The best dividend stocks put piles of cash in your pocket year after year. These proven wealth builders can provide you with reliable and steadily growing streams of income while adding ballast to your investment portfolio.

Here are two powerhouse dividend-paying stocks that are particularly great buys today.

Enterprise Products Partners

Large dividend payouts can be unsustainable. But that doesn't appear to be the case with Enterprise Products Partners (EPD 0.45%). This steadfast passive income generator has increased its cash payments to investors for 25 straight years.

Enterprise owns some of the most valuable energy infrastructure in the world. Its pipelines, storage facilities, and marine terminals help to move oil, natural gas, and petrochemicals around the U.S. By connecting producers to end users, Enterprise serves a critical role in enabling U.S. energy security.

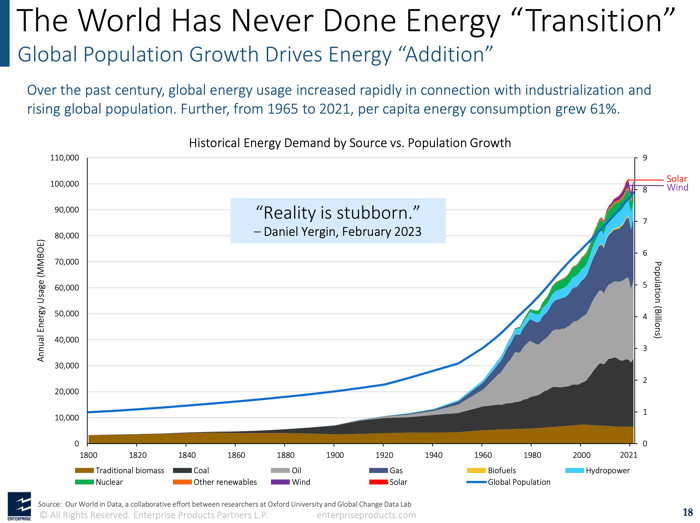

Fossil fuels still account for roughly 80% of global energy consumption, despite increased usage of solar, wind, and other renewable power technologies. Population growth and economic expansion in the U.S. and international markets should continue to drive demand for oil and gas higher in the decades ahead.

Image source: Enterprise Product Partners.

Moreover, as a primarily volume-based business, Enterprise is largely protected from the price volatility that's inherent in the oil and gas industry. The company's mostly fee-based revenue tends to hold up well during challenging market environments. These dependable income streams also lend an element of predictability to Enterprise's operations.

As a master limited partnership (MLP), Enterprise Products Partners must pass the lion's share of its cash flow on to its investors. It does so via bountiful cash distributions. Today, the energy giant's dividend yield stands at a hefty 7.8%.

You can expect these cash payments to grow steadily in the coming years. Enterprise ended 2023 with $6.8 billion worth of expansion projects, several of which are slated to come on line later this year. "These projects provide visibility to new sources of cash flow for the partnership for this year and beyond," co-CEO Jim Teague said in the company's fourth-quarter earnings release.

Ares Capital

If you'd like to earn even more dividend income from your investments, consider Ares Capital (ARCC 0.73%). At its current yield of 9.5%, this financial stalwart offers one of the largest cash payouts in the stock market.

Ares is a leading business development company (BDC) based in the U.S. As a direct lender, it supplies the capital that private companies need to fund and grow their operations.

Ares typically serves established businesses with revenue of $10 million to $1 billion. It further reduces the risks for investors by focusing on mature enterprises with competitive advantages, consistent profits, and seasoned leadership.

Industry and geographic diversification also help to mitigate losses. Ares spread its $22.9 billion in loans and investments across more than 500 different companies as of the end of 2023.

Ares takes the profits from these debt and equity holdings and sends them to its shareowners. By serving a customer base that's often neglected by the U.S. banking titans -- namely, middle-market businesses -- Ares collects relatively high interest rates on its loans. With an average yield on total investments of over 11% as of Dec. 31, the BDC can easily cover its dividend payments.

Looking ahead, demand for business growth financing should rise as the Federal Reserve begins to reverse its recent interest rate hikes as expected later this year. A strengthening economy should also help to limit loan defaults, which could provide an additional boost to Ares' profits.