Study: Americans Value Credit Card Rewards Over Trust

KEY POINTS

- REWARDS OVER TRUST: 64% of respondents prioritize credit card features such as interest rates and rewards over the issuer's trustworthiness.

- CASH BACK PREFERRED: Cash back credit cards are the most popular among respondents, with 68% holding them.

- INTEREST RATES MATTER: Interest rates are the most crucial factor for 36% of respondents when choosing a credit card, surpassing rewards and annual fees.

Americans place more importance on credit card features, like rewards, interest rates, and other perks, than how much they trust a credit card issuer, according to a survey from Motley Fool Money.

Motley Fool Money also found that cash back credit cards are the most popular credit cards in America and Capital One is the most common issuer of credit cards.

Different generations have different credit card priorities. Members of Gen Z are most likely to have a credit card with a solid sign-up offer bonus, while baby boomers are more likely to have a store or brand-specific credit card.

Younger and older Americans also differ on how much they value credit card interest rates versus rewards and other features.

For a look into credit card rewards preferences, which credit card features matter most to Americans, and which credit card issuers are most trusted, read on.

Credit card interest rates and rewards are more important than trust for consumers

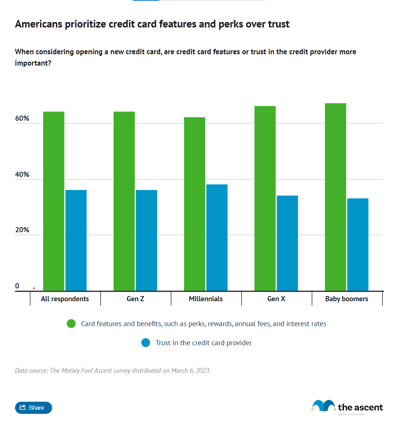

When considering opening a new credit card, 64% of Americans say credit card features like interest rates, rewards, and other perks, are more important than whether they trust the issuer of the credit card.

Prioritizing credit card interest rates and rewards over trust in the issuer carries through across generations and credit scores.

Cash back credit cards are the most popular type of credit card

Cash back credit cards are the most common type of credit card held by Americans. Sixty-eight percent of Americans have a cash back credit card, making them the most common type of credit card held by Americans.

Thirty-two percent hold travel rewards credit cards, while 27% hold gas and groceries credit cards and balance transfer credit cards respectively.

The least common type of credit cards are store or brand-specific credit cards, held by 15% of Americans, and student credit cards, held by 11% of Americans.

| What type of credit card do you have? | Respondents |

|---|---|

| Cash back | 68% |

| Travel rewards | 32% |

| Gas and groceries | 27% |

| Balance transfer | 27% |

| 0% APR | 25% |

| Secured | 22% |

| Sign-up bonus | 20% |

| Store or brand-specific rewards | 15% |

| Student | 11% |

The best rewards credit cards for an individual depend on a number of factors, like top spending categories, how they want to be able to spend their rewards, and how they prioritize annual fees, interest rates, sign-up offers, and more.

There's a separate debate on whether credit card rewards are worth it. The short answer is yes, if you're using your credit card responsibly. After making that determination, you can begin to think about how to maximize your credit card rewards. Plus, you should take the time to brush up on your understanding of how credit card points work.

Credit card reward preferences by generation

Credit card reward preferences vary by generation.

- Gen Z are more likely to have a sign-up bonus credit card than any other generation. They're also more likely to have a student credit card. Those two findings are logical given that Gen Z are anywhere from 11 to 26 years old. Gen Z haven't had as much time to amass cash back or points, so a sign-up bonus may be more attractive to them. Much of the generation is also still in the typical age range of a student, so a student credit card is a straightforward option.

- Millennials are most likely to have a cash back credit card and least likely to have a store or brand-specific credit card compared to other generations. They're also more likely to have a sign-up bonus card than older generations. Millennials are more likely to have travel rewards credit cards than other generations. Balance transfer credit cards are also popular with millennials. They also take advantage of 0% APR credit cards.

