On Dec. 18, FedEx (FDX +0.89%) reported earnings that fell somewhat short of analyst expectations. However, in the company's supplemental material, it provided a detailed breakdown of its operations. This packet gives investors a quick glimpse at the company's secret engine for growth: its FedEx ground segment.

Sometimes the low road is the way to travel

Operations for FedEx are divided into four segments. The second-largest segment, FedEx ground, focuses on providing ground-based delivery services to almost every location in the United States and Canada. With $10.6 billion in revenue during the 2013 fiscal year, the segment made up 23.9% of total revenue for the company. This is up significantly from the 21.4% (or $7.4 billion) of revenue for FedEx that the segment made up during 2010. This implies an annualized growth rate of 12.5%.

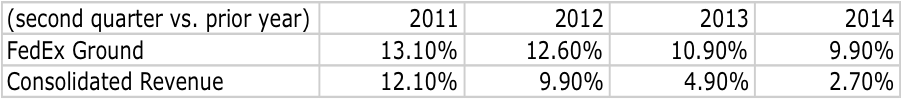

Eventually, you would expect the segment's growth to taper off as the market matures and becomes saturated, but the growth engine appears to be alive and well. Compared to the same quarter a year earlier, the segment grew revenue by 9.9% from $2.6 billion to $2.8 billion.

Looking at the table above, we can see that the FedEx Ground segment has been slowing, but it is still a big part of the business. This is especially true when you compare it to the company's consolidated revenue growth. Over the same time frame, FedEx Ground has grown revenue by an average 11.6% per year, far faster than the 7.4% rate seen by the company as a whole.

In fact, if you remove the impact from the company's FedEx Ground segment, its annualized growth rate shrinks from 7.3% to 6.1%. Though that 1.2% difference may not seem relevant, the company's consolidated income would be 25% smaller today without it.

Growth isn't worth a thing if margins are trivial

Growth is something that most every investor loves, especially if you can get it at a reasonable price. However, it shouldn't be the only factor in determining a company's (or segment's) prospects. Profitability should also be a primary factor.

In the case of FedEx, we can see that its operations have been relatively profitable. For the company's 2013 fiscal year, it enjoyed a 5.8% operating margin and a 9.7% return on equity. This means that FedEx saw $0.058 of every dollar in revenue come in as profit before factoring in taxes and other miscellaneous expenses, and that shareholders received $0.097 for every dollar invested into the business. This trend has continued year-to-date, with the company's operating margin hitting 7.2% and its return on equity edging up slightly to 10%. These results are far different from the returns experienced by United Parcel Service (UPS +8.00%), the largest player in the industry.

During the company's 2012 fiscal year, United Parcel Service saw its operating margin come in at 2.5%, less than half of what FedEx enjoyed. However, this picture is somewhat distorted. For the year, both FedEx and United Parcel saw their returns negatively affected by one-time expenses that were anything but immaterial. Looking at the year before, we would notice that FedEx's operating margin was 7.5%, while United Parcel's sat at a more impressive 11.5%. Similarly, United Parcel enjoyed a better return on equity than FedEx that year, as the companies' results were 53.4% and 13.6%, respectively.

Although these results are impressive, especially for United Parcel, the FedEx Ground segment blows each consolidated entity's operating results away. During FedEx's most recent fiscal year, the segment posted an operating margin of 16.9%. Year-to-date, this metric has fallen to 16%, but is still very impressive. In juxtaposition, the company's largest segment, FedEx Express, saw its operating margin come in at 4.2%.

Foolish takeaway

As we can see, the data above suggests that FedEx's FedEx Ground segment has been and likely will remain a big contributor to the company's growth. Admittedly, revenue growth for the segment is slowing as it and competitors like United Parcel approach a point of market saturation, but it still shows strong growth.

Furthermore, while United Parcel's profitability is more attractive than FedEx's, it should not be forgotten that the company's FedEx Ground segment is the real driver of profitability. As this part of the business grows, it's likely that FedEx will see its margins improve and, perhaps someday, match those seen by United Parcel.