The Roth 401(k) is an employer-sponsored retirement savings plan that's funded with after-tax money. If you're familiar with a traditional 401(k), you may already recognize one similarity and one difference. The traditional 401(k) is also employer-sponsored, but it's funded with pretax money. That tax distinction is important because it means you can use a Roth 401(k) to manage your income taxes in retirement.

Those income taxes can be a budget-killer for retirees. Many retirees are surprised to learn that most of their income sources are taxable, including Social Security. Even if you already knew you'd pay income taxes in retirement, the size of your tax bill can also catch you off guard.

That’s why it's useful to brush up on your knowledge of the Roth 401(k). If you have access to this retirement account, you'll want to know how to put its tax features to work.

Let's take a closer look at the Roth 401(k), including how it compares to a traditional 401(k), whether you can contribute to a Roth and a traditional 401(k) simultaneously, and a summary of the benefits the Roth 401(k) delivers.

What is a Roth 401(k) and how does it work?

The Roth 401(k) is typically a feature within a traditional 401(k), sometimes referred to as a designated Roth account. You can think of it as a separate bucket of funds from your traditional 401(k) contributions.

Deposits to a designated Roth account are not tax-deductible. However, the qualified withdrawals you make in retirement are tax-free. You won't pay taxes on your investment earnings from year to year either. Basically, you fulfill your tax burden on these funds at the start when you deposit after-tax money into the account.

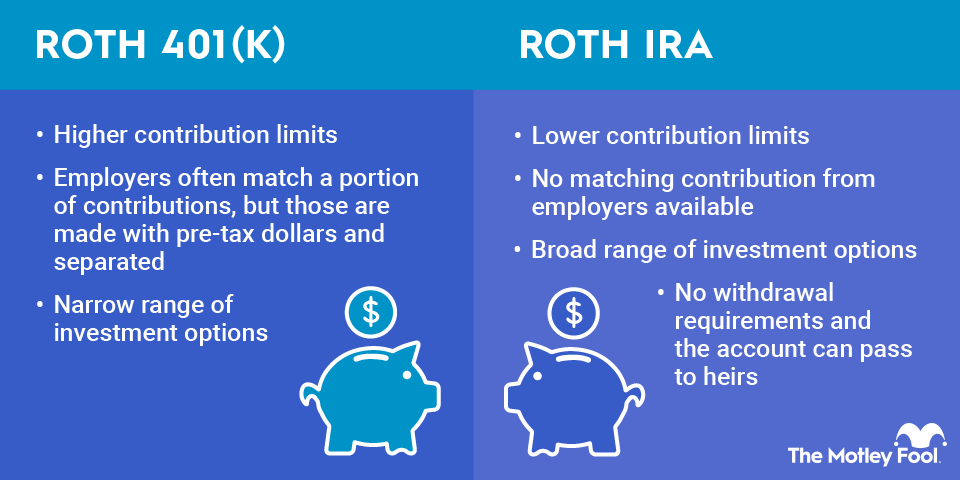

This is the same tax structure you'll find in a Roth IRA, which is an individual retirement account that's not tied to your employer. The Roth IRA has lower contribution limits relative to the Roth 401(k) and income restrictions that could prevent you from contributing anything at all. The Roth 401(k) doesn't have income restrictions, which is a huge plus if your income is well into six-figure territory.

Roth 401(k) vs. traditional 401(k)

Now that you've had an overview of a Roth 401(K), you're probably wondering what's really the difference between the two?

As previously noted, your Roth 401(k) contributions are not tax-deductible, but qualified withdrawals in retirement are tax-free. A traditional 401(k) flips that around: Contributions to a traditional 401(k) are tax-deductible, but you owe ordinary income taxes on withdrawals.

On paper, the Roth approach of paying taxes up front makes the most sense when you expect to be in a higher tax bracket in retirement. In this scenario, you'd pay a lower tax bill today versus a higher one later.

In practice, it's tough to predict your future tax rate. There are many variables, including some that are outside your control, such as the national debt and who's running things in Washington, D.C.