- Baby boomers are most likely to have a store or brand-specific credit card compared to other generations. They're least likely to have a sign-up bonus credit card, balance transfer credit card, secured credit card, or student credit card.

| Which types of credit cards do you have? | All respondents | Baby boomers | Gen X | Millennials | Gen Z |

|---|---|---|---|---|---|

| Cash back | 68% | 65% | 66% | 71% | 63% |

| Travel rewards | 32% | 25% | 31% | 35% | 30% |

| Gas and groceries | 27% | 17% | 24% | 29% | 29% |

| Balance transfer | 27% | 19% | 24% | 30% | 26% |

| 0% APR | 25% | 20% | 20% | 28% | 25% |

| Secured | 22% | 11% | 20% | 26% | 22% |

| Sign-up bonus | 20% | 9% | 13% | 23% | 25% |

| Store or brand-specific rewards | 15% | 22% | 14% | 13% | 15% |

| Student | 11% | 4% | 5% | 10% | 22% |

Credit card interest rates -- not credit card rewards -- are the most important factor for consumers

Thirty-six percent of Americans view interest rates as the most important factor when choosing a credit card compared to 18% that see credit card rewards as the most important variable.

Annual fees, which can be costly but worth it, are the most important factor for 15% of Americans.

The least important factors when picking a credit card are card design (3%), contactless payment capability (2%), and foreign transaction fees (2%).

| What is the most important factor in choosing a credit card to apply for? | All respondents |

|---|---|

| Interest rate | 36% |

| Rewards | 18% |

| Annual fees | 15% |

| 0% APR window | 10% |

| Sign-up bonus | 7% |

| Balance transfer terms | 4% |

| Issuing bank/organization | 4% |

| Card design | 3% |

| Contactless payment capability | 2% |

| Foreign transaction fees | 2% |

Card design has no function beyond aesthetics, so it's not surprising that it isn't a highly valued feature.

Contactless payment, also known as tap to pay, is becoming commonplace and also accessible via smartphones. Tap to pay, while convenient, doesn't impact rewards that you owe your credit card issuer so it's logical that Americans don't prioritize it.

Credit cards that waive foreign transaction fees can offer decent savings to Americans who travel often, but that group may be small and other costs appear to be more important.

Credit card feature preferences by generation

Credit card feature preferences vary by generation:

- Baby boomers and Gen Z differ on what credit card features are most important. Interest rates are most important for 47% of baby boomers compared to 26% of Gen Z, the highest and lowest percentages by generation, respectively. Rewards are most important for 21% of Gen Z compared to 13% of baby boomers, again the highest and lowest percentages by generation.

- Baby boomers and Gen Z also differ on the importance of annual fees, which are prioritized by baby boomers, and sign-up bonuses, which are prioritized by Gen Z.

| What is the most important factor in choosing a credit card to apply for? | All respondents | Baby boomers | Gen X | Millennials | Gen Z |

|---|---|---|---|---|---|

| Interest rate | 36% | 47% | 38% | 36% | 26% |

| Rewards | 18% | 13% | 16% | 19% | 21% |

| Annual fees | 15% | 18% | 20% | 14% | 12% |

| 0% APR window | 10% | 6% | 10% | 11% | 9% |

| Sign-up bonus | 7% | 2% | 5% | 7% | 9% |

| Balance transfer terms | 4% | 2% | 3% | 4% | 4% |

| Issuing bank/organization | 4% | 5% | 3% | 3% | 5% |

| Card design | 3% | 2% | 2% | 2% | 7% |

| Contactless payment capability | 2% | 2% | 2% | 2% | 4% |

| Foreign transaction fees | 2% | 3% | 1% | 2% | 2% |

Most Americans have one or two credit cards

Thirty-one percent of Americans have one credit card while 29% have two credit cards.

Just 20% of Americans have three or more credit cards. Another 20% have no credit cards.

| How many credit cards do you have? | All respondents | Baby boomers | Gen X | Millennials | Gen Z |

|---|---|---|---|---|---|

| 0 | 20% | 17% | 25% | 19% | 16% |

| 1 | 31% | 30% | 29% | 31% | 37% |

| 2 | 29% | 24% | 26% | 30% | 29% |

| 3 | 12% | 16% | 12% | 12% | 10% |

| 4 or more | 8% | 13% | 8% | 8% | 7% |

Baby boomers are slightly more likely than younger generations to have three or four credit cards.

Gen X are most likely to have no credit cards -- a quarter of that generation say that they don't have one.

