Nvidia (NVDA 6.18%) has become a candidate to overtake Microsoft and Apple as the largest company in the world. After starting 2023 being valued at around a $350 billion market cap, Nvidia is now worth about $2.2 trillion.

That's a dramatic expansion in value and it puts it within striking distance of Microsoft and Apple, which are valued at around $3.1 trillion and $2.6 trillion, respectively. It's still a sizable gap to close, but it may happen sooner than you think if the right circumstances occur.

How did Nvidia get so large?

Nvidia is at the forefront of the artificial intelligence (AI) arms race, as it provides the computing power necessary to make these models work. Its primary product, the GPU (graphics processing unit), excels at crunching through arduous workloads. GPUs are connected to create powerful supercomputers, which often have over 1,000 GPUs.

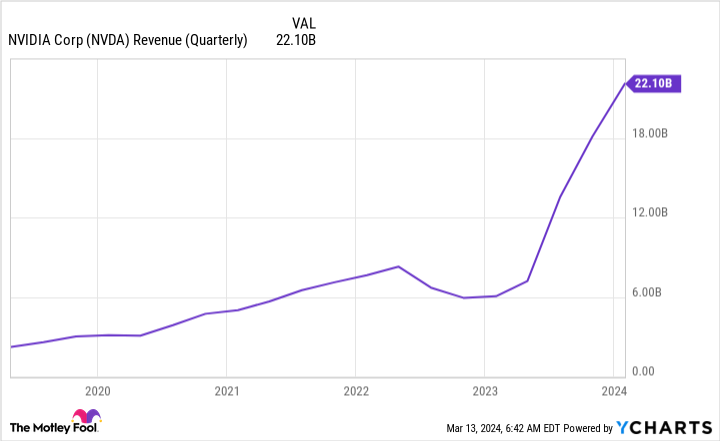

With Nvidia's flagship GPU, the H100, rumored to cost about $30,000, there's a lot of potential revenue for Nvidia. When AI demand started to take off during Nvidia's second quarter of 2023 (ending July 30, 2023), that's when its growth really started.

NVDA Revenue (Quarterly) data by YCharts

In the last three quarters, Nvidia's revenue more than tripled compared to the previous year's results. For the current quarter, which is first quarter of fiscal year 2025, that trend is also expected to continue as management projects $24 billion in revenue -- a 234% projected increase.

After Q1, Nvidia will have harder comparisons. However, if it can maintain its revenue levels in the mid-$20 billion range, it will still post strong growth, as Q2 and Q3 of FY 2024 saw $13.5 billion and $18.1 billion in revenue, respectively.

But will that be enough to surpass Apple and Microsoft?

Nvidia isn't as close as some may think

If Nvidia can achieve its projection of $24 billion in revenue in Q1 and barely grow quarter over quarter throughout the year to attain $100 billion in revenue for FY 2025, that could set Nvidia up nicely.

Using its Q4 profit margin of 55% as a baseline, Nvidia would produce $55 billion in profits. But how does that compare to Microsoft and Apple?

The chart below shows the trailing 12-month (TTM) total of each company's net income. So, even if Nvidia achieves $55 billion in annual profit, it would still be far behind Microsoft and Apple.

NVDA Net Income (TTM) data by YCharts

For Nvidia to surpass either company, investors would have to place a significant premium on the stock, reflected in an expensive price-to-earnings (P/E) ratio. Nvidia's P/E ratio is already much higher than that of Microsoft or Apple, as it trades for 77 times earnings versus Microsoft's 38 and Apple's 27.

If Nvidia kept its 77 times earnings price tag with $55 billion in profit, it would be valued at $4.24 trillion, easily surpassing Microsoft as the world's largest company. But that isn't likely.

Nvidia's stock is valued at a premium because investors know that this figure will come down as it grows into its newfound business. So, the only way Nvidia will maintain its 77 times earnings premium at the end of this fiscal year is if it continues doubling or tripling its revenue each quarter.

If Nvidia does that, it will have earned the title of the world's largest company. This seems a far stretch, considering that many GPU orders have already been placed.

Will Nvidia overtake Microsoft or Apple in valuation? I'd say it's unlikely. But Nvidia has produced uncommon growth for the last three quarters, and if that trend continues over the next year, it has a shot at capturing the title of the world's largest company.