Eli Lilly's (LLY 0.50%) shares have soared over the past year as the company grew its presence in what could become a $100 billion drug market. The company sells two drugs prescribed for weight loss -- Mounjaro and Zepbound -- and they're likely to become long-term blockbusters.

Lilly and peer Novo Nordisk, which sells a pair of similar drugs, dominate this market, though others, from small biotechs to big pharma players, aim to launch products in the coming years. But one number in particular may ensure Lilly's dominance in this world of weight loss drugs.

Image source: Getty Images.

Lilly's success so far

First, it's important to consider Lilly's success so far. Mounjaro is approved for type 2 diabetes, but doctors often prescribe it for weight loss, and this drug brought in more than $5 billion in revenue last year. Zepbound, approved uniquely for weight loss, in just its first few weeks of commercialization generated more than $175 million in revenue.

But Lilly isn't stopping there. The pharma company currently is testing what may become even better weight loss drugs in phase 3 clinical trials: an oral tablet candidate as well as a candidate interacting with three hormones (versus two in the cases of Mounjaro and Zepbound).

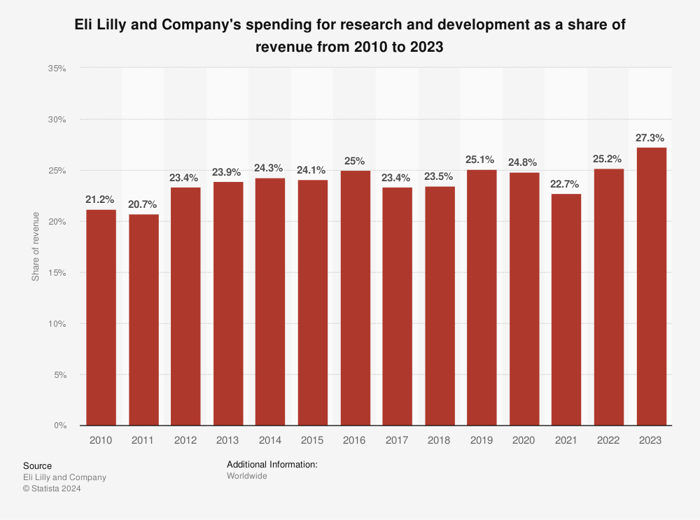

And this brings me to the one number that may ensure Lilly's dominance. As shown in the chart, below, Lilly's research and development spending as a share of revenue has increased significantly over the past three years, from 22.7% to its highest in at least 13 years, reaching more than 27% of revenue last year.

Image source: Statista.

This is key because it confirms Lilly's commitment to delivering better and better drugs in the area of weight loss and beyond, and that should translate into earnings growth.

What could this mean for Lilly stock? Even though the shares have climbed nearly 120% over the past year, they still have plenty of room to run as today's weight loss drugs and potentially others down the road boost earnings. So, Lilly makes a great long-term buy for investors today.