How many credit cards should the average American have? Motley Fool Money recommends that most consumers should have one or two credit cards.

Credit cards are the most secure form of payment, they can help build credit if used responsibly, and offer rewards and other perks.

69% of Americans open a new credit card once per year or less

Most Americans, 69%, open a new credit card once a year or less. Just 12% open a new credit card three or more times a year.

| How often do you open a new credit card? | All respondents | Baby boomers | Gen X | Millennials | Gen Z |

|---|---|---|---|---|---|

| Once per year or less | 69% | 70% | 56% | 55% | 51% |

| Twice per year | 19% | 6% | 9% | 20% | 19% |

| Three times per year | 6% | 2% | 5% | 3% | 8% |

| More than three times per year | 6% | 5% | 5% | 4% | 6% |

Gen Z are opening new credit cards at the most rapid rate. Baby boomers are opening new credit cards at the slowest rate. This trend aligns with Gen Z showing the most interest in sign-up bonuses while baby boomers don't prioritize them.

Americans opening multiple new credit cards each year could be trying to take advantage of credit card churning to quickly rack up and spend credit card rewards. However, credit card companies are making this practice more difficult, and applying for more credit on a regular basis can harm your credit score.

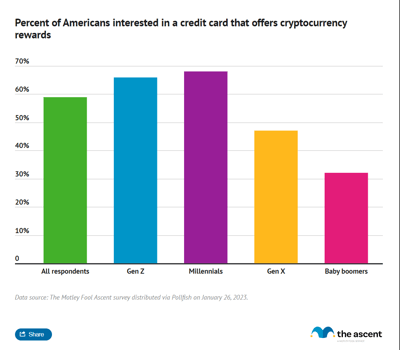

59% of Americans are likely to apply for a credit card that offers crypto rewards

Despite cryptocurrencies having a tough year in 2022, the majority of Americans, some 59%, are still interested in applying for a credit card that offers cryptocurrency rewards.

Millennials are most likely to be interested in credit cards that offer crypto rewards. Only a third of baby boomers and 47% of Gen X are interested.

| How likely would you be to apply for a credit card that delivered rewards in cryptocurrency? | All respondents | Baby boomers | Gen X | Millennials | Gen Z |

|---|---|---|---|---|---|

| Likely | 59% | 32% | 47% | 68% | 66% |

| Unlikely | 41% | 68% | 53% | 32% | 34% |

Crypto rewards credit cards come with unique pros and cons. Unlike other credit card rewards, cryptocurrencies fluctuate in value, while cash back or travel points are directly exposed to inflation.

The downside is twofold. First, crypto is a volatile investment and the value of crypto rewards could plummet quickly. And second, selling cryptocurrency is a taxable event, but most other credit card rewards aren't.

Capital One, Bank of America, and Chase are the most popular credit card issuers

Thirty-seven percent of Americans hold a credit card from Capital One, making the issuer the most popular in the United States.

Bank of America credit cards are in the wallets of 32% of Americans. Twenty-six percent of Americans hold a Chase credit card and 25% hold a credit card from American Express.

| From which of the following issuers do you currently hold a credit card? | Respondents |

|---|---|

| Capital One | 37% |

| Bank of America | 32% |

| Chase | 26% |

| American Express | 25% |

| Discover | 17% |

| Citibank | 16% |

| Wells Fargo | 15% |

| U.S. Bank | 10% |

| USAA | 9% |

| Barclays | 9% |

| PNC | 8% |

| Navy Federal Credit Union | 6% |

American Express, Capital One, and Chase are the most trusted credit card issuers

American Express is the most trusted credit card issuer among Americans, with 86% saying they find them trustworthy.

Eighty percent or more said Capital One, Chase, Discover, Citibank, and Bank of America are trustworthy as well.

| How trustworthy do you find the following credit card issuers? | Trustworthy |

|---|---|

| American Express | 86% |

| Capital One | 84% |

| Chase | 82% |

| Discover | 81% |

| Citibank | 80% |

| Bank of America | 80% |

| Navy Federal Credit Union | 78% |

| U.S. Bank | 78% |

| USAA | 77% |

| PNC | 73% |

| Wells Fargo | 72% |

| Barclays | 64% |

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.