Meta Platforms (META -1.02%) dominates the internet. Consider this: Facebook, owned by Meta, has 3.07 billion monthly active users (MAUs).

That means three out of every eight people alive today, from 100-year-old great-grandmothers in Peru to six-month-old babies in Cameroon, have a Facebook account.

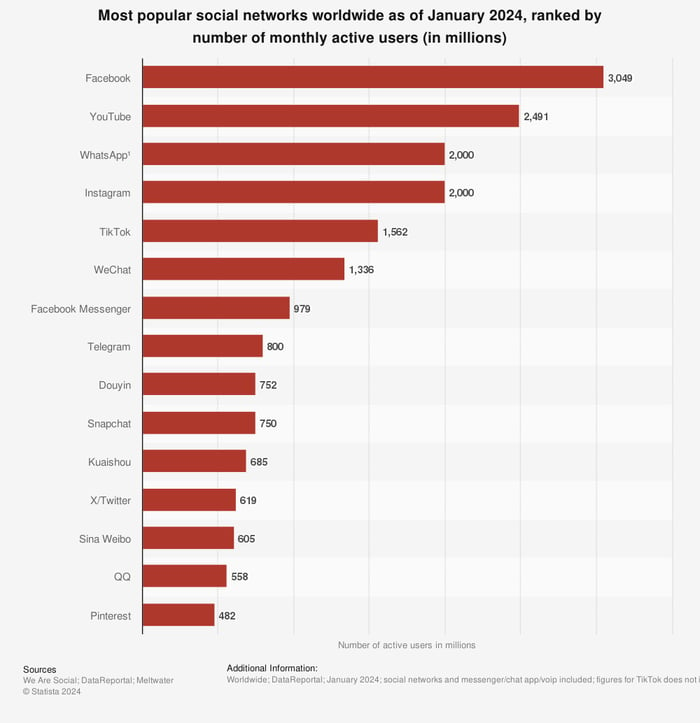

What's more, Facebook is just one of Meta's online platforms. And when it comes to social media, size really matters as you can see below:

Image source: Statista

Welcome to the internet

Of the top four most popular social media networks, Meta Platforms operates three: Facebook, WhatsApp, and Instagram (plus Facebook Messenger in seventh place).

All told, Meta's family of apps boasts 8.0 billion MAUs, and while many crossover accounts are included in that total, it's still a jaw-dropping figure.

Indeed, the sheer scale of Meta's reach helps explain the company's astounding ad revenue. In the fourth quarter of 2023, Meta grew ad revenue 24% year over year to $38.7 billion. Net income more than tripled to $14.0 billion.

A closely-watched metric for social media companies is average revenue per user (ARPU). Meta's global ARPU rose 21% to $13.12 last quarter. For U.S. and Canadian users, the figure was even higher at $68.44.

As a result of its stellar financial results, the company recently initiated a quarterly dividend of $0.50 per share. What's more, Meta repurchased just over $20 billion of its own stock in 2023.

With this unmatched network of social media platforms generating high-margin ad revenue, Meta stock has quickly recovered from the multiyear low it hit during 2022's bear market. And even though shares are up over 300% since the beginning of last year, Meta still has plenty to offer long-term investors.