Given that uncertainty, having money stashed in Roth and traditional 401(k)s does prep you for various tax situations. You'd have the option to take taxable or tax-free withdrawals in retirement as needed to manage your tax bill.

Can I contribute to both?

You can contribute to a Roth 401(k) and a traditional 401(k) at the same time. If your plan allows for Roth contributions, you can set separate contribution amounts for your Roth and traditional accounts.

Note that the IRS does limit your annual 401(k) contributions. Those limits apply to the combined total of your Roth and traditional 401(k) contributions. In 2025, savers younger than age 50 can contribute up to $23,500 to their 401(k) for the year. In 2026, the limit if you're under 50 is $24,500.

So if you contribute $5,000 to a Roth 401(k), that leaves $19,500 available to contribute to a traditional 401(k) in 2026.

A few things to consider

1. Matching contributions

Matching contributions are deposits your employer makes to your retirement account based on your savings activity. If your 401(k) offers a matching program, you should get those matching contributions for any qualified Roth contributions you make.

Matching contributions have historically been pretax and would go into your traditional 401(k) account instead of the Roth one. Under the Secure Act 2.0, employers can now make post-tax Roth contributions; however, many plans haven't yet implemented this feature.

2. Withdrawals

Once you reach age 59 1/2 and it's been five years since you funded the Roth 401(k), you won’t pay penalties or taxes on Roth 401(k) withdrawals. You can avoid the taxes and penalties by qualifying for an exception or by waiting. If you become disabled, for example, the IRS will waive the penalty for withdrawing earnings early.

Unlike with a Roth IRA, you can’t withdraw your Roth 401(k) contributions whenever you want. If you withdraw money early, the IRS will use a pro-rata formula to determine how much of the distribution is taxable and subject to a 10% early withdrawal penalty. For example, if your account consists of 80% contributions and 20% earnings, you’d owe taxes and a penalty on 20% of the withdrawal.

Note that in a traditional 401(k), there's no tax distinction between contributions and earnings. Unless you qualify for an exception, you'll pay taxes and penalties on any early withdrawal.

3. Required minimum distributions

Traditional 401(k)s are subject to required minimum distributions, or RMDs. These are IRS-mandated withdrawals you must take after your 73rd birthday. (Previously, RMD age was 72). The Secure Act 2.0 eliminated RMDs for Roth 401(k)s in 2024 and subsequent tax years.

The big negative of RMDs is that they force you to move the funds to another account where you won't get a tax deferral on your earnings. Another RMD downside is that these withdrawals limit your ability to bequeath your retirement funds to loved ones.

Benefits of a Roth 401(k)

As a final note, here are six appealing features of the Roth 401(k):

- Tax-free withdrawals in retirement: Once you are 59 1/2 and your Roth 401(k) has been funded for at least five years, your withdrawals are tax-free.

- Tax-free investment growth: As long as you don't withdraw earnings early, your realized gains, interest income, and dividend income in your Roth 401(k) are tax-free.

- High contribution limits: 401(k) contribution limits are significantly higher than those for IRAs. These 401(k) contribution limits apply to your total deposits across Roth and traditional 401(k)s. You have the option of maxing out the limit in your Roth 401(k) or splitting it between your Roth and a traditional 401(k).

- No income restrictions: You can fund your Roth 401(k) up to the contribution limit at any income level.

- No RMDs: The Secure Act 2.0 eliminates RMDs from Roth 401(k)s beginning in 2024.

Roth 401(k) for tax diversity and estate planning

Because the Roth combines tax-free retirement withdrawals with high contribution limits and no income restrictions, it can be a powerful component of your retirement readiness plan. Saving in a Roth 401(k) and a traditional 401(k) gives you the flexibility to take taxable or tax-free withdrawals in retirement as needed.

And, if it turns out you don't need your Roth 401(k) funds to cover living expenses, you can roll them into a Roth IRA and pass them on to your loved ones as an inheritance.