After a rocky second quarter, biopharma stocks have rallied in a big way heading toward the end of the year. Gilead Sciences, for example, has shot up 41.5% year to date, with most of this upward movement coming in recent weeks.

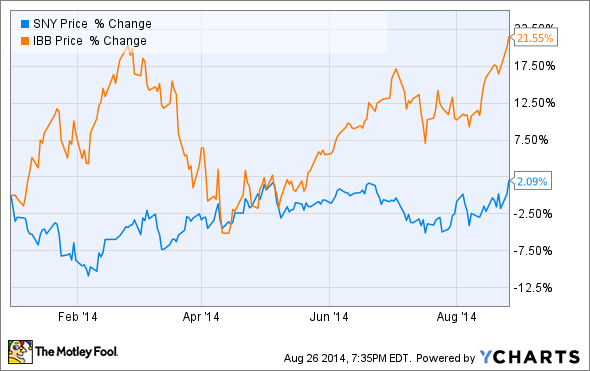

Even so, Sanofi (NYSE: SNY) and some other large-cap pharma stocks have largely failed to participate in this broad-based rally. To illustrate this point, the iShares Nasdaq Biotechnology Index (NASDAQ: IBB) has now risen by close to 22% in 2014, yet Sanofi's shares have posted a mere 5.8% gain thus far.

Sanofi's anemic gains, in comparison to its peers, are likely due to the company reorganizing following a bout with the so-called patent cliff. With most of these patent issues firmly in the past, I believe there are three reasons why Sanofi is now set to return to growth, making it a stock to watch.

Reason No. 1

Sanofi's late-stage pipeline is expected to generate two additional major drug approvals (Toujeo and Lemtrada) within the next 12 months in the U.S. Earlier this month, the Food and Drug Administration approved Cerdelga for the treatment of Gaucher disease type 1, with a commercial launch expected as soon as September. So if all goes as planned on the regulatory front, Sanofi should see a nice bump in top-line growth next year, with experts projecting a forward price-to-earnings ratio somewhere in the low teens.

Moreover, Sanofi and partner Regeneron (NASDAQ: REGN) recently released strong late-stage top-line results for alirocumab as a potential treatment for hypercholesterolemia; they subsequently announced that regulatory filings in the U.S. and European Union should be completed before year's end. The two companies have set up a thematic conference call to discuss alirocumab with investors on Sept. 2.

All told, Sanofi appears to be on the fast track to return to growth due, in large part, to a promising clinical pipeline and research collaborations.

Reason No. 2

Sanofi's Genzyme unit is back to posting double-digit growth as a result of its Fabry disease therapy, Fabrazyme, regaining market share in the U.S. and the highly successful launch of Aubagio for multiple sclerosis last year. Taken together, these two events helped Genzyme sales leap by 29.1%, year over year, in the second quarter.

Looking ahead, the potential entry of Amicus Therapeutics' (NASDAQ: FOLD) competing Fabry disease treatment could cut into Fabrazyme's growing sales down the line. However, Amicus' oral therapy isn't expected to be used as a broad-based treatment, suggesting that its competitive impact might be limited.

Reason No. 3

In the first half of 2014, Sanofi saw a 33% year-over-year increase in free cash flow. Although the company has not rewarded shareholders by significantly upping either the dividend or share repurchases lately, this notable increase in free cash flow should translate into stable dividend payments and stock buybacks going forward.

Some of Sanofi's peers have recently suspended repurchasing shares in light of their own patent issues, while other growing biotechs with even stronger cash positions have yet to consider offering a dividend.

So as Sanofi continues to move past the patent cliff and transitions into new products, investors looking for a stable source of income could find this name quite attractive.

Foolish wrap-up

Sanofi's growth strategy is unfolding nicely with the approval of Cerdelga and the monstrous growth of its Genzyme subsidiary. That said, the approval of its long-anticipated multiple sclerosis drug Lemtrada is far from a shoe-in, given that it was rejected by the FDA last year and this resubmission is based solely on hope that a new analysis of old data will somehow sway regulators this time around. Regardless of Lemtrada's ultimate regulatory fate, I believe Sanofi has enough irons in the fire to make it a stock worth putting on your watchlist.