The market continues to be undecided about the future of the electric vehicle in the industry, pushing stocks lower yesterday and then driving them higher today. We got a decent earnings report from CarMax, but there wasn't a lot of industry news ahead of the holidays; stocks have simply had a volatile week.

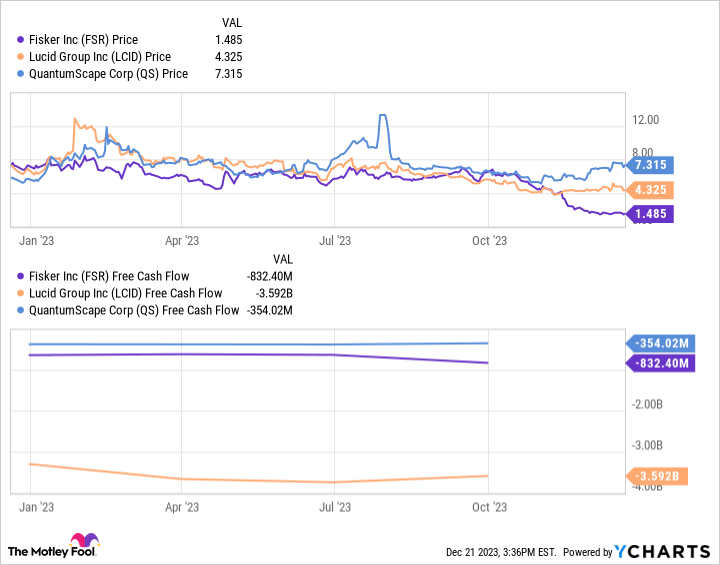

Today's biggest movers are Fisker (FSRN -12.70%) rising as much as 7%, Lucid Group (LCID 0.41%) jumping 4.9%, and QuantumScape (QS 5.69%) rising 7.7% in midday trading. By 3:40 p.m. ET, shares were up 4.9%, 1.5%, and 4%, respectively.

Auto demand remains strong

Overall, it seems the used car market is remaining strong after CarMax reported better-than-expected results. Revenue fell 5% in the quarter, but that topped estimates and the company earned $0.52 per share, also beating estimates.

Used cars are obviously not what these EV companies are selling, but they're a proxy for the demand in the auto industry today. Higher interest rates in 2023 have resulted in weaker demand for new and used cars -- as a result, used car prices have dropped, and some manufacturers have reduced the prices of new cars as well.

Fisker, Lucid, and QuantumScape all need the auto market to remain strong because they're not yet profitable building vehicles or, in the case of QuantumScape, batteries. If demand for vehicles drops, they'll be the first companies to suffer.

So, this is essentially kicking the can down the road a little further, hoping demand will remain strong enough to scale their operations. Add in a little "risk on" trading from investors today and you get the pop in shares.

Big challenges remain

This doesn't mean these companies are out of the woods. Fisker and Lucid have seen their stocks drop dramatically in 2023, despite a strong market overall. And falling stock prices can lead to fewer financing options for a money-losing company.

QuantumScape's shares are up in 2023, but the company is even earlier in its development and revenue cycle, still working on building products and figuring out how to scale them.

I think we are starting to see the weeding out of the players in the EV industry, and Fisker and Lucid are in a particularly challenging position as that happens. Their products aren't seeing strong demand and they're not making enough money to ride out demand waves or pivot the business. So, they're stuck hoping to survive as competition improves.

QuantumScape has a ton of potential, but there are too many unknowns to get a clear picture of its future. That leaves shares in the purely speculative phase of the market, which is fine if investors know the risk they're taking.

Shares of these three companies are up today, but I think that's a selling opportunity more than anything else. Business fundamentals are still weak, and this is a high-risk business that will get harder in the years ahead.