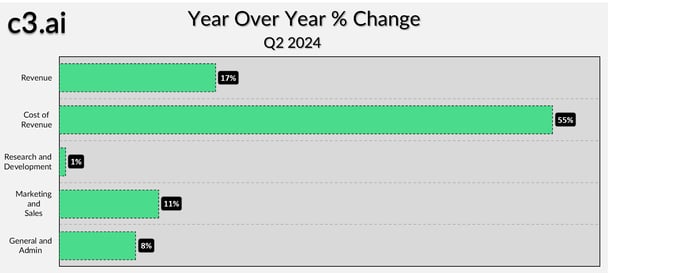

Secondly, while revenue did increase on a year-over-year basis, it was nowhere near the level of increase in its cost of revenue. Here's a look at how much C3.ai's revenue and expenses items increased by on a year-over-year basis.

Image source: Company filings. Chart by author.

While other expenses didn't rise by nearly as much, cost of revenue for C3.ai is fairly broad and includes salaries, bonuses, payments to cloud service providers, and other expenses that relate to its production environment and professional services.

At the end of the day, what's troubling is that despite achieving decent year-over-year revenue growth, the company's gross profit declined, going from $41.7 million a year ago to $41.1 million this past quarter. Without a drastic improvement in its cost structure, it'll be difficult for the company to get on to a path to profitability.

Investors should avoid C3.ai stock

Shares of C3.ai are up over 170% this year thanks to the popularity of AI. But over the past six months the stock has nosedived by more than 30% as investors have lost confidence in the company being a good AI business to invest in. Until C3.ai can prove it has some much stronger growth prospects, or at the very least a path to profitability, investors will be better off avoiding C3.ai and going with other AI stocks instead.