Dutch tech giant ASML Holdings (ASML 3.06%) makes equipment that's crucial for the semiconductor market. And on April 17, the company reported financial results that sent the stock sliding.

For context, before the financial report, ASML stock was up roughly 50% over the past year and had even hit an all-time high. At its peak, the company was valued at over $400 billion, fueled by investor enthusiasm for artificial intelligence (AI).

AI fuels semiconductor demand due to its outsize needs for computing power, memory, and more. This is why investors consider ASML a top AI stock and why it's up so much in the past year. Indeed, soon-to-retire CEO Peter Wennink told Bloomberg, regarding the rise of AI, "I think without ASML, without our technology, that's not going to happen."

Therefore, investors, analysts, and management all believe that AI is a big trend and believe that ASML is a crucial enabler of the trend. And that's why the market was concerned with the company's big drop in orders in the most recent quarter.

Why are investors selling ASML stock?

When looking at ASML's net sales for the first quarter of 2024, the number was fine. The company had net sales of 5.3 billion euros ($5.6 billion), which was within management's prior guidance. But investors seem to be more focused on its bookings number.

Think of it as a backlog. When ASML receives an order for one of its lithography machines, the value counts toward its bookings. When the company delivers a machine, it counts toward its net sales. Therefore, bookings can be a tangible, forward-looking metric.

In the fourth quarter of 2023, ASML had record bookings of $9.8 billion. But in the first quarter of 2024, bookings dropped way down to $3.8 billion. Granted, the company's bookings are customarily prone to wild swings such as this, but they were considerably lower than what analysts had expected.

Furthermore, its bookings might have been worse in recent quarters if not for China. Various countries, including the Netherlands, are restricting semiconductor exports to China. For its part, China has responded by doubling its efforts to increase its domestic supply of semiconductors. And ASML's older machines aren't subject to restrictions, according to Reuters.

In the first quarter of 2024, net sales to China accounted for 49% of ASML's total net sales, which was a record. And in the fourth quarter of 2023, net sales to China accounted for 39% -- a bigger share than sales to the U.S. and South Korea combined.

Reading the tea leaves, it appears that China is quickly buying up ASML machines to build domestic manufacturing capacity before export restrictions get worse. That's not something that the company will benefit from indefinitely, and the sharp drop-off in bookings suggests this temporary benefit could already be fading.

Should investors buy the dip?

It's going to sound like I'm talking out of both sides of my mouth. On one hand, ASML remains one of the best-positioned businesses in the world for long-term success. On the other hand, this isn't really a dip worth buying.

Allow me to explain: Buying the dip implies a good deal. But in the case of ASML, it has merely dipped to where the stock traded just two months ago. Moreover, from a valuation perspective, it's hard to say that it's necessarily a bargain. After all, its current price-to-sales ratio of 12 is above its five-year average and well above the valuation it had just a few months ago.

ASML PS ratio data by YCharts; PS = price to sales.

Therefore, for investors wanting a relative bargain, I'd say keep waiting with ASML stock. That said, it's likely that it will head higher over the long term, so investors need to be careful not to wait too long.

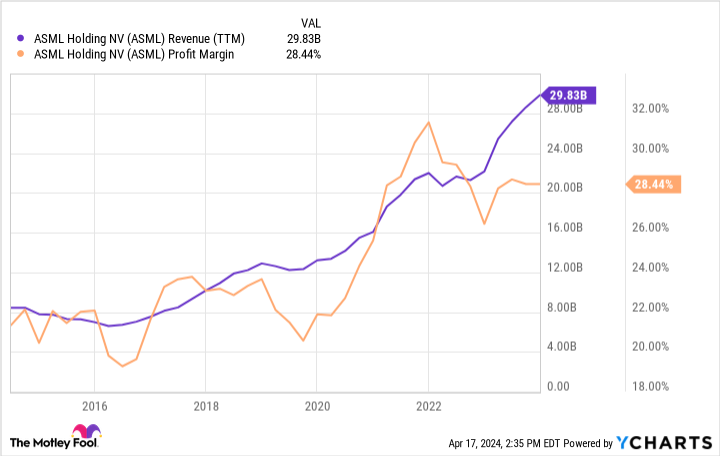

The semiconductor space was growing long before AI became a hot topic, and it's expected to keep growing regardless of how AI shakes out. And ASML's equipment is vital to the process. Because of this reality, the company's revenue has steadily grown for more than a decade, and it's been able to command spectacular net-profit margins.

ASML revenue (TTM) data by YCharts; TTM = trailing 12 months.

The semiconductor space is notoriously cyclical, and ASML's management believes it just hit the bottom of the cycle. Therefore, it expects 2025 and 2026 to be boom years for its business.

There's good reason to believe this is true. For example, while financial results from ASML's U.S. customers have been muted in recent quarters, the U.S. is handing out incentives to increase domestic manufacturing. Companies are consequently building now and will likely be placing orders with ASML in short order.

In conclusion, ASML stock slipped due to disappointment with its bookings. The dip doesn't necessarily make it a bargain buy today, but investors who think the company's best days are in the rearview mirror are likely mistaken. The company is well positioned to profit from semiconductors for the foreseeable